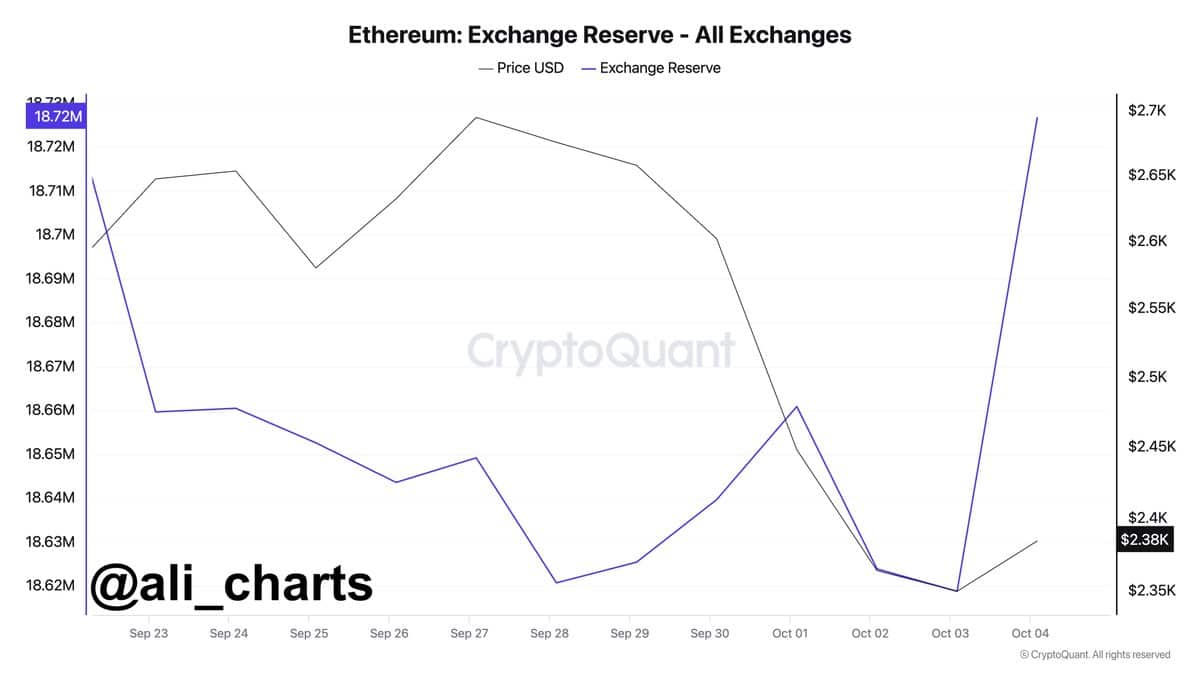

$259.2 million worth of Ethereum has arrived at exchanges—another sign of Ethereum facing price pressure?

ETH is facing selling pressure, lower fees, and poor performance following the Dencun upgrade.

With the continued ICO sell-off, there is a massive flow of ETH to exchanges.

- The Dencun upgrade has caused ETH to lose some revenue to L2s.

Ethereum (ETH), the second-largest cryptocurrency in the market after Bitcoin (BTC), has recently faced increasing selling pressure, especially as traders move ETH to exchanges.

At the time of publication, over 108,000 ETH, worth approximately $259.2 million, was sent to exchanges in just 24 hours.

Such an influx often indicates a potential decrease in Ethereum’s price, as increased supply, combined with stagnant demand, leads to lower prices.

Source: Ali/X

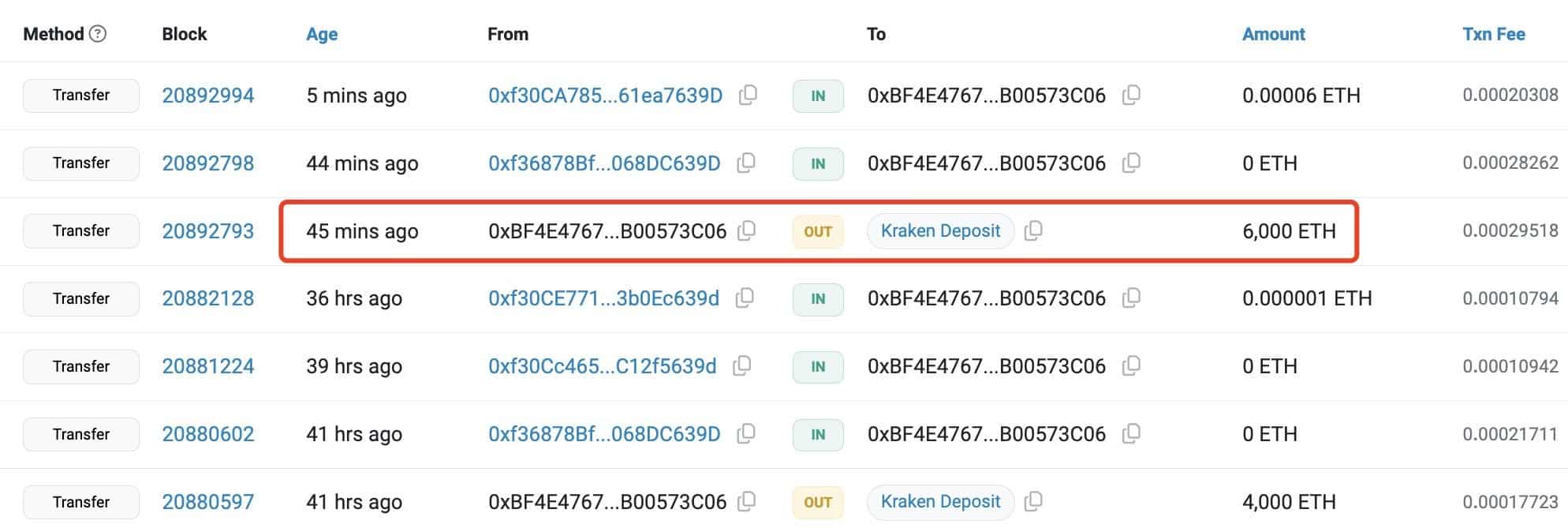

Additionally, one of the participants in the Ethereum (ICO) has been steadily selling ETH.

Recently, they sold 6,000 ETH worth $14.11 million, bringing the total to 40,000 ETH since September 22, 2024. These sales were executed at an average price of $2,525.

Despite these transactions, the ICO participant still holds 99,500 ETH, valued at approximately $238 million, indicating potential selling pressure in the future.

Source: Lookonchain

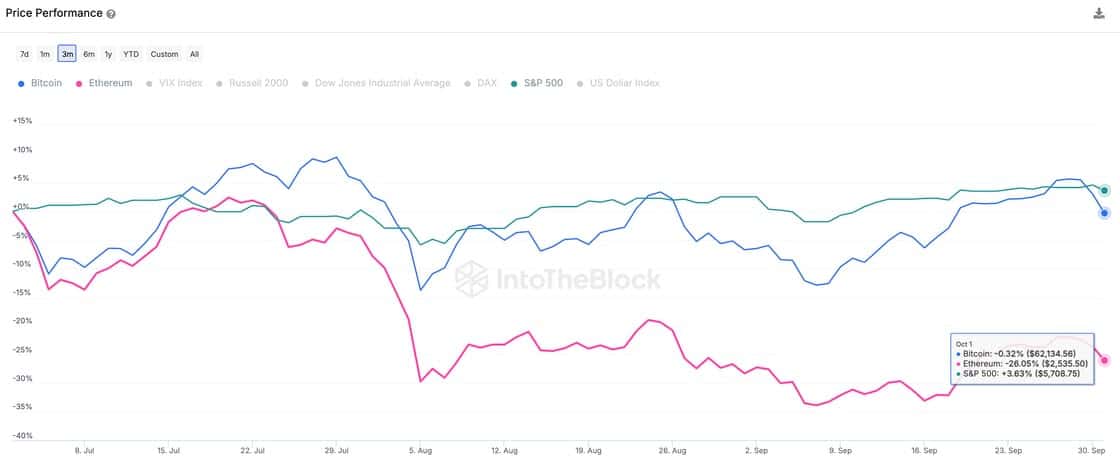

ETH’s price performance compared to other assets

- ETH has also performed poorly compared to other risk assets like Bitcoin and the S&P 500.

While Bitcoin has seen a slight decline of 0.32%, and the S&P 500 experienced a positive change of 3.63%, ETH has significantly dropped by 26% over the past three months.

Total network fees on Ethereum have also decreased by 43.9%, reaching $247.6 million. The drop in fees contributes to Ethereum’s struggles. Additionally, on-chain activity on the Ethereum mainnet has declined over the past three months.

Source: IntoTheBlock

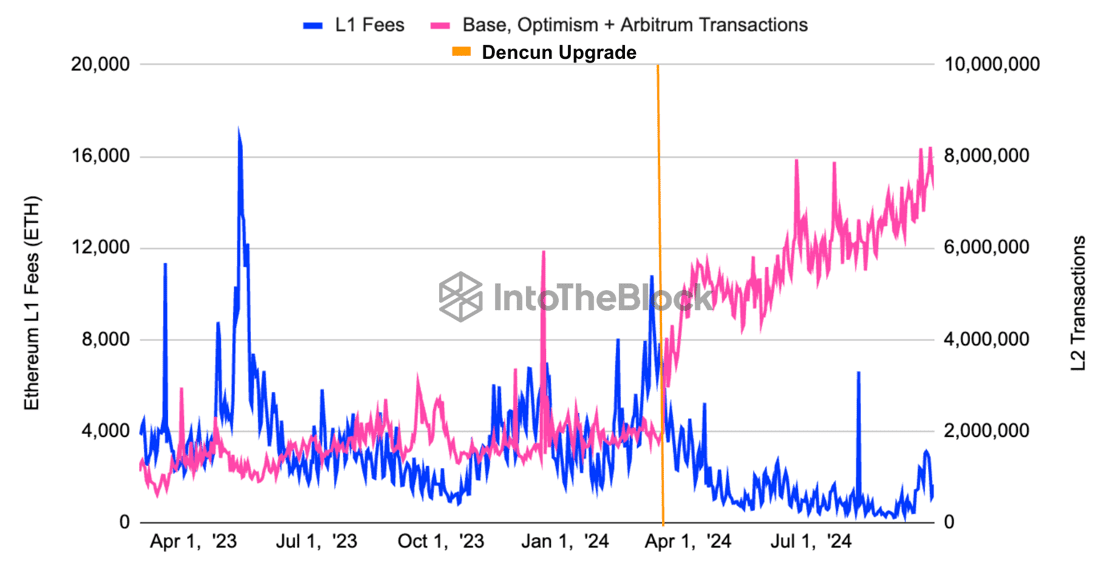

Impact of the Dencun Upgrade

The Dencun upgrade has also contributed to Ethereum’s poor performance. This update, which included EIP 4844, reduced layer 2 (L2) transaction costs by more than tenfold, leading to a surge in L2 activity.

As a result, Mainnet ETH fees have significantly decreased, reaching their lowest levels. This has impacted the amount of ETH being burned, and after previously experiencing a deflationary path, the cryptocurrency has reverted to inflation.

Source: IntoTheBlock

The summer calm and sideways trading in traditional markets have led to chain fees dropping to their lowest levels in several years. Lower fees and reduced ETH burning resemble a company facing declining revenue and halting stock buybacks. With these changes, it’s not surprising that ETH’s price has struggled.

Additionally, the long-term benefits of ETH, which can derive from the miner-extractable value (MEV) of L2s, remain unclear.

Impact of L2s on ETH and Increasing Optimism

Ultimately, Optimism (OP), one of the leading layer 2 networks on Ethereum, has seen better performance of its governance token compared to other networks.

In the third quarter, the OP/ETH pair rose by 28%, benefiting from increased activity on-chain in L2, indicating that it is performing better than Ethereum.

The rising optimism, partly due to activity on Coinbase’s Base L2 in the Optimism superchain, highlights the increasing dominance of L2s. This continues to impact the value of Ethereum.

Source: IntoTheBlock