Ethereum is “leading” against Bitcoin – everything you need to know!

Divergence in fundamentals has allowed ETH to maintain steady gains.

Crypto speculators remain concerned about profit-taking and price correction worries.

- Since April 2024, there have been no consecutive green weekly candles for ETH/BTC.

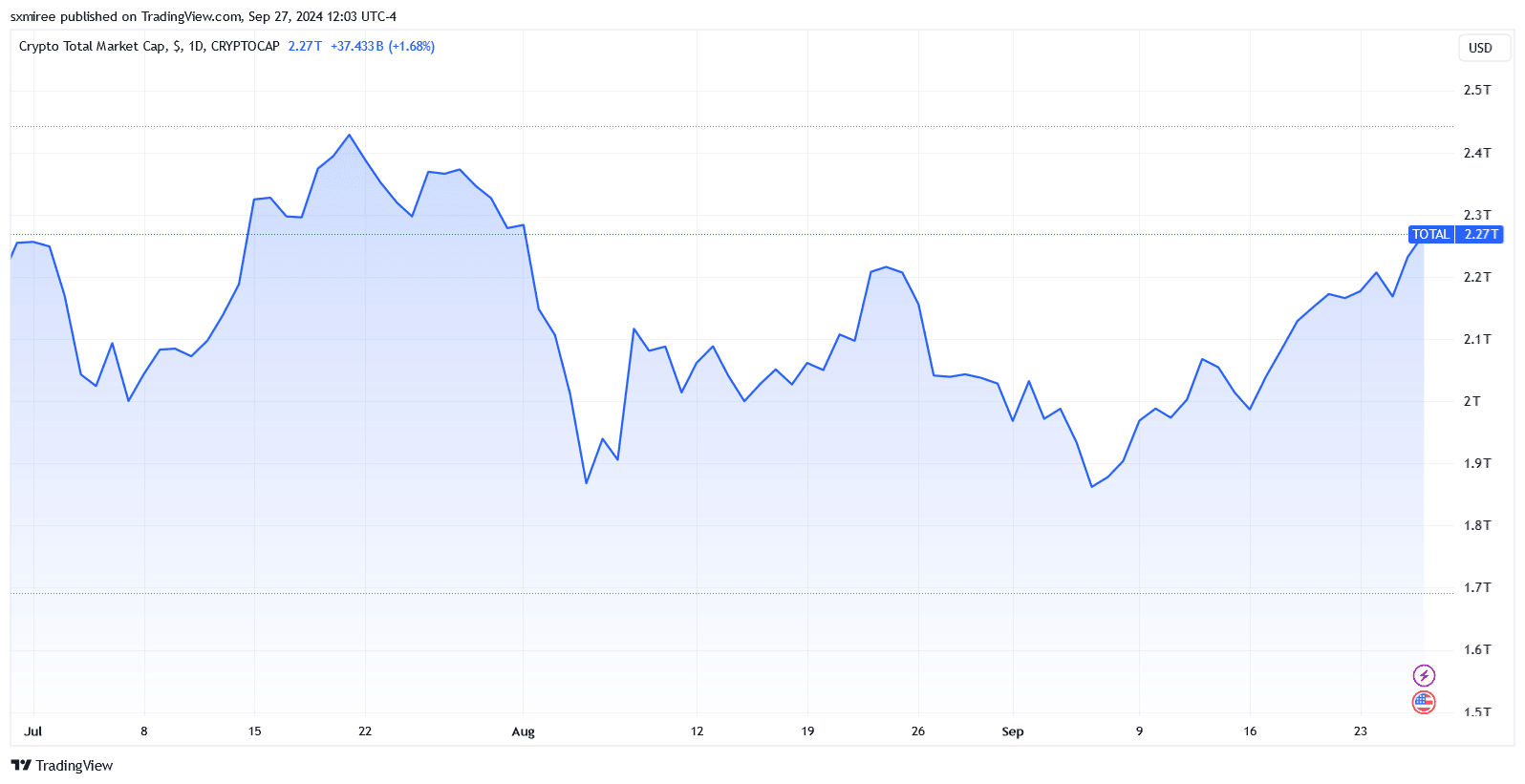

Most cryptocurrencies traded in the green on Friday after appropriate gains between Wednesday and Thursday. In fact, the market’s growth reversed the early mid-week decline that occurred following a weak start to the week.

Source: TradingView

Ethereum (ETH), which has seen an increase in strength in recent weeks, was trading at $2,689 at the time of publication, with bulls closing above $2,770 for the first time since August 24.

It’s worth noting that Ethereum has outperformed Bitcoin in the second half of the month, gaining 16.34% since September 15.

Source: TradingView

However, that’s not all. Data from Coinglass showed that the price of Ethereum increased by 11.26% last week, while BTC rose by 7.38%. While both cryptocurrencies have slowed down this week, they remain on track for their third consecutive weekly gains.

Bitcoin bulls are targeting double-digit monthly gains.

Ignoring their recent activity, Ethereum has fallen by 20.75% over the past three months. This decline is particularly notable given the bullish expectations following the launch of the Ethereum Exchange-Traded Fund (ETF) in the United States on July 23. This institutional-focused offering has failed to live up to the hype, yielding mixed results thus far.

In three days, Bitcoin is leading the benchmark altcoins in monthly returns. In fact, Bitcoin’s price trajectory places it on a path to achieve double-digit monthly gains if it maintains a price above $65,000. In contrast, ETH stands at a 5.70% price increase for September at the time of publication.

BTC and ETH Price Targets Before Q4

As the weekend approaches, traders are keeping an eye on the monthly close of their respective cryptocurrencies. At the time of publication, Bitcoin was trading near $66,000, with support around $62,800. Meanwhile, Ethereum remained stable above $2,600.

Analysts have set a short-term price target for Bitcoin between $68,000 and $70,000 and for Ethereum between $2,760 and $2,820. However, potential pullbacks, especially if the momentum decreases, require caution in long positions. Momentum exhaustion paves the way for bears to take over the weekend and drive prices down, as happened in July.

Source: TradingView

The corrective targets for Bitcoin on the downside include a return below $62,000, with a potential dip to $57,400. Ethereum, on the other hand, faced rejection at $2,770 on August 24 and saw its price drop to $2,430 three days later.

The upside potential for Ethereum’s price is also challenged by the pressure from further ETH issuance, which could impact short-term movement. In fact, data from Ultrasound Money showed that a total of 54,098.4 ETH has been added to the supply in the past 30 days, indicating an annual inflation rate of 0.547%.