Bitcoin Cash: BCH Faces Weak Demand After Mid-October – Why?

Bitcoin Cash bulls haven't been able to follow through on their mid-month stunt. We explore what this means in terms of BCH demand.

After a promising performance in the middle of the month, the Bitcoin Cash bulls did not show up at all.

- BCH ownership evaluation and address statistics.

Should You Still Buy Bitcoin Cash [BCH] After the Mid-October Plunge ? A large upward movement in price in one day is often translated as a rally by whales. BCH showed such a result about a week ago, but since then it has struggled to maintain its upward momentum.

Bitcoin Cash has gradually moved away from its last local low in August. It is a sign of recovery from its previous recession. A mid-month price rally on October 14 was expected to bring excitement back to the cryptocurrency.

Since then BCH has struggled to maintain a more bullish trend, indicating weak demand since then. Selling pressure was also limited, allowing Bitcoin Cash to retain most of its mid-month gains. This digital currency was traded at the price of $258.6 at the time of publication.

The weak selling pressure may indicate that the whales behind the mid-month buying have not taken profits off the table. While this suggests that bullish expectations remain intact, it may not necessarily indicate a continuation of BCH’s bullish trend.

But what does chain data say about this?

There are no signs of a strong accumulation of Bitcoin Cash ?

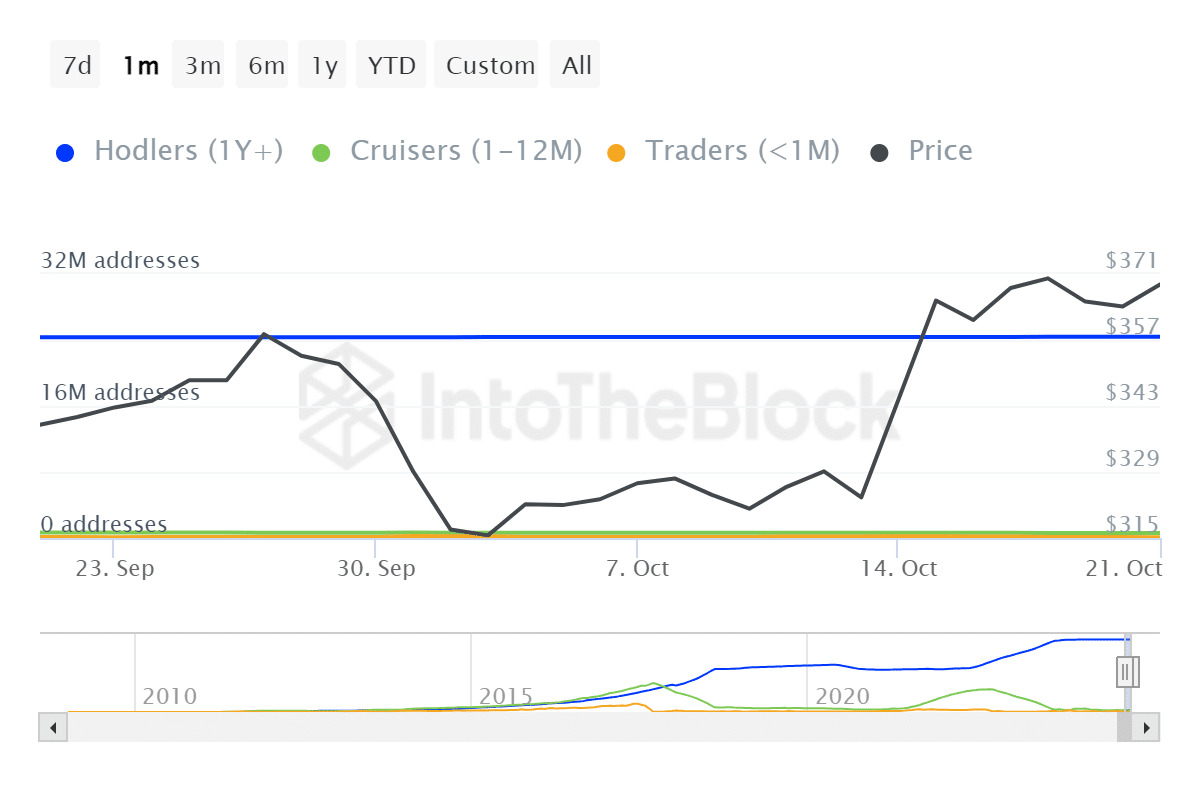

Ownership data confirms that HODLer addresses have increased slightly since mid-October. As of September 24, there were 24.34 million holder addresses, which has since grown to 24.39 million.

Cruisers fell from more than 653,710 addresses to 618,460 as of September 22. Traders decreased from 107,640 addresses to 94,820 addresses during the same period.

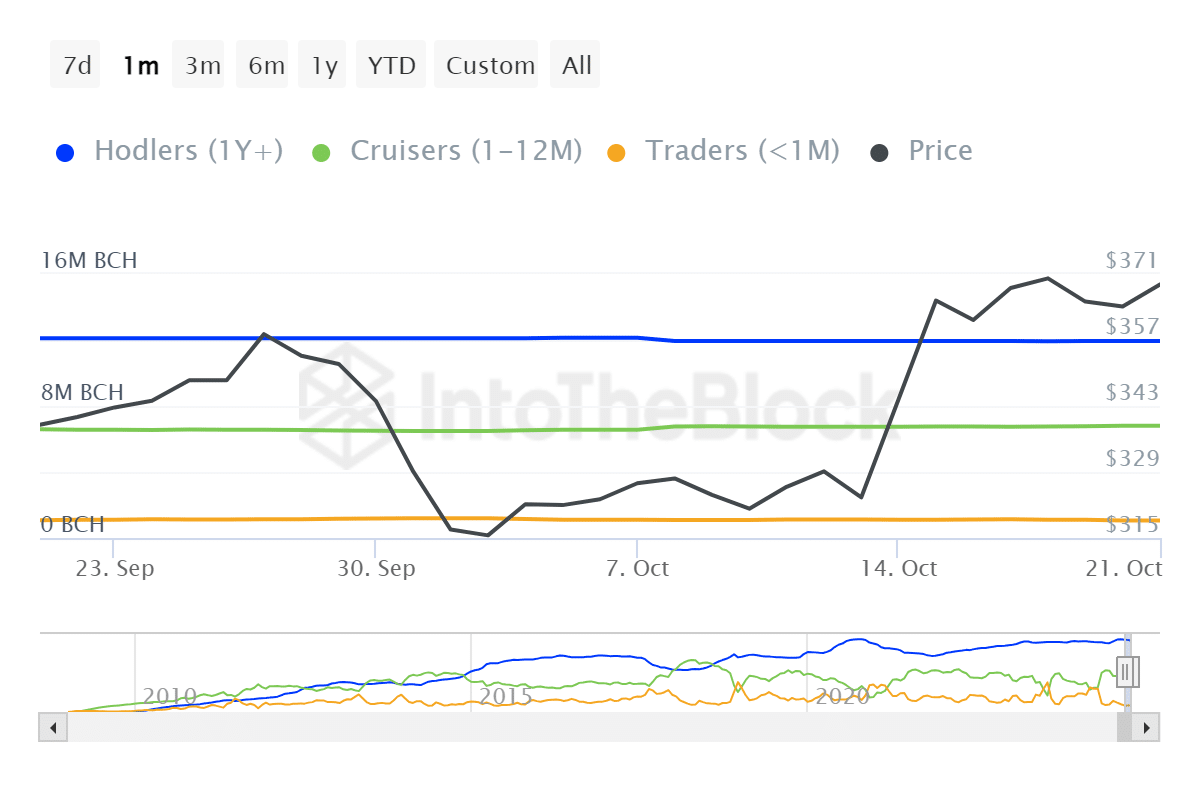

Address data confirms a shift from a short-term to a long-term focus as addresses decrease. But due to addressing activity since the mid-week rally, Hadler’s balance has dropped from 11.94 million BCH to 11.93 BCH . This may indicate that some have benefited.

Cruisers added to their inventory during this time. Their balance increased from 6.75 million BCH to 6.8 million BCH . According to the latest data, traders’ balances have decreased from 1.11 million BCH to 1.07 million BCH.

These findings did not provide conclusive evidence that strong accumulation was occurring.

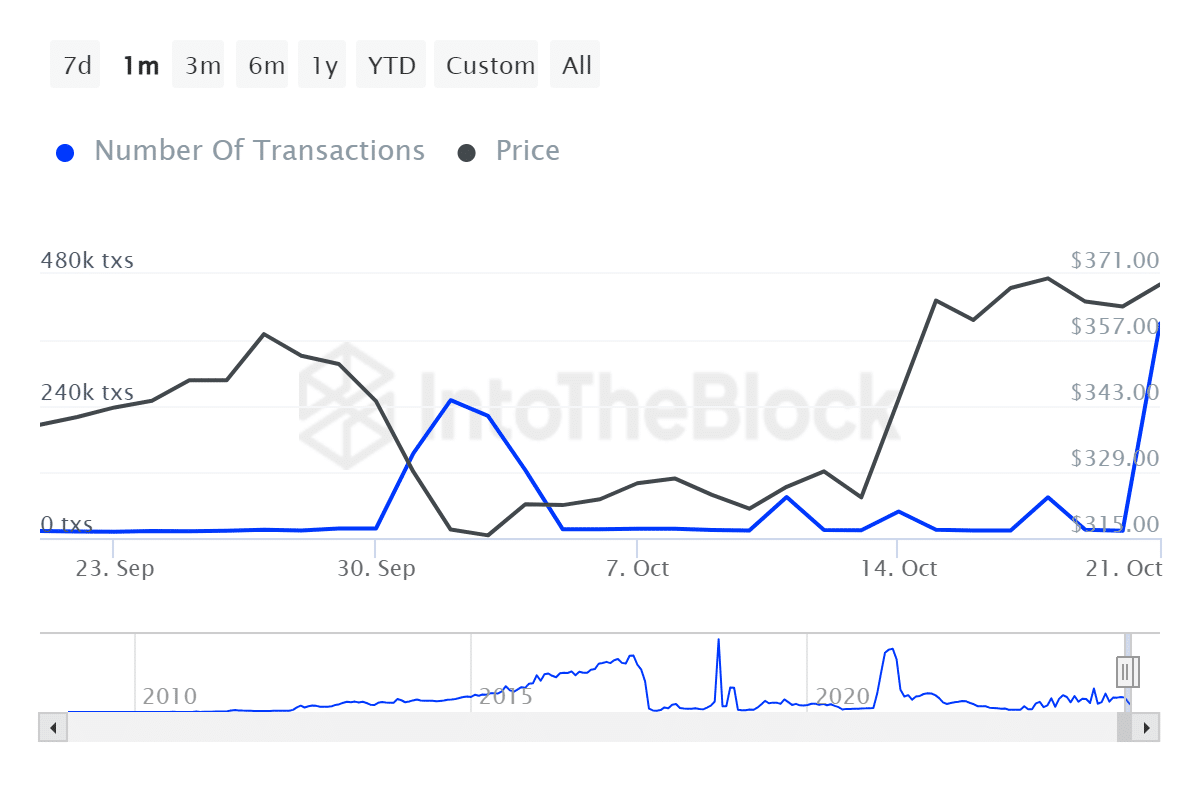

The recent bullish activity in the middle of the month may have been an attempt to induce activity. Currently, Bitcoin Cash has just recorded its highest transaction jump since mid-August.

The number of transactions increased from around 13,000 TX on October 20th to over 368,000 transactions on October 21st. It is not clear whether the transaction spike and the mid-month increase are related.

However, this renewed uptick in trading activity may provide more confidence to investors.