SUI has surged by 49%—could it surpass Litecoin among the top 20 rankings?

As SUI surpassed more coins with a weekly increase of 40%, AMBCrypto is curious if it can replace Litecoin.

SUI has performed better than most coins and secured a top weekly position.

- Consequently, if this trend continues, it may challenge LTC’s position in the market – what are the odds?

Sui [SUI] ended the week as the top winner among the top 25 tokens, rising 49% to $1.62. Now ranked twenty-first, SUI’s growth has analysts speculating about its potential to replace Litecoin, which saw an 8% increase to $68.49.

With SUI aiming for a March ATH of $2.09, the chances of surpassing Litecoin in the top 20 are increasing.

SUI is defying the odds, but there is a catch.

Source: Coinalyze

In the daily price chart, SUI shows consistent green candles that have started an upward trend since September. Notably, SUI has increased by over 100% since then, despite broader market volatility.

Meanwhile, LTC bears have neutralized twice, preventing LTC prices from rising above $65,000. However, following Bitcoin’s upward swing, LTC bulls have retested the $68,000 ceiling.

In summary, LTC appears more vulnerable to Bitcoin’s movements, while SUI has made progress, suggesting that SUI may hold more future value for stakeholders.

However, SUI’s price increase during September was accompanied by rising trading volume, with the RSI climbing into overbought territory, indicating accumulation. Similarly, the CMF has also risen above its previous resistance. This growth rate has exceeded what SUI experienced when it reached its ATH.

Simply put, heightened investor interest in SUI coincided with Bitcoin’s return to the $64,000 range, making SUI a more attractive alternative.

If so, this raises questions about SUI’s long-term outlook and challenges the theory of surpassing LTC. So, is the 49% increase just a temporary spike?

The chart suggests potential accumulation.

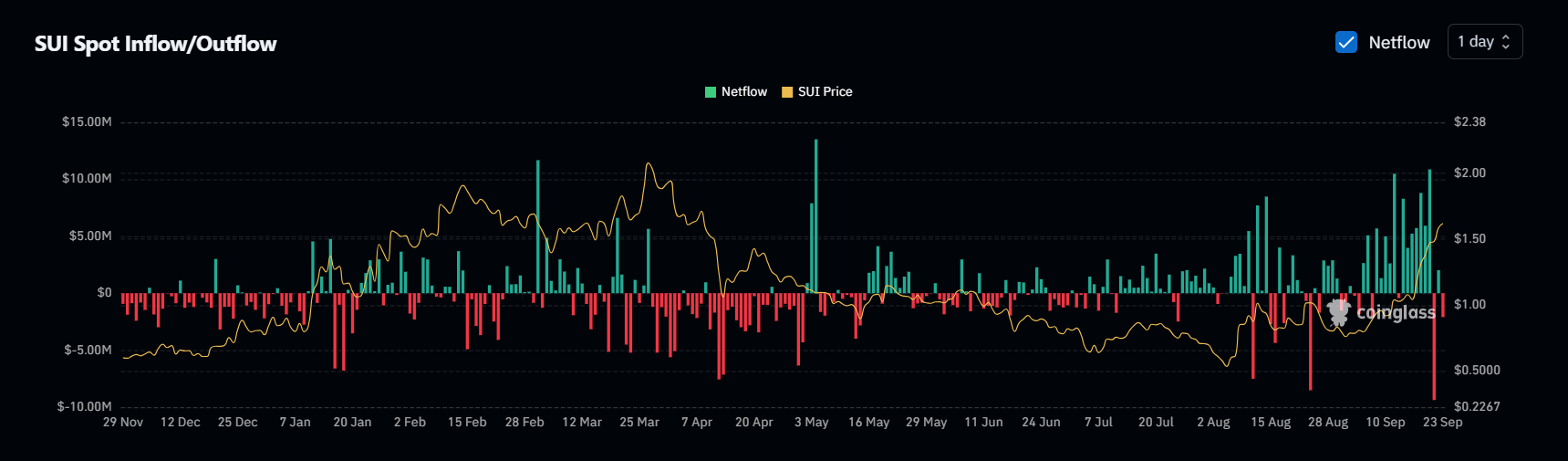

As previously mentioned, SUI’s performance over the past week has secured its position as the top winner. Surprisingly, this significant increase was accompanied by a surge in SUI entering exchanges.

Source: Coinglass

In simple terms, this indicates that SUI has not been significantly affected by Bitcoin’s volatility. However, accumulation by holders, as indicated by the above metrics, helped prevent a retracement.

While accumulation is a bullish signal, it could harm the altcoin in the long term, pushing many traders to cash out after securing profits, as seen when SUI reached its ATH in mid-March, aligning with BTC’s peak.

After that, following BTC’s decline, SUI sharply dropped to $1.06 within two weeks. Since then, it has been in a downward trend, with its momentum only increasing after 180 days.

If this trend repeats, SUI may be just a few days away from a strong correction. However, if the bulls can maintain resistance at $1.70 before targeting the ATH, SUI’s chances of outperforming LTC will improve – why?

Growth rate matters.

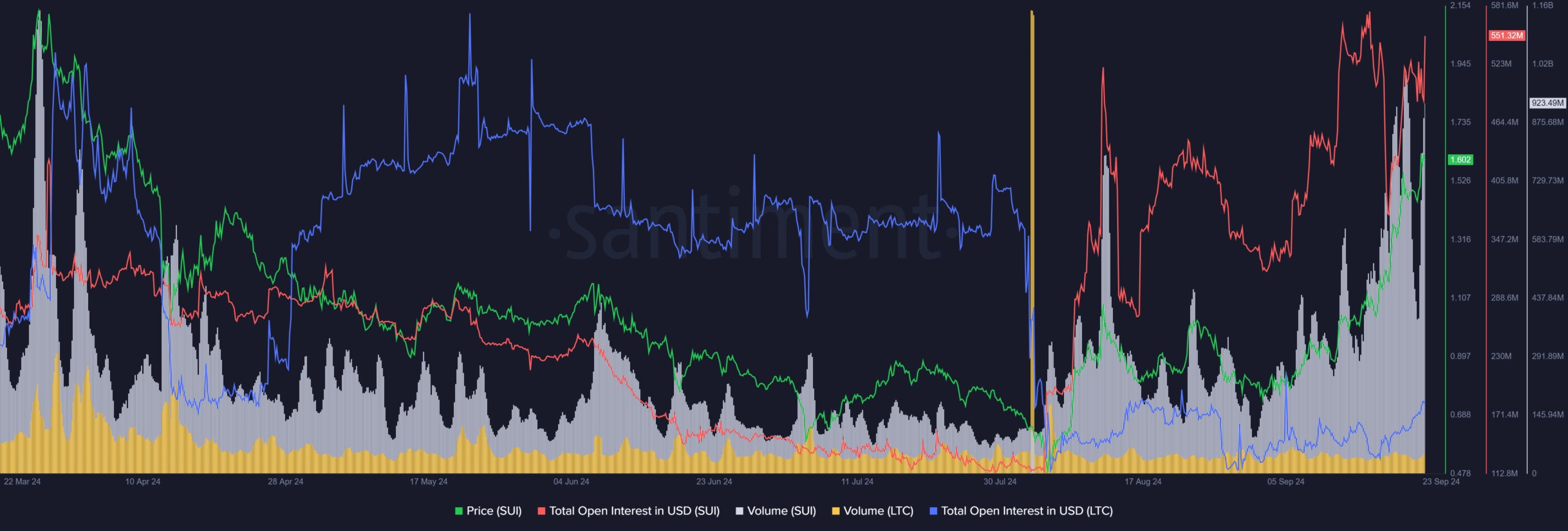

As the twentieth largest coin by market cap, LTC has been consolidating in the $60,000 to $70,000 range for over a month. Meanwhile, SUI has experienced a significant rally during this period.

Despite high transaction volumes and low fees for LTC, no notable results have been observed. In fact, volume has decreased from over $1 billion in April to $246 million at the time of publication. Additionally, open interest in dollar terms has also halved.

Source: Santiment

In contrast, SUI has seen a significant increase in volume and open interest (OI), with OI reaching half a billion dollars and volume approaching $1 billion.

AMBCrypto notes that while these metrics indicate growth, they are not reliable predictors of future gains. The focus is on the speed at which SUI is gaining attention compared to LTC.

The conclusion is clear – SUI has risen from market lows to maintain its top position and attract holders. Its growth rate has significantly outpaced that of LTC.

Overall, if the bulls can maintain their liquidity and support at $1.70 while targeting the ATH, SUI has a strong chance of replacing LTC as the twentieth largest coin by market cap.