Déjà vu? Bitcoin is set for a parabolic rise in 2024 – here’s why.

Bitcoin reflects the launch following the 2020 halving, indicating a potential parabolic rise in 2024.

Bitcoin’s price movement in 2024 reflects that of 2020, suggesting another imminent parabolic rise.

- Bitcoin traders are looking for accumulation trends as key resistance levels indicate a potential breakout in the future.

Bitcoin (BTC) shows signs of repeating its post-halving behavior from 2020, increasing the likelihood of a parabolic increase in 2024.

According to Rekt Capital, a cryptocurrency analyst, Bitcoin’s price action in 2024 mirrors market dynamics observed after the 2020 halving.

The focus is on the 161-day period following the halving, which has historically led to significant price increases.

Rekt Capital’s analysis highlights the similarities between Bitcoin’s price movements after the halvings in 2020 and 2024.

In 2020, Bitcoin’s price rose after breaking out of its accumulation range, marking the start of a major rally.

This breakout was characterized by increased buying activity and a shift in market sentiment, pushing prices to new all-time highs.

In 2024, Bitcoin is again showing its position right after the critical 161-day period following the halving, indicating a likelihood of a similar breakout.

As of the time of publication, Bitcoin traded at $63,439, reflecting a 0.60% increase in the last 24 hours and a 7.51% increase over the past week.

This upward movement mirrors the pattern seen in 2020, reinforcing expectations of another strong rally.

Key Resistance and Support Levels to Watch

Bitcoin’s price is approaching key resistance levels that need to be cleared to confirm a breakout.

The recent increase from $56,000 to $63,000 indicates a strong upward momentum; however, resistance at these levels remains a critical barrier.

Support levels, as marked on the chart, indicate strong buying interest, similar to the setup in 2020.

These support areas, highlighted with orange circles, create a solid foundation that could help stabilize Bitcoin’s price in the event of a pullback, maintaining the overall bullish outlook.

Traders’ Focus on Accumulation Peaks

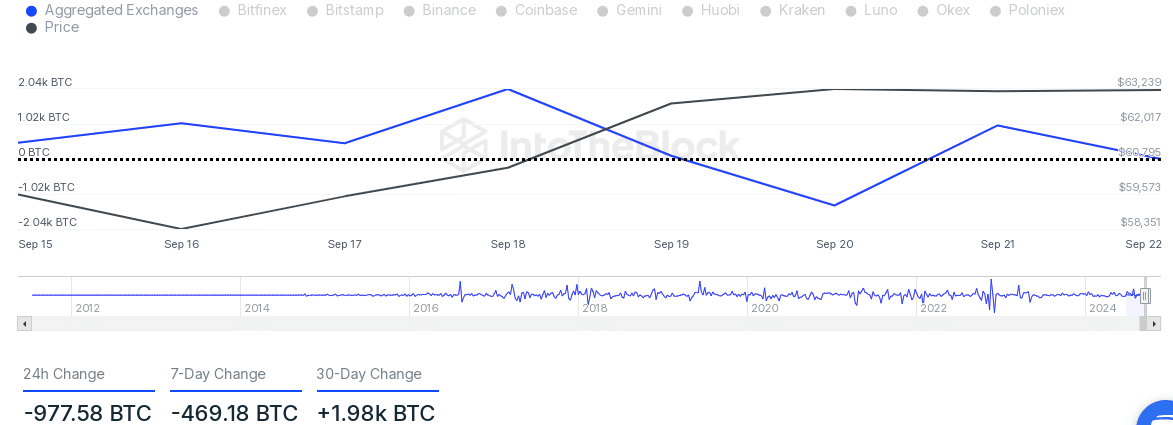

The Bitcoin market setup indicates the potential for an imminent breakout. Prices fluctuated between $58,351 and $63,239 from September 15 to 22, with a significant low of $59,573 recorded on September 20 before recovery.

On-chain data also points to accumulation trends, with a net BTC outflow of -977.58 BTC in the last 24 hours and -469.18 BTC over the past week, indicating reduced selling pressure.

These outflows suggest that Bitcoin market participants have retained their holdings, potentially positioning themselves for further price increases.

According to DefiLlama data, the total value locked (TVL) in Bitcoin-related projects was $573.26 million, with 24-hour fees totaling $373,571 and active addresses reaching 595,289.

These metrics reflect ongoing market activities that could act as a catalyst for further price increases, supporting the notion of a sustainable upward trajectory as seen in previous cycles.

Bitcoin market activity reflects continued investor interest, as indicated by recent trading volumes and on-chain data.