AAVE is on the rise, and here are the factors explaining why!

AAVE is currently gaining significant momentum, but is this good for sustainability?

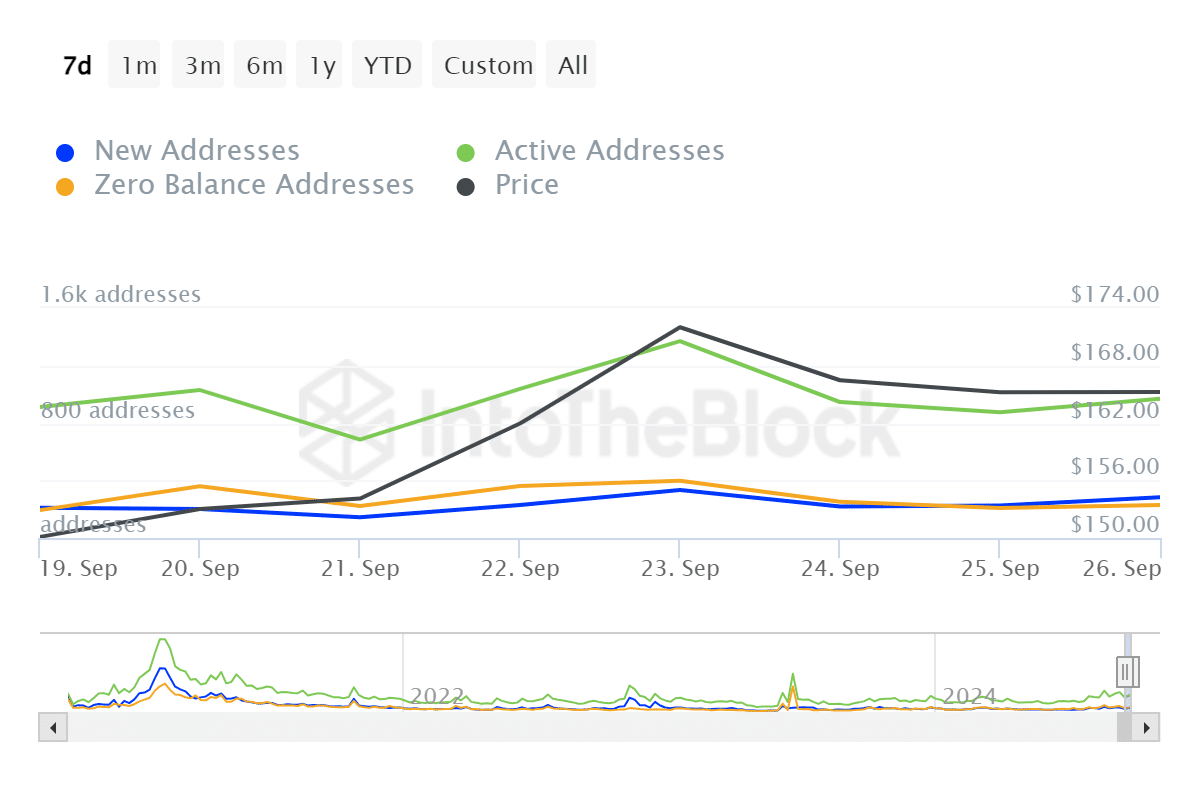

Active AAVE addresses have increased by 34% in the last 24 hours, indicating greater user engagement.

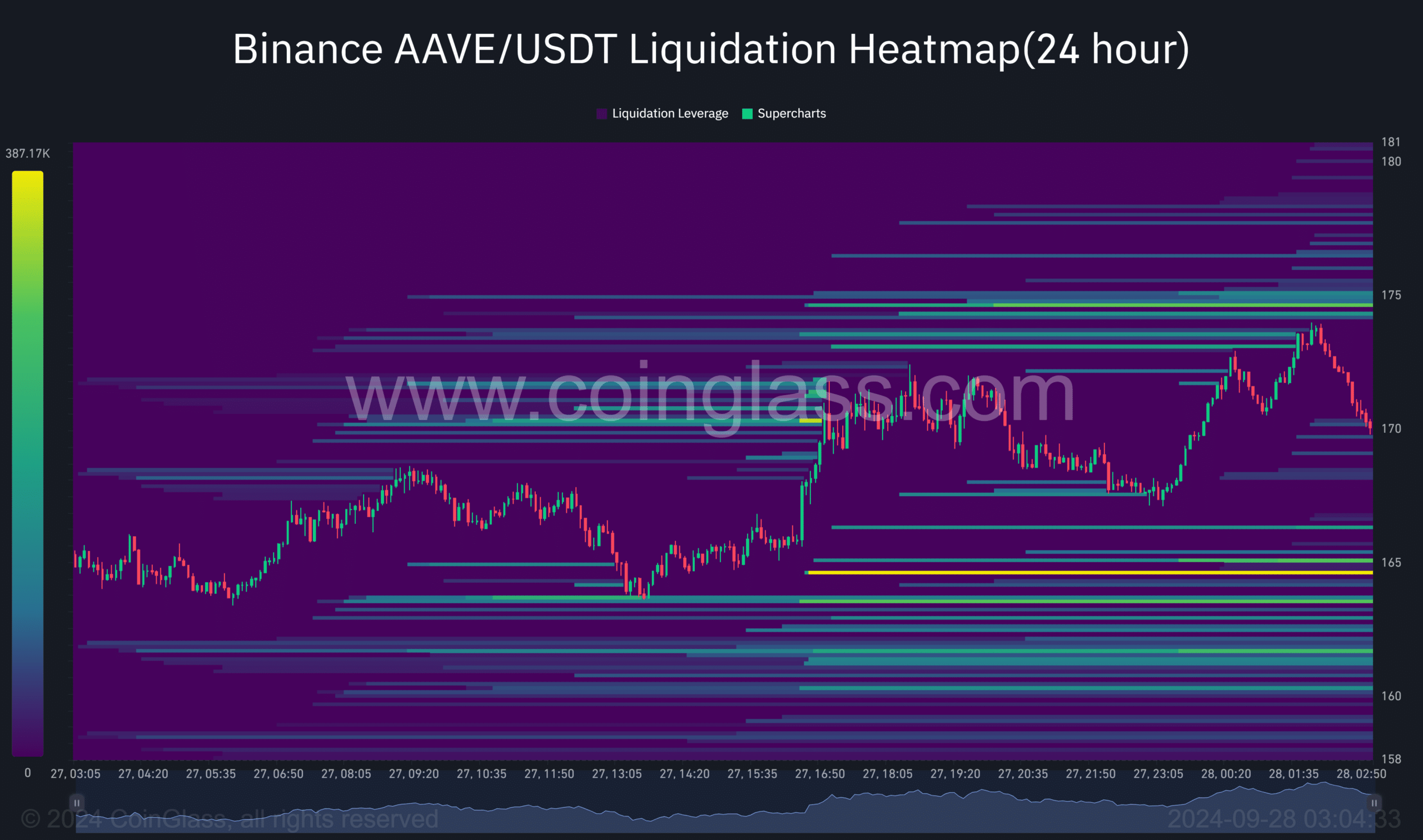

- Market sentiment has improved with increased liquidity—an indication of a bullish bias as most liquidity is on the short side.

AAVE has recently gained significant momentum, with bullish trends in the market spotlight. It is now expected to be among Grayscale’s top-performing assets for the fourth quarter of 2024, supported by increased on-chain activity and positive market sentiment.

With a decrease in corrective momentum, AAVE has very strong potential for further increases on the charts.

Active addresses increase by 34%

In just the last 24 hours, AAVE trading activity has significantly surged. According to AMBCrypto’s analysis of IntoTheBlock data, the number of active addresses has risen by 34%.

This increase reflects a growing market activity that could push the coin’s price higher on the charts.

Higher network activity usually indicates greater adoption and increased market confidence. This is a positive sentiment for the long-term market outlook.

Source: IntoTheBlock

Liquidation data indicates strong bullish sentiment.

According to Coinglass, the liquidation heat map has moved upward in the last 24 hours. It seems that most liquidations occurred on the short side. This can be interpreted as a sign that buying pressure simply overcomes any selling that may occur with the token.

Given the market bias favoring bulls, the current AAVE rally may continue in the short term.

Source: Coinglass

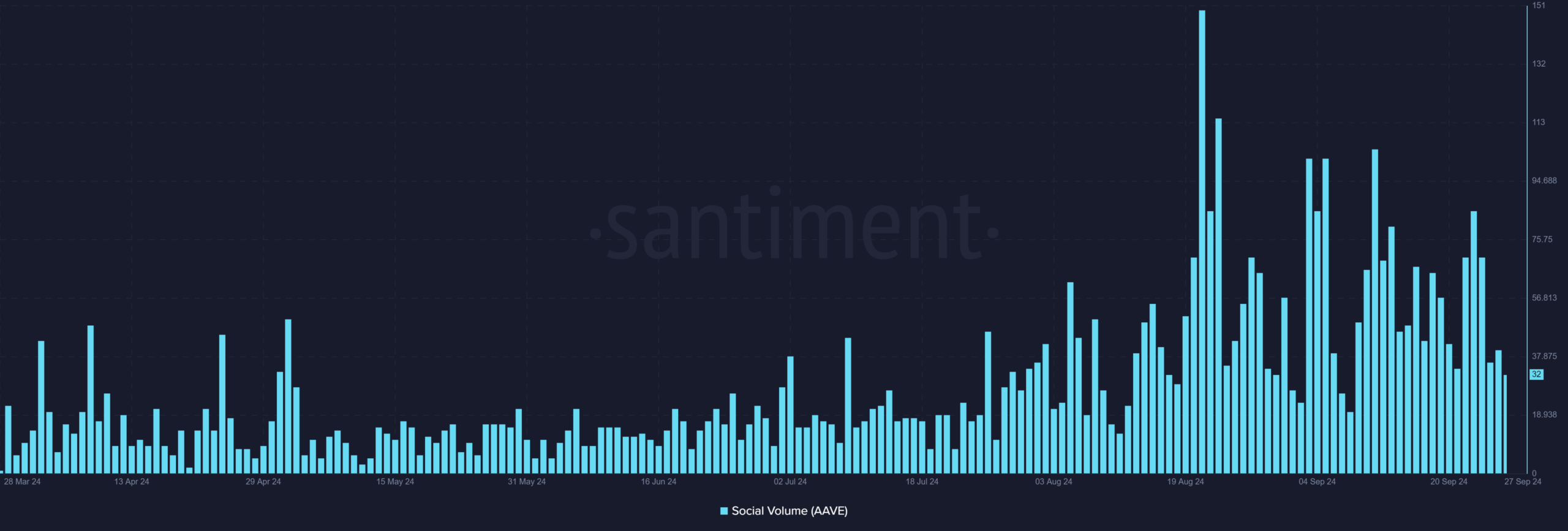

Social media buzz further propels AAVE.

In addition to the aforementioned positive sentiment, social media mentions of AAVE have also increased.

In fact, social mentions of AAVE rose from March to September 2024, indicating heightened interest among investors.

Given that social sentiment often correlates with pricing trends, this could lead to a significant increase in the asset’s value.

Source: Santiment

The bullish future of AAVE looks bright.

The continuous increase in active addresses, bullish liquidation data, and rising social mentions all point to a long-term rally that may have just begun.

With market sentiment remaining positive and Grayscale ranking AAVE among the top performers, investors have plenty of reasons to be optimistic.