The Bitcoin protocol sees the growth of TVL as the lifting of restrictions

The Bitcoin protocol has reached a milestone with 24,000 Bitcoins worth $1.5 billion locked up.

The Bitcoin protocol reached about 24,000 locked Bitcoins, which is worth a total of about $1.5 billion.

- Bitcoin ranks third in NFT sales volume with sales of nearly $15 million in seven days.

The Bitcoin [BTC] protocol , Babel, has recently experienced a significant increase in its Total Value Locked ( TVL ). This increase follows the removal of some betting restrictions.

Also, this change allowed more bitcoins and created a new milestone for the network.

In addition, the expanded staking function is another step in its evolution, which is shown among the networks with the highest volume of NFT sales.

The bitcoin protocol locks up more bitcoins

According to recent data, the Bitcoin protocol, Babylon , currently has nearly 24,000 Bitcoins locked up, which equates to approximately $1.5 billion at the current market price.

Additionally, this milestone was reached after the protocol lifted its cap on new deposits on August 8, allowing users to share more bitcoins.

Thousands of bitcoins were shared in just over an hour, covering about 10 bitcoin blocks.

The only limitation was the limit of 500 bitcoins per transaction, a change from the initial cap of 1,000 bitcoins when the protocol was launched in early August .

Additionally, the removal of the stake cap caused rapid growth in TVL, indicating a growing interest in using the Bitcoin protocol for stake purposes.

Comparison of shareholder assets of the Bitcoin protocol with Ethereum

Currently, approximately 24,000 Bitcoins – about 0.122% of the circulating supply – have been subscribed to the Bitcoin protocol. Bitcoin has a market cap of over $1.2 trillion and a circulating supply of over 19.7 million bitcoins.

While this percentage is significant given the protocol’s relatively new staking performance, it pales in comparison to Ethereum [ETH] .

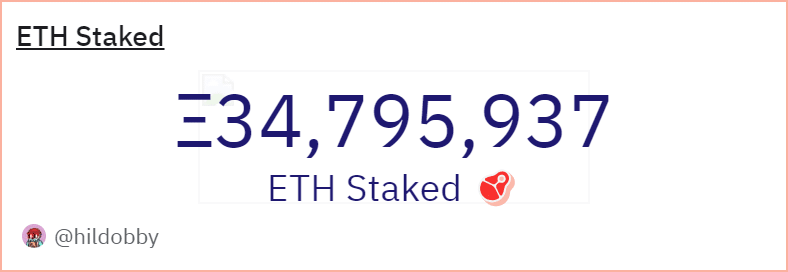

Data from Dune Analytics shows that nearly 35 million ETH are currently at risk, which is more than 28% of the total ETH supply.

The data shows that Ethereum’s market cap is approximately $294 billion and its circulating supply is around 120.4 million Ethereum. With this, the contribution of Ethereum is much higher than that of Bitcoin.

Growth in NFT sales volume

In addition to staking, the Bitcoin network has made advances in NFT. This network is among the top five networks in terms of NFT sales volume.

Additionally, according to Crypto Slam , Bitcoin has recorded nearly $15 million in NFT sales over the past seven days. This makes it the third top network for NFT sales, after Ethereum and Mythos.