Investigating whether the SUI price will remain above $2 after its 3x TVL increase

TVL Sui's explosive growth and rising open interest signal the potential for further upside.

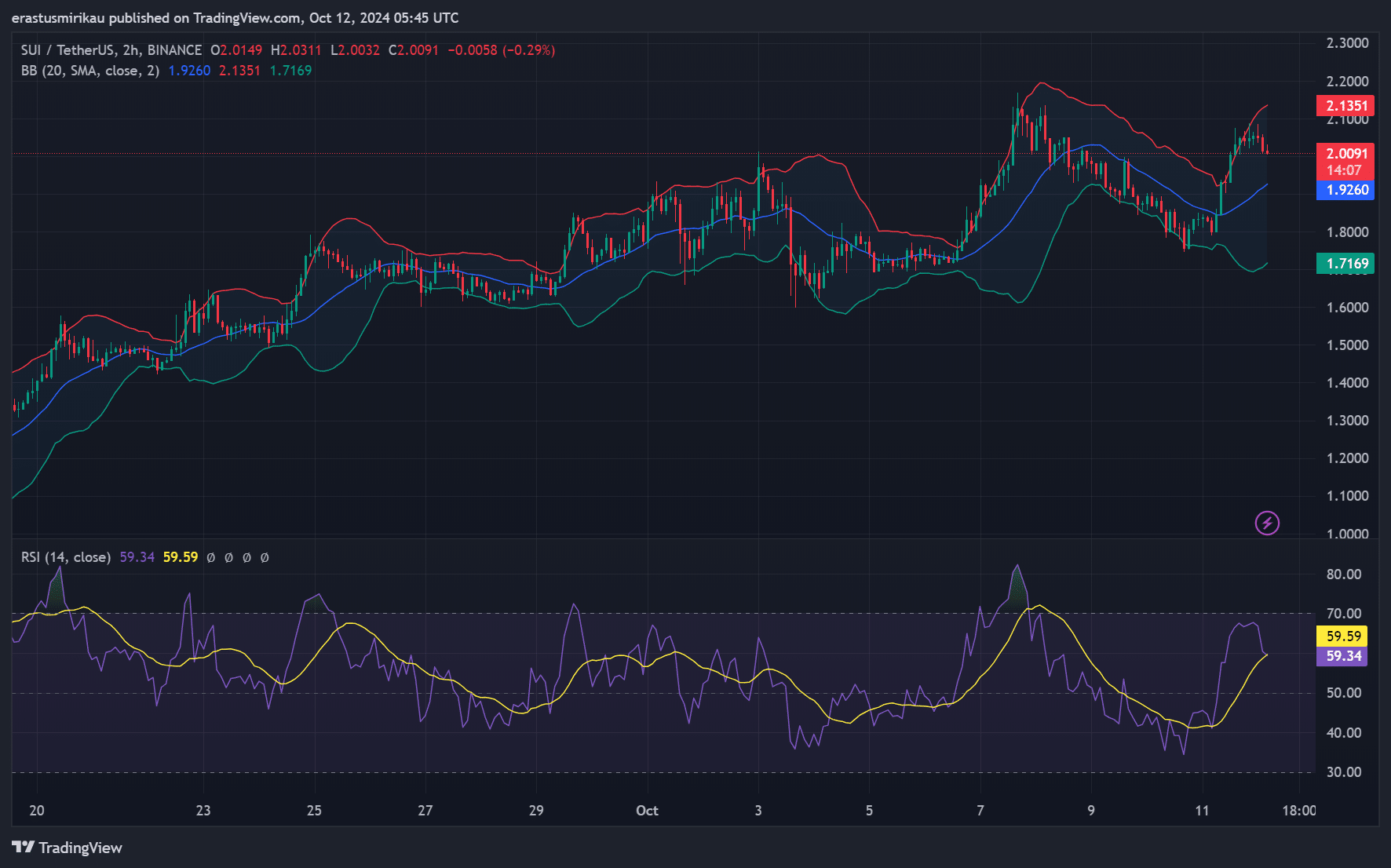

SUI price crossed $2 with strong resistance at $2.135, creating bullish movement on the charts.

- The increase in open interest and positive capital rates indicate continued confidence in the upward trajectory of the SUI

Sui’s Total Locked Value (TVL) [SUI] has seen explosive growth, tripling since August 5 to $1.03 billion. This significant increase in TVL coincided with SUI’s price increase to $2.01 – a 10.77% increase at the time of publication.

As a result, this increase in TVL and the combination of the price increase has fueled speculation about Sui’s potential for wider ecosystem expansion.

Can SUI break above key resistance levels?

The SUI broke through key resistance levels and traders are now looking for a possible breakout. At the time of publication, the next resistance based on the Bollinger Bands was $2.135, showing signs of easing volatility. Furthermore, the RSI level of 59.34 indicates that the market is still bullish, but not yet overbought.

However, if the RSI approaches 70, there is potential for a short-term pullback. Traders should closely monitor these technical indicators to assess whether the SUI can maintain its uptrend or face a correction.

Top Holders and Their Influence – Will the Whales Support the Rally?

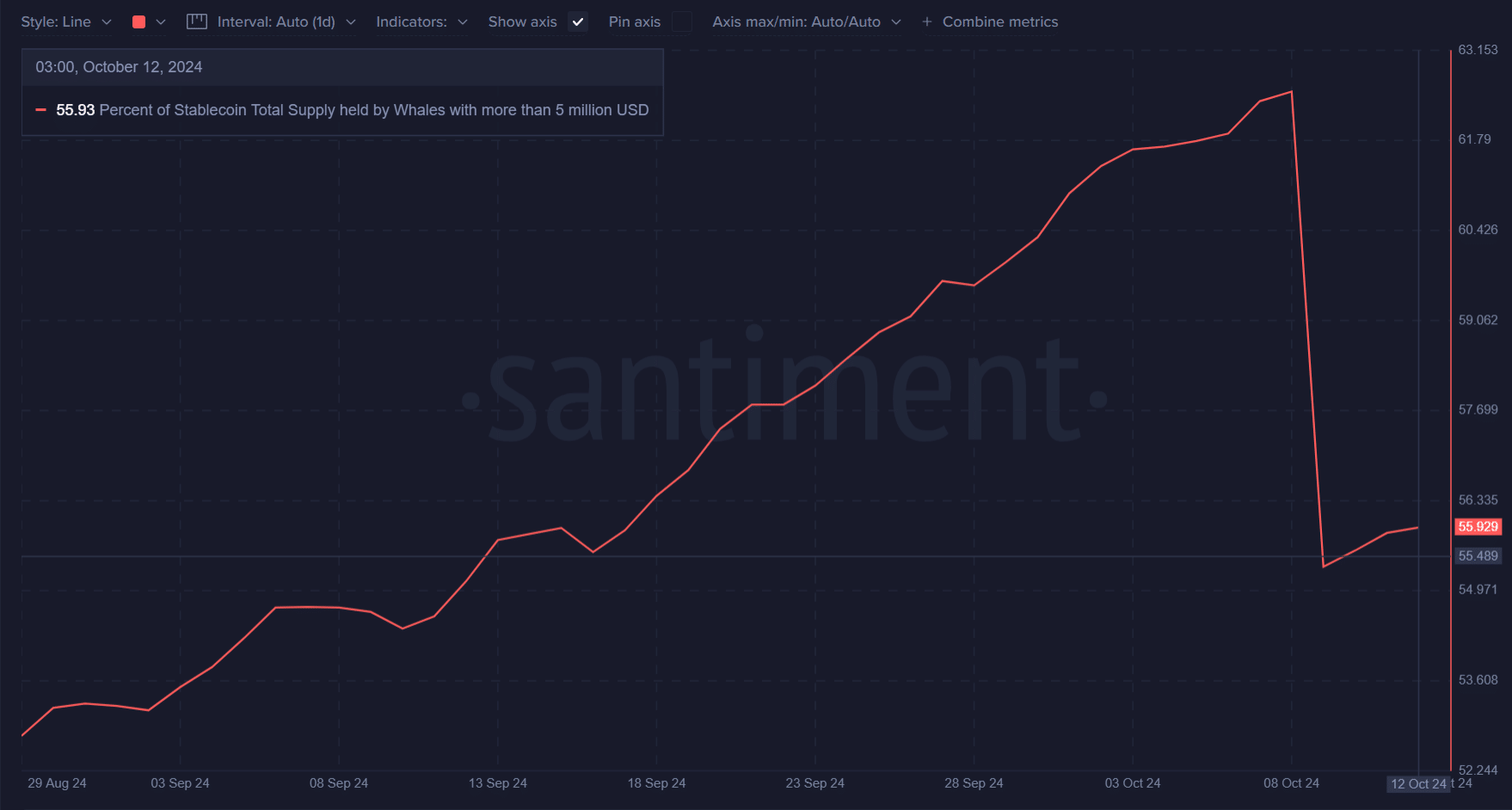

As shown in the accompanying data, at the time of writing, top SUI holders own 55.93% of the outstanding supply. Although whaling activity has declined slightly from previous levels, they still control a significant portion of the supply.

Therefore, their actions are likely to be very important in determining future SUI price movements. Will these whales continue to hold, which could stabilize prices, or will they start selling, potentially causing more volatility?

Rising SUI Open Interest – What Does It Mean for SUI Price?

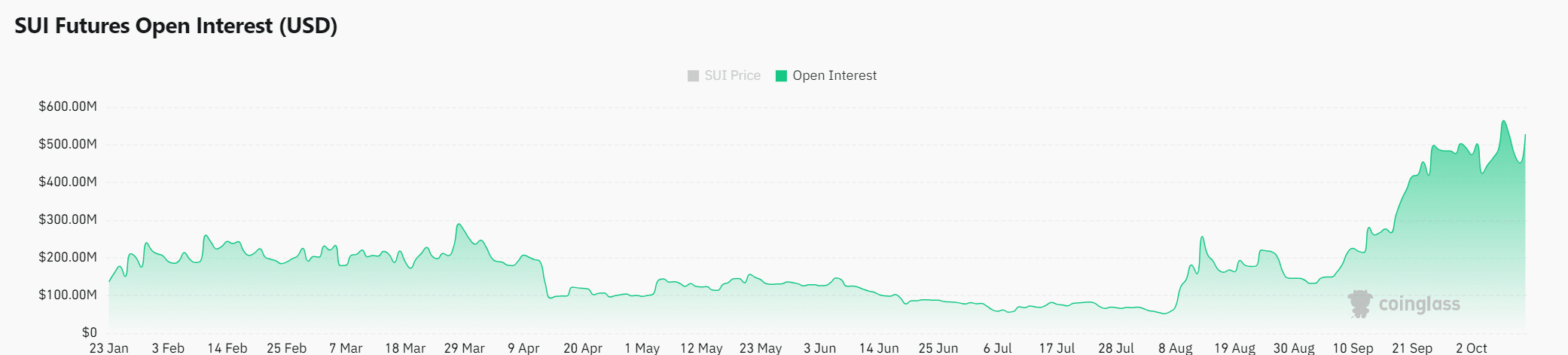

Additionally, open interest for SUI rose 15.36% to $ 518.27 million on the charts. This increase is a sign of increased market confidence and speculative activity around the token.

Additionally, rising open interest often leads to more liquidity, which may help support prevailing price levels and extend the rally.

OI Weighted Funding Rate – Is the Market in Bulls’ Favor?

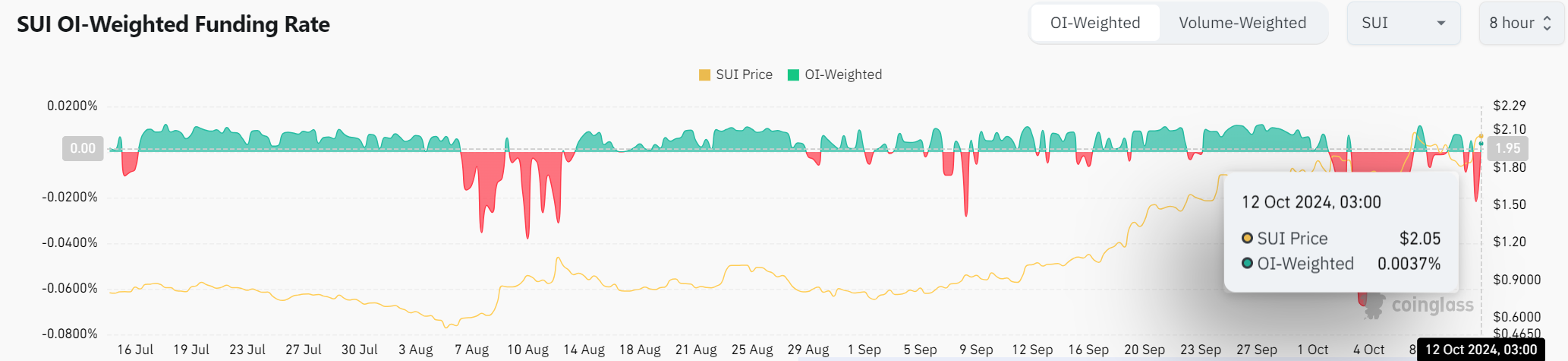

Finally, the OI-weighted funding rate for SUI turned positive at 0.0037% – a sign of bullish sentiment among traders. When long positions pay a premium, as they are now, it often means confidence in the token’s upside.

However, this can also lead to excessive leverage, which may create short-term selling pressure if a liquidation occurs.

Is SUI ready for its next failure?

With a combination of increasing TVL SUI, strong open interest, and favorable finance rates, the token may be well positioned for further growth. However, a break of the $2.135 resistance is necessary for the SUI to maintain its upward momentum.

If market conditions remain favorable, SUI could be on the verge of a significant expansion .