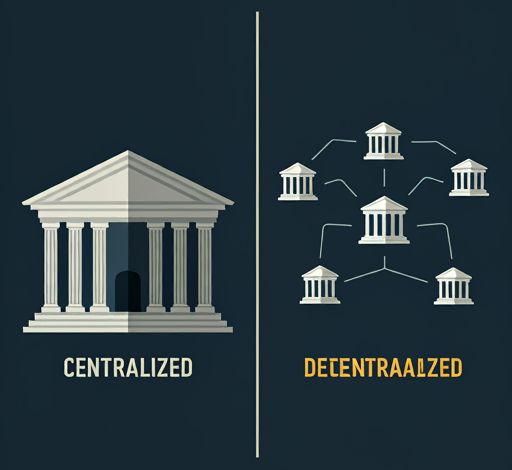

The difference between centralized and decentralized cryptocurrencies: which is better?

Cryptocurrencies are divided into two main categories: centralized and decentralized. Each type has its own features, advantages, and disadvantages, and the choice between them depends on the needs and preferences of the users. In this article, we will examine the differences between these two types of cryptocurrencies and help you make a better decision regarding the suitable type for investment and use.

What Are Centralized Cryptocurrencies?

Centralized cryptocurrencies are controlled and managed by a central entity or company. These types of currencies are similar to traditional currencies like the dollar and euro but operate in a digital format. Central Bank Digital Currencies (CBDCs) are one of the primary examples of centralized currencies offered by central banks of countries.

In these currencies, all transactions and activities are confirmed and recorded through a central entity. This entity can easily monitor transactions and block them if necessary, or even freeze accounts. Therefore, users in these systems are somewhat dependent on the policies of the central authority.

Advantages of Centralized Cryptocurrencies

- Higher Trust: Since a reputable and recognized entity controls the cryptocurrency, users generally feel more trust in it.

- Monitoring and Control: It allows for monitoring of transactions and prevention of fraud or illegal activities.

- Wider Acceptance: Centralized currencies like CBDCs may be officially accepted by governments or banks, facilitating financial processes.

Disadvantages of Centralized Cryptocurrencies

- Lack of Full Transparency: Due to the concentration of power in a central authority, transactions and policies may not be fully transparent.

- Security Risks: If the central entity suffers a security breach or is hacked, all users could be affected.

- Control Over Transactions: The central authority can control or even block transactions, contradicting the decentralized nature of cryptocurrencies.

What Are Decentralized Cryptocurrencies?

Decentralized cryptocurrencies are not controlled by any entity or company, and transactions are confirmed and recorded by a distributed network of nodes. These types of currencies, like Bitcoin and Ethereum, operate on blockchain technology. In these systems, no entity can control or monitor transactions, and all information is transparently and publicly recorded on the blockchain.

Decentralized currencies are highly popular among users and investors due to their transparency, high security, and independence from central authorities.

Advantages of Decentralized Cryptocurrencies

- Complete Transparency: All transactions are publicly recorded on the blockchain, and all users can view them.

- High Security: Due to the distributed structure and advanced cryptography, hacking or tampering with information in these systems is very difficult.

- Independence from Central Authorities: Users have complete control over their assets and do not need to trust financial or banking institutions.

Disadvantages of Decentralized Cryptocurrencies

- Scalability Issues: With an increase in the number of transactions, some decentralized currencies face issues such as reduced processing speed.

- Less Official Acceptance: Many governments and official entities have not fully recognized decentralized currencies, which may create challenges for widespread adoption.

- Technical Complexity: Using decentralized currencies may be complex for new users and require more technical knowledge.

Comparison of Centralized and Decentralized Currencies

| Features | Centralized Currencies | Decentralized Currencies |

|---|---|---|

| Control and Management | By a central entity | By a distributed network of nodes |

| Transaction Transparency | Limited and monitored | Transparent and public |

| Security | Dependent on the central entity | High blockchain security |

| Official Acceptance | Broader acceptance by governments | Less acceptance by governments |

| Security Risks | Risk of hacking or breaches in the central entity | Less risk due to decentralization |

Conclusion

Both centralized and decentralized cryptocurrencies have their own advantages and disadvantages. Centralized currencies come with more oversight and control and are suitable for everyday use, trusted by many governments. On the other hand, decentralized currencies provide users with more control over their assets and offer greater transparency and security.

The choice between these two types of currencies depends on your needs and priorities. If you are looking for currencies backed by official entities with greater security and support, centralized options are suitable. However, if you seek financial independence and more control over your assets, decentralized currencies may be a better choice.