Understood! Please provide the sentences you’d like translated into English.

With the increase in active buyers, the number of active Ethereum addresses has reached 5 million in the past week.

The price of Ethereum increased by 14.5% over the past week.

- With the increase in active buyers, the number of active Ethereum addresses has reached 5 million in the past week.

Ethereum [ETH] has been on an upward trend since hitting a weekly low of $2,251 on September 16. In fact, at the time of writing this article, ETH was trading at $2,641, reflecting a 14.50% increase over the past week.

Before this price increase, Ethereum had been on a downward trajectory for the past month.

The recent shift in market sentiment has led analysts to discuss whether this upward trend is part of a sustainable recovery and what is driving this increase. Analysts have suggested that the current rally is driven by the rise in active buyers.

What Market Sentiment Says

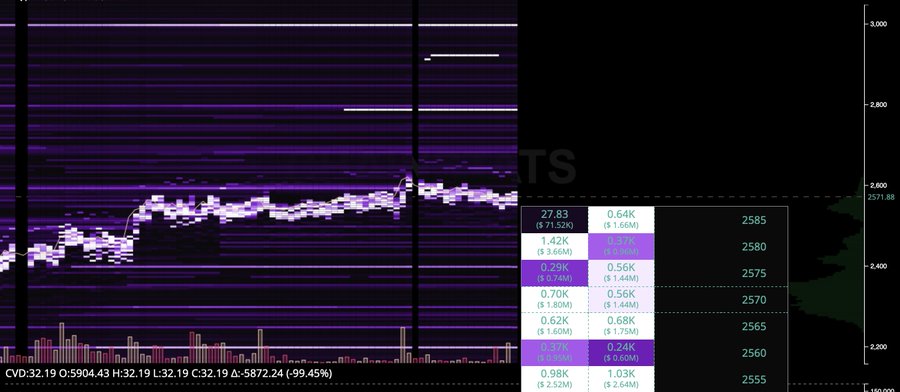

In its analysis, ChainStatsPro pointed to the increase in active buyers and limited offers.

According to this assessment, liquidation hunting in the futures markets for Ethereum has continued as limited offers are being filled. However, CVD remains stable, with offers and requests accumulating at $2,400 and $2,790.

Source: ChainStatsPro

This means that active buyers are acquiring ETH at current market rates, indicating increased demand. Therefore, traders are positioned to buy when ETH drops to $2,400 and sell if it reaches $2,790. These custom offers reflect increased market activity.

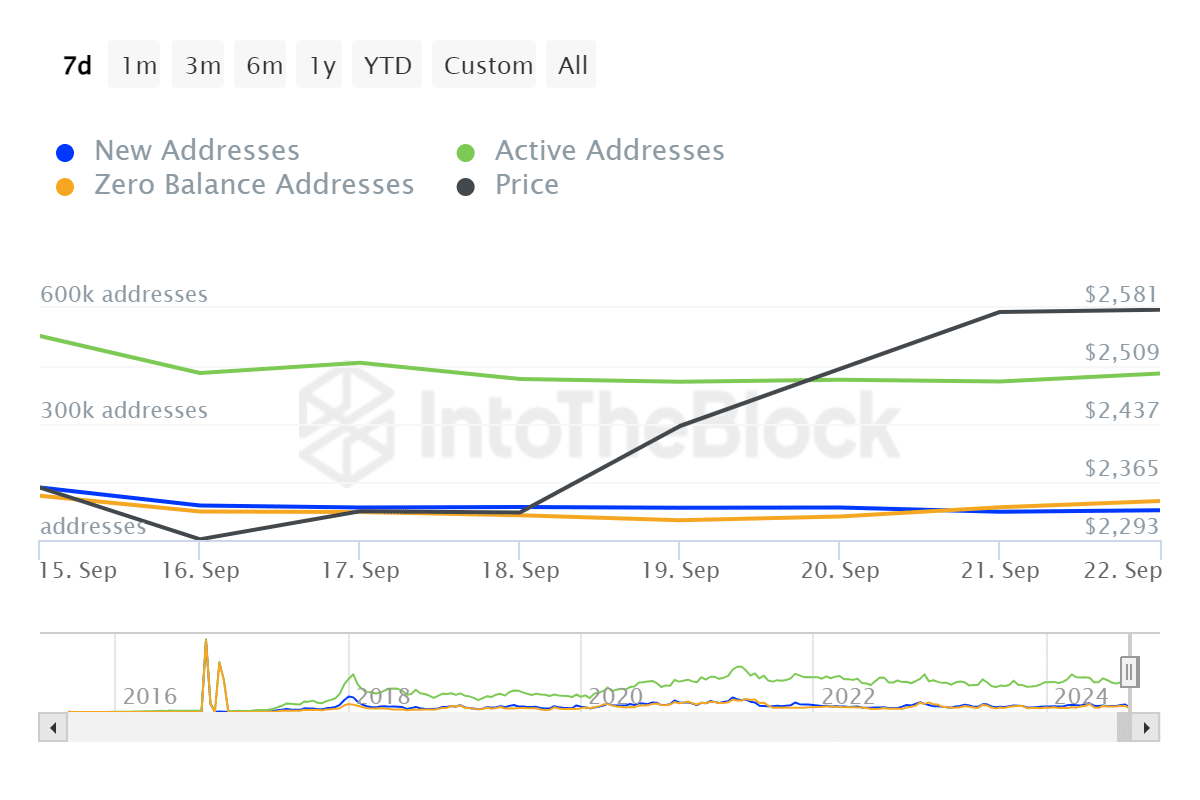

Source: IntoTheBlock

Looking deeper, the increase in active buyers and investors setting point limits is reflected in the greater number of active addresses over the past seven days.

According to the report from IntoTheBlock, active addresses reached 5 million last week. This indicates an increase in transactions as more users are actively engaging with the network. This is a bullish market sentiment, as the rise in active addresses leads to higher prices.

What the ETH charts show…

As noted by ChainStatsPro, ETH experienced an increase in transaction activity over the past week. This market condition prompted Ethereum to undergo a sustained upward movement last week.

Source: TradingView

To begin with, this increase in buying pressure is further supported by the positive Chaikin Money Flow (CMF). At the time of publication, Ethereum’s CMF was at 0.28, indicating that buyers are actively accumulating the asset.

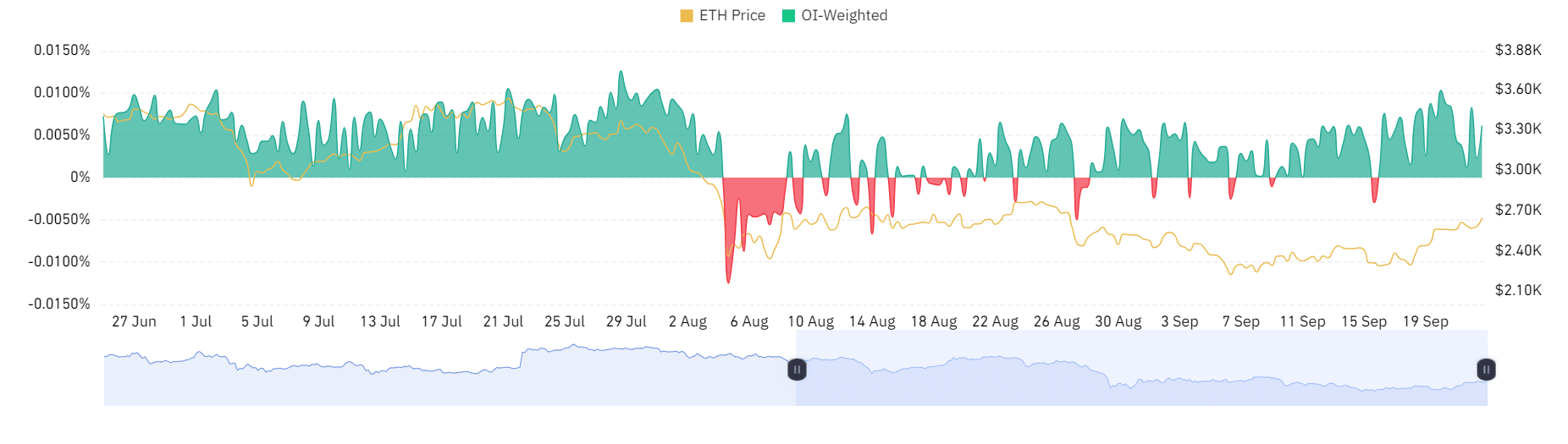

Source: Coinglass

Finally, Ethereum’s funding rate with OI has been positive over the past week. A positive funding rate weighted by OI indicates increased demand for long positions, with these holders paying short.

Thus, as noted by ChainStatsPro, ETH is experiencing an increase in active buyers. This positive market sentiment positions the altcoin for further gains.

If the current conditions persist, Ethereum will likely test the $2800 resistance level in the short term.