Aptos aims for $10.41 with an accelerating upward momentum

APT is on a significant upward trajectory as it continues to strengthen its bullish trend.

APT benefits from strong technical indicators suggesting a potential surge, with predictions pointing to a two-digit figure of $10.41. Investor confidence remains high, evidenced by significant capital flows, along with some indicators showing an upward trend.

In just the past week, Aptos [APT] has increased by 17.81%, primarily driven by a daily rise of 13.04%.

AMBCrypto’s analysis supports this optimistic outlook, highlighting new bullish formations that confirm the asset’s strong movement.

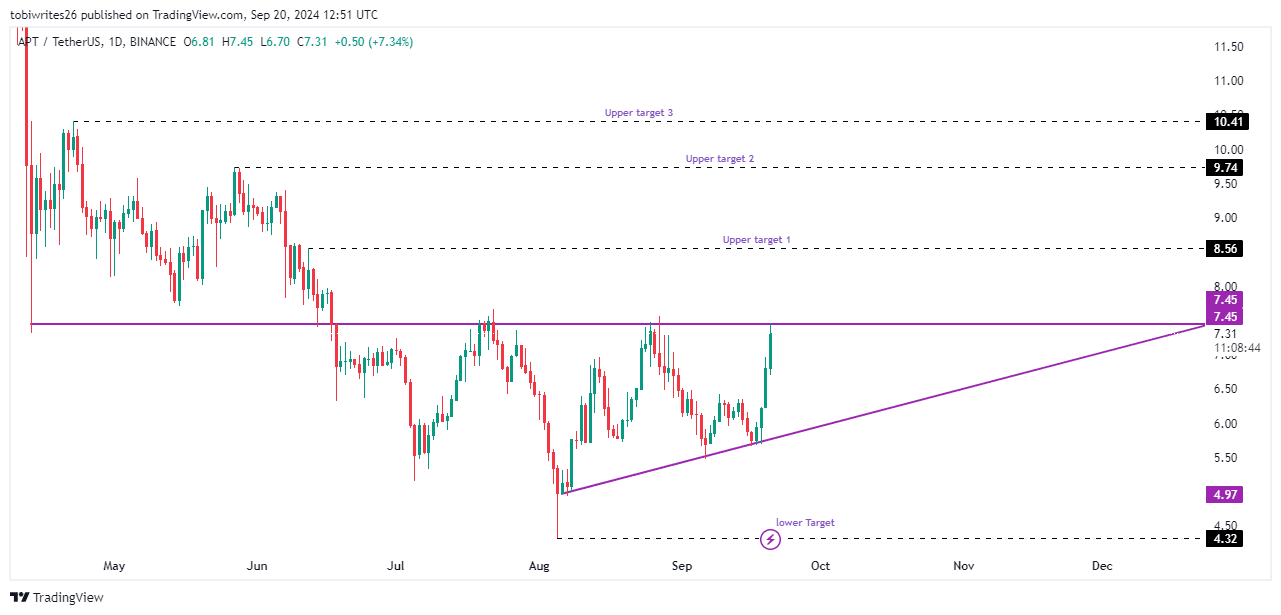

APT is currently trading within an ascending triangle, a bullish configuration characterized by the emergence of rising prices. This pattern is defined by a horizontal resistance line and an ascending support line.

Recent price action indicates that APT has rebounded from this support line and is now approaching the resistance area at $7.45. If buying pressure overcomes selling at this level, APT could be poised for a breakout.

Following a successful breakout, a rally could extend to key price levels of $8.56, $9.74, and $10.41, where the price may stabilize. Conversely, if broader market trends turn bearish, APT could retreat to $4.32.

Source: Trading View

AMBCrypto also highlighted several indicators suggesting a bullish movement, potentially aiding APT in surpassing the resistance zone.

Indicators Indicate Strong Upward Movement

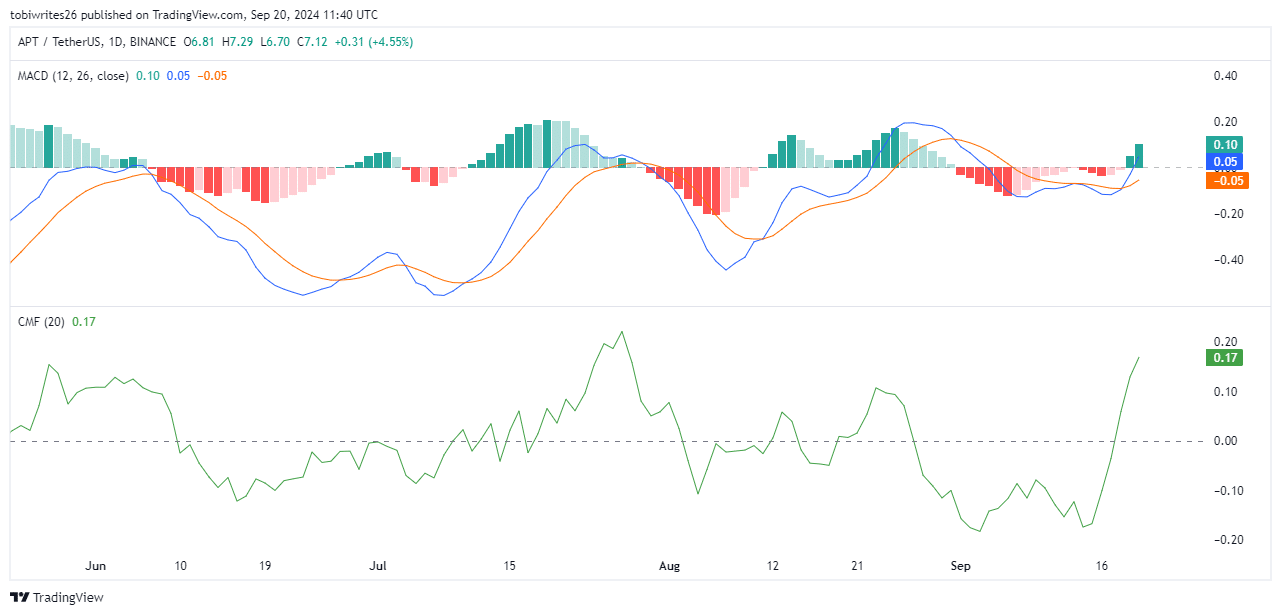

At the time of publication, APT reached a significant technical milestone known as the golden cross, marked by the blue MACD lines crossing above the orange signal lines. Additionally, the MACD line currently has a positive reading of 0.05.

The golden cross is largely a bullish signal, indicating that the price of APT is likely to continue its upward trajectory from the current level.

Furthermore, the Chaikin Money Flow (CMF), which evaluates both price and volume to measure the flow of funds into or out of an asset, shows that APT is in an accumulation phase.

This phase is confirmed as the CMF value has risen to 0.18 and is strengthening.

Source: Trading View

Open Interest in APT Indicates Strong Buying Interest

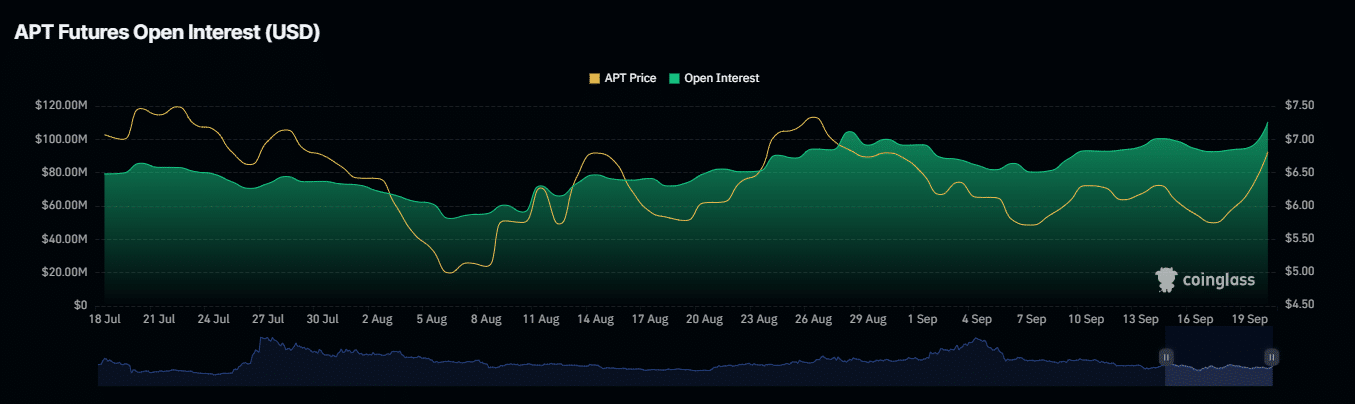

According to Coinglass, open interest for APT has significantly increased, rising by 21.16% in the past 24 hours. This substantial growth reflects an increasing interest from investors in APT, with traders actively acquiring more of the asset.

Open interest works by quantifying the total number of outstanding derivative contracts, such as futures or options, reflecting ongoing market participation.

Additionally, trading volume for APT has reached 54.04%, indicating significant interest in the asset. This increase in activity is likely to further drive up the price of APT.