Is Ethereum going to outperform Bitcoin? Key data shows…

Ethereum's performance trails Bitcoin's growth, but analysts suggest significant upside potential based on key metrics.

Analysts predicted that Ethereum could outperform Bitcoin due to key indicators.

- Ethereum spot ETF inflows and bullish price channels indicate potential price targets up to $10,000.

Ethereum [ETH] has so far failed to keep up with the steady upward movement of Bitcoin [BTC] .

While Bitcoin has hit new record highs in recent weeks, Ethereum is still down 36.2% from its 2021 record high of $4,878.

At the time of writing, ETH was trading at $3,111, up 0.6% over the past day and almost 1% over the past week . This performance disparity has raised questions about whether Ethereum can catch up to Bitcoin.

Despite this weak move, some market analysts were optimistic about Ethereum’s potential.

One such analyst, Ali, recently expressed a positive stance on social media , predicting that ETH will soon overtake Bitcoin.

Ali’s confidence comes from several indicators, including the “Alternate Season Indicator.”

According to him, every market cycle historically experiences a phase where Ethereum outperforms Bitcoin, but this has yet to happen in the current cycle. Ali saw this as a potential buying opportunity.

What supports the development of Ethereum?

Ali also highlighted the MVRV (Market Value to Real Value) metric as an important indicator for Ethereum’s future performance.

The MVRV metric measures the ratio between the market value and the actual value of an asset, providing insights into whether an asset is overvalued or undervalued.

Ali noted that when Ethereum’s MVRV Momentum crosses its 180-day moving average (MA), it historically indicates a period of better performance for the cryptocurrency.

Although the price of Ethereum has recently risen from $2,400 to $2,800, the crossover has yet to occur, indicating further upside potential.

In addition to the MVRV metric, Ali noted increased inflows into ETH spot ETFs. He explained that investors have shifted from distribution to accumulation, with spot ETH ETFs amassing more than $147 million in ETH .

Additionally, Ethereum whales have reportedly bought over $1.40 billion worth of ETH, supporting Ali’s bullish outlook.

According to Ali, Ethereum’s potential price path could include a test of resistance levels at $4,000 and $6,000, with a bullish scenario predicting a target of $10,000 if Ethereum mirrors the price performance of the S&P 500.

Check the market position

While causal analysis offers a promising outlook for Ethereum, an examination of key metrics can provide further insights into whether Ethereum can realistically outperform Bitcoin.

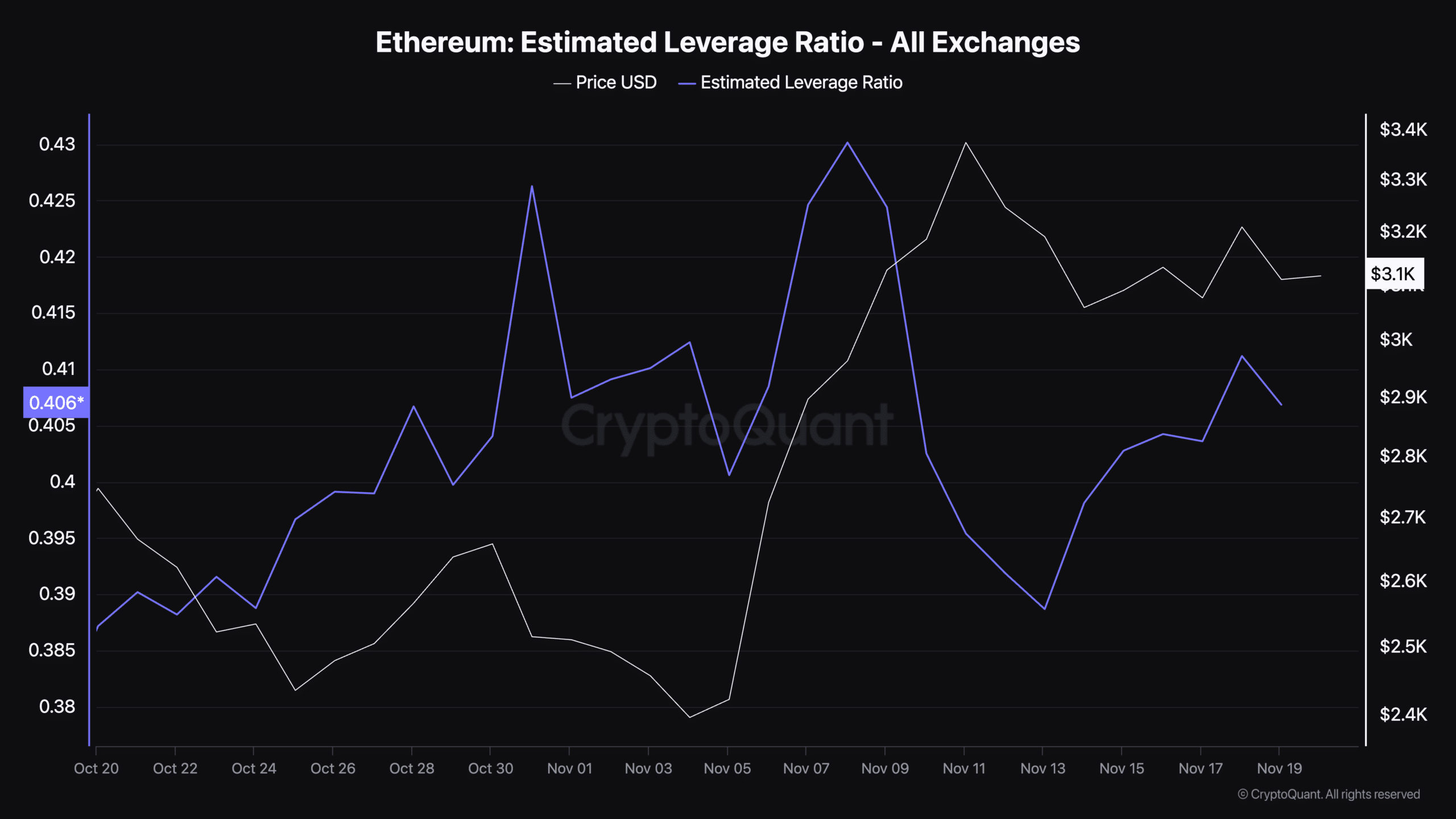

One of these measures is the estimated leverage ratio, which indicates the level of leverage used by traders in the derivatives market.

A high leverage ratio often indicates increased risk and potential volatility, while a lower one may indicate reduced speculation.

Ethereum’s estimated leverage ratio fell to 0.40 as of November 19, after reaching 0.430 earlier in the month, according to data from CryptoQuant.

This decline may reflect a reduction in speculative activity, potentially paving the way for more sustainable growth.

Coinglass data also showed that Ethereum’s open interest fell by 0.09%, bringing its current value to $17.88 billion.