Analyzing why Solana has failed to maintain its gains in the second half of 2024

Recently, what is happening with Solana, and can it change soon?

A significant change has occurred in the demand dynamics for Solana.

- There may be a correlation between the demand for SOL and the Solana stablecoin market.

Does the Solana ecosystem relate to SOL’s efforts to return above $200? This cryptocurrency showed strong demand in the first half of 2024, allowing it to rebound strongly after any downturns. However, the same cannot be said for SOL’s recent performances.

SOL has underperformed in the past three months, which aligns with some observations from the Solana network. In fact, the growth of the Solana market so far this year shows an interesting correlation with the price performance of SOL.

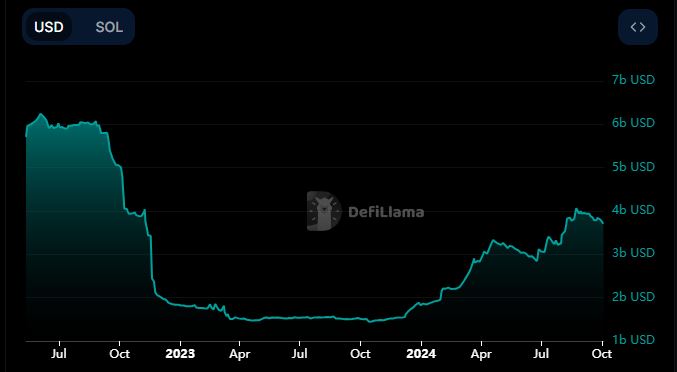

The market value of the Solana stablecoin briefly surpassed $4 billion in the last week of August. However, since then, there has been a significant outflow, reducing it to $3.72 billion. The last time such a severe drop was observed was from mid-April to the last week of June.

Source: DeFiLlama

This cryptocurrency attempted to rebound to $200 from April to June. Similarly, its recent bullish efforts have shown weak momentum.

Has the Solana network activity slowed down?

The Solana stablecoin market has experienced aggressive growth during periods of increased demand in the market. For Solana, this was primarily due to strong demand for memecoins in the first quarter of 2024. However, it seems that the hype around memecoins, especially since June, has diminished.

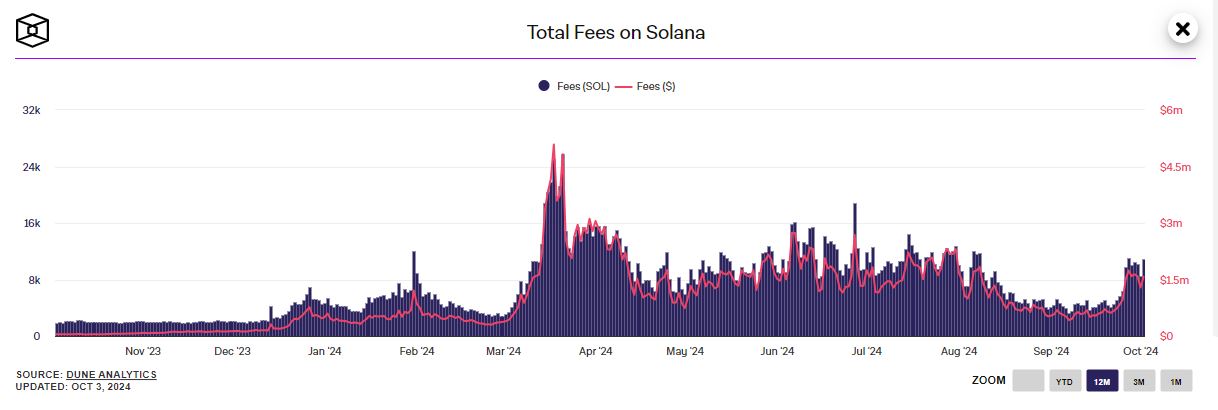

The slowdown in network activity can be more accurately observed through network fees. Solana’s fees peaked in March, which coincided with the highest demand for the network and its productivity.

Source: Dune

Network fees were also based on the value of SOL, which fluctuated according to market demand. This means it may not necessarily provide the most accurate assessment of network performance. The Solana stablecoin market is more aligned with on-chain transactions.

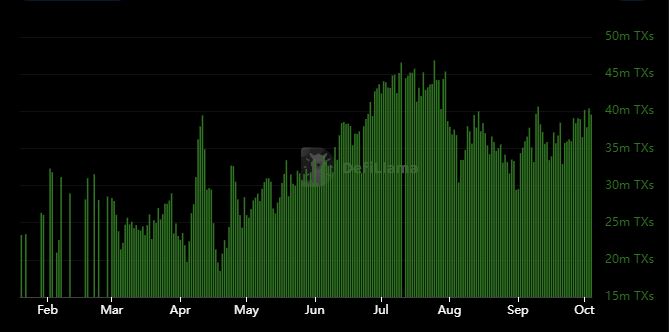

The initial surge in transactions peaked in April and then experienced a decline, followed by a higher peak in July. Since then, transactions have slowed down, indicating a slowdown in network tools.

Source: DeFiLlama

Based on the above findings, it is clear that network demand has been declining, especially in the past three months. As a result, the organic demand that strengthened the value of SOL is not at the same level as in the first half of the year.

This may be a reason why SOL does not seem to be as strong as before.