AAVE’s attempt to break this resistance again: Will it reach $200 by the end of the year?

To confirm a breakout from the 800-day range, the price must stay above $154 for an extended period.

AAVE could reach $200 if it breaks through key resistance.

Increasing TVL, highlighting rising adoption.

Aave [AAVE] is progressing in the current market environment, outperforming many other crypto assets since the downturn on August 5.

The price of Aave has been steadily increasing, and recent price actions have led it to trade above $154, which is a key resistance level.

To confirm a breakout from the 800-day range, the price must remain above this level for an extended period. The weekly chart shows that Aave is approaching this resistance level for the second time, supported by bullish momentum.

The Wave Trend Momentum Oscillator (WTMO) signals strong upward momentum, increasing the likelihood of breaking this resistance.

If Aave continues to form higher highs and lows, a breakout and retest could solidify the $200 target as the next key level in the medium term.

Source: TradingView

However, staying above the $154 level is crucial for continuing this upward movement, supported by the WTMO, which indicates strong momentum to raise prices.

Growing Adoption of Aave Drives Price Up

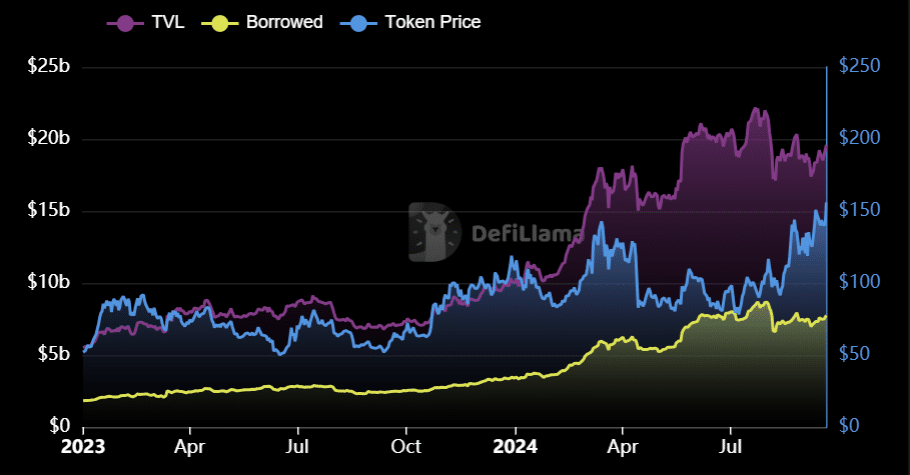

The success of Aave is not only reflected in its pricing. Its total value locked (TVL) has been steadily increasing since the beginning of the year.

Although it was stagnant between April and July, Aave’s TVL is now on the rise again. Currently, the TVL stands at $19.6 billion, while the total amount borrowed through the Aave protocol has reached $7.748 billion.

This strong growth highlights Aave’s position as a major player in the DeFi space. The increase in TVL and borrowed assets reflects growing adoption and trust in Aave, adding more weight to the idea that its price could reach $200 before the end of the year.

Source: DefiLlama

In addition to strong pricing and increasing TVL, whales are increasingly buying, adding significant upward pressure on its price. Data from Hyblock Capital shows that the current whale metric against retail delta is 74%, indicating that whales are accumulating Aave at a notable pace.

Furthermore, the net delta for long positions currently stands at 84%, providing the potential for Aave to reach the $200 mark before the end of the year.

The convergence of whale buying activity and strong net gains reflects a bullish sentiment surrounding Aave.

Address Activity

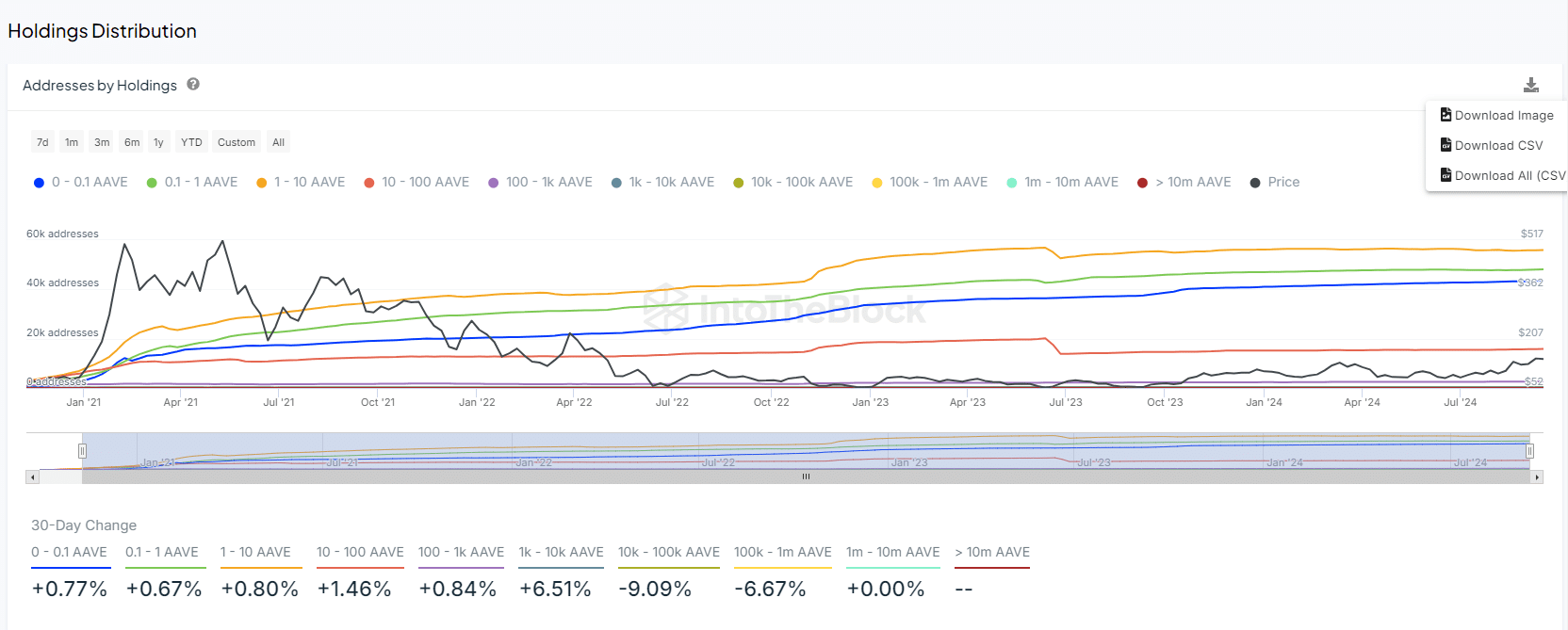

Ultimately, Aave has seen a continuous increase in the number of addresses holding tokens, especially from retail investors to whales, as well as from long-term to short-term holders.

The monthly change in addresses by holdings shows steady growth, although there has been a slight decline for holders with between $10,000 to $100,000 in Aave, as well as for those holding tokens valued between $100,000 to $1 million.

These categories have seen reductions of 9.09% and 6.67%, respectively.

Source: IntoTheBlock

Despite this decline, the overall trend remains positive, and Aave’s adoption continues to grow. This increasing adoption, coupled with whale buying activity, rising TVL, and upward price action, indicates that Aave is on track to reach the milestone of $200.