Long-term Bitcoin holders have recorded a new high.

Bitcoin shows strength with increased institutional backing and long-term holder accumulation.

Long-term Bitcoin holders are aggressively buying.

- MicroStrategy’s convertible debt enables further Bitcoin purchases.

Bitcoin [BTC] continues to demonstrate its strength as the cryptocurrency market rebounds after a six-month downturn. Actions taken by long-term holders are crucial for Bitcoin traders, providing insights into trade timing.

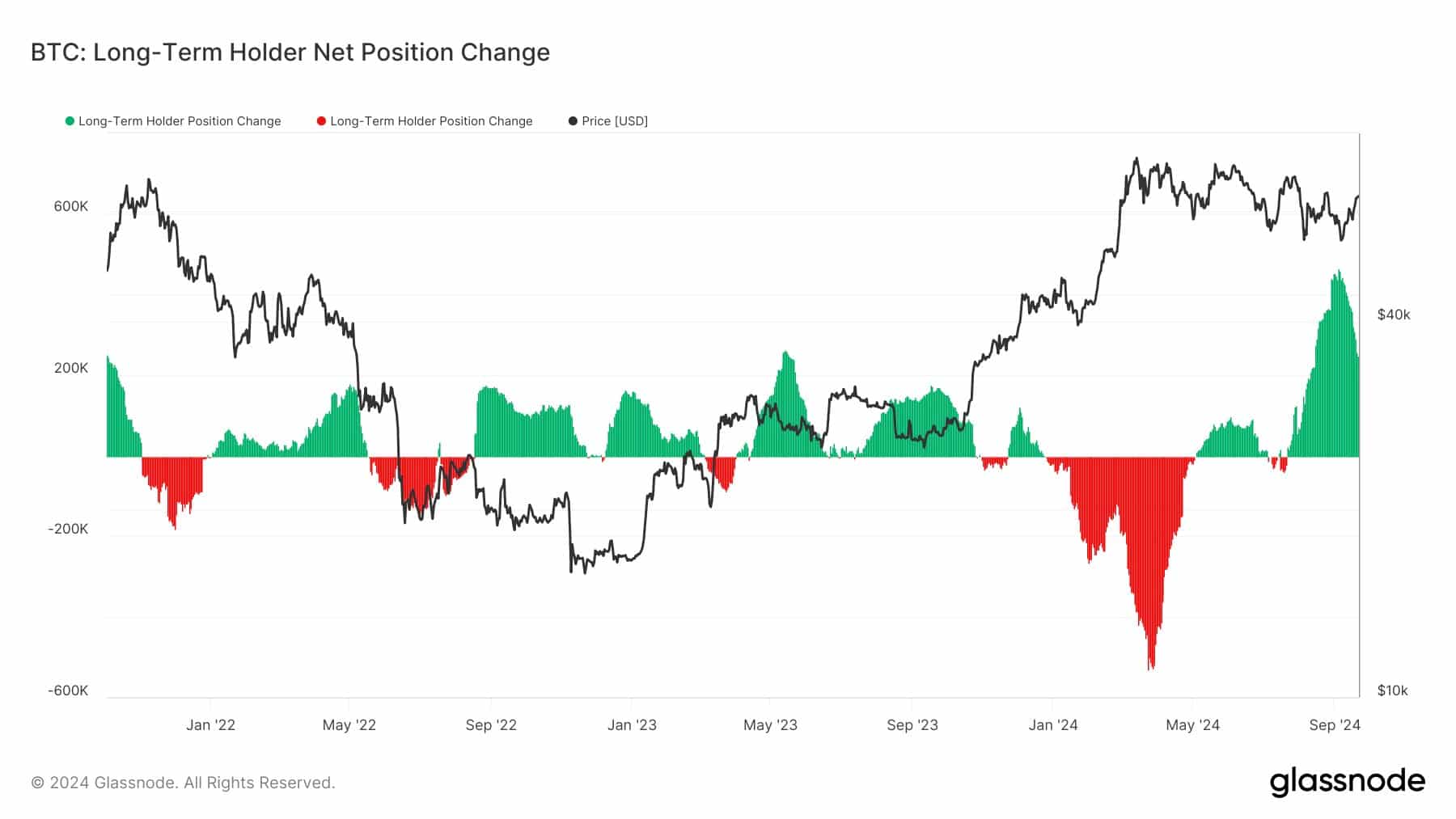

Over the past two months, more long-term Bitcoin holders have accumulated, marking the highest accumulation period in three years.

Additionally, these investors, along with newcomers, have collectively purchased over 1 million Bitcoins since 2022.

This aggressive buying behavior reflects strong confidence in Bitcoin’s future. Some of the earliest Bitcoin mining addresses have recently become active, increasing the long-term Bitcoin supply.

Source: Glassnode

MicroStrategy (MSTR) is a leader among the top 10 stocks in the S&P 500 and has supported Bitcoin with over 1000% profit since adopting its Bitcoin strategy.

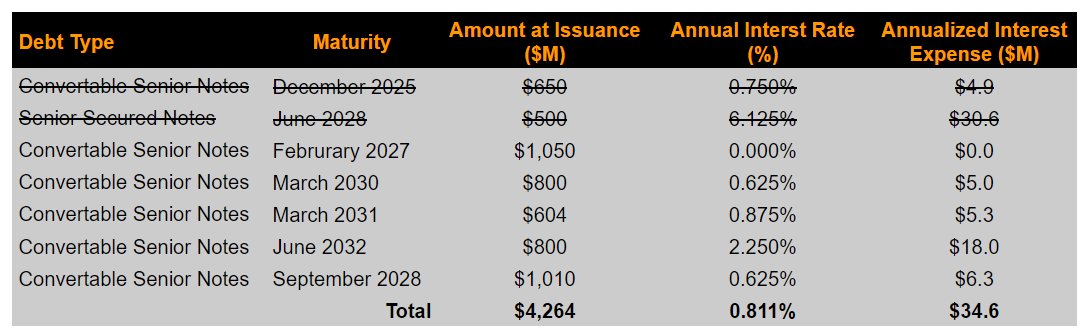

Recently, MSTR issued $1 billion in convertible debt at a low-interest rate of 0.625% to repurchase $500 million of senior secured notes at a rate of 6.125% to finance Bitcoin purchases.

This move reduced its combined interest rate from 1.6% to 0.81%, lowering its annual interest expenses.

Source: X

Notably, this debt issuance also strengthens MicroStrategy’s balance sheet, allowing it to purchase more Bitcoin in the future, even if the price of BTC decreases.

Ongoing purchases by major institutions like MSTR position Bitcoin for future growth.

The 3-day MACD of Bitcoin has crossed into bullish territory, indicating continued strength as Bitcoin trades above $63,000.

With expectations of breaking the $65,000 level soon, Bitcoin shows resilience and an upward trend towards recovering the 100-day moving average.

This bullish movement suggests that being bearish on Bitcoin at this time could be risky, especially as it appears to be poised for new highs.

Performance from Cycle Low

Ultimately, the analysis of Bitcoin’s price performance since its cycle low shows that in the last three market cycles, Bitcoin has consistently been higher in the month of September.

Bitcoin has increased nearly 300% from its current cycle low. If Bitcoin continues its historical pattern and finishes the year like previous cycles, the potential price target could reach $108,000.

With improving market conditions, this target becomes increasingly feasible.

Source: Glassnode

The strong institutional backing of Bitcoin, increased activity among long-term holders, and bullish technical indicators suggest a significant price increase for Bitcoin in the near future.

Growing confidence among investors and major players like MicroStrategy only strengthens the outlook for Bitcoin, as it continues to rise in both price and market dominance.