Bitcoin Withdrawal Passes 65k As Bitcoin Approaches $100k: What’s Next?

Bitcoin's $100,000 milestone approaches amid supply squeeze.

Bitcoin withdrawals from exchanges have reached $6.37 billion in 96 hours.

- Social media mentions of $100,000 Bitcoin have also reached a record high.

Bitcoin [BTC]’ s six-figure rally is a fraction away, and the surge may be fueled by significant exchange withdrawals.

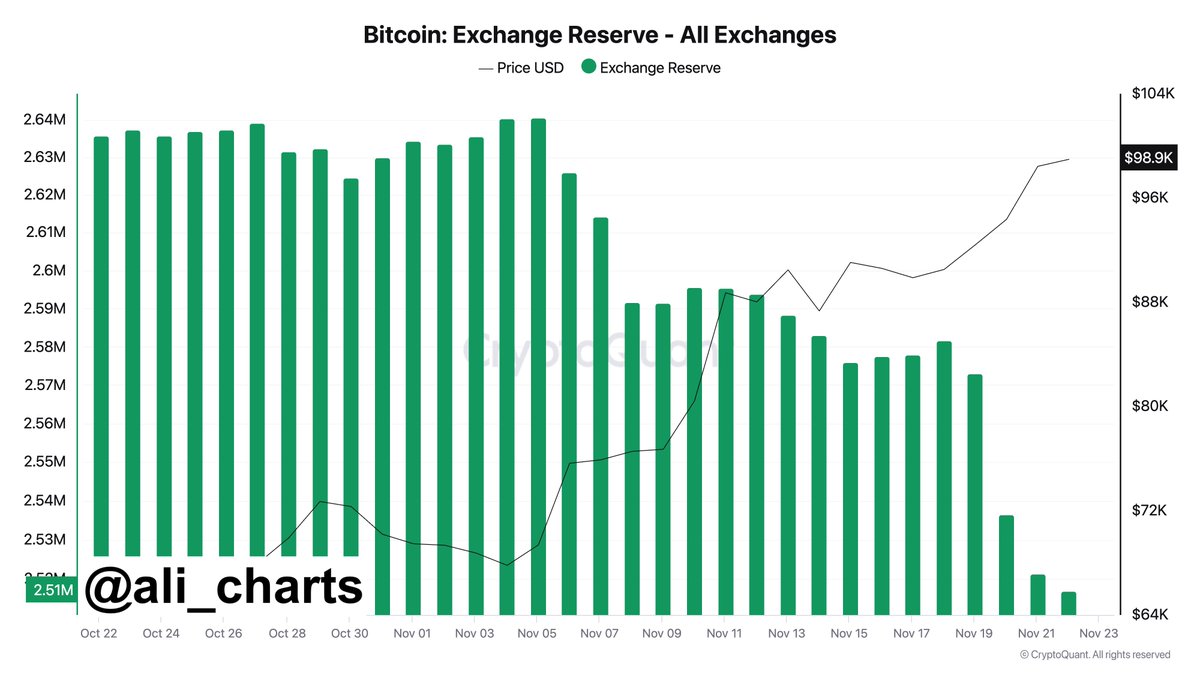

According to a tweet by a well-known analyst, about 65,000 bitcoins worth $6.37 billion have left the reserve exchanges.

Historically, such significant flows indicate that holders are moving assets into cold wallets, indicating a reduction in selling pressure.

Supply contraction on exchanges often precedes bullish price action, as lower availability increases price upside.

For example, in previous cycles of Bitcoin, there were large withdrawals from exchanges prior to significant price increases.

The current sustained outflow indicates increasing investor confidence in the long-term rising price as Bitcoin has reached an ATH of $99,000.

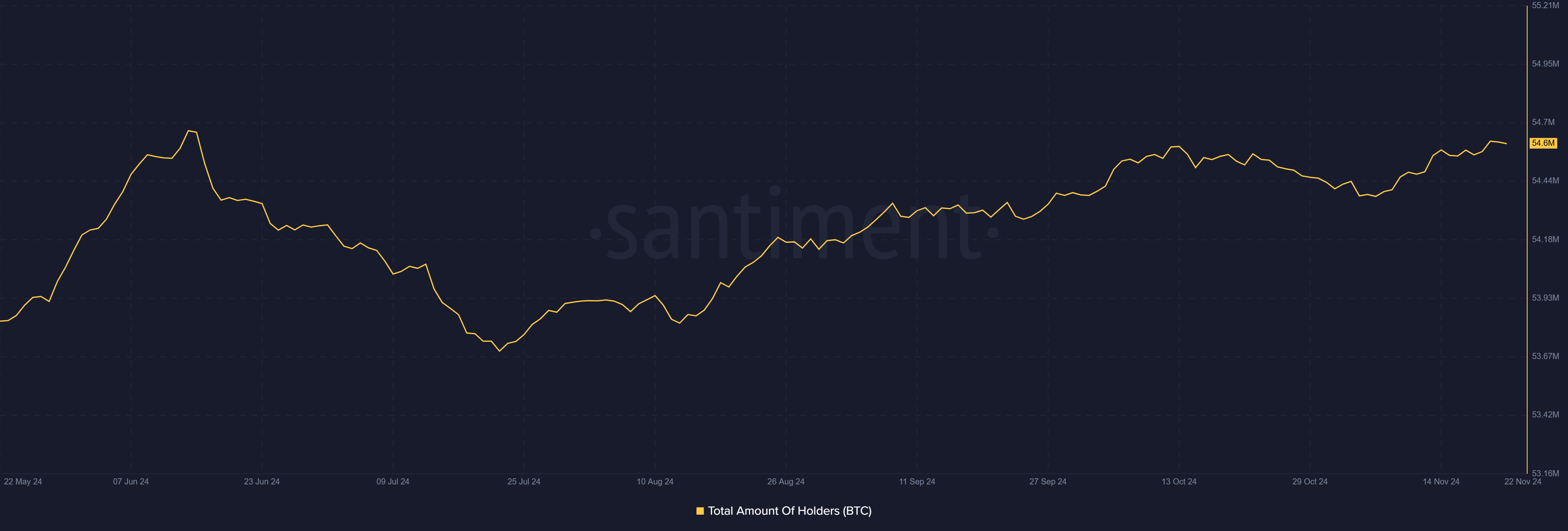

Increasing Bitcoin holders and social registrations

According to AMBCrypto’s analysis of Santiment data , the number of Bitcoin holders has also increased in the past 24 hours.

This comes at a time when mentions of $100,000 Bitcoin are increasing on platforms like X, Reddit , and Telegram. Social media chatter about Bitcoin’s six-figure price has reached high levels.

It is noticeable that the fear of loss has increased and some traders expect a quick increase of more than 100 thousand dollars.

On the other hand, pointing to lower price ranges , such as $60,000 to $79,000, reflects the remaining fear of correction in the short term.

What’s next for BTC ?

Historically, the price of Bitcoin tends to increase after periods of increasing withdrawals and decreasing exchange reserves. The next important milestone will be the psychological barrier of $100,000.

If this bullish momentum continues, it could send Bitcoin sharply to new highs.

However, while fear of missing out on fuel price action , fear of corrections could lead to profit taking at this key stage.