PEPE Price Prediction – Profit-taking could halt the uptrend, but…

The coin's 90-day average age has been in a steady downward trend since July, signifying a distribution phase.

PEPE’s short-term interest holders could block any bullish recovery efforts

- The increase in the MDIA metric emphasized the stagnation of the network

Pepe [PEPE] has seen increased volatility over the past ten days. Prices and sentiment fell as Bitcoin [BTC] fell 8.4% from October 7-10. Among the top 5 popular memcoins, PEPE saw the second gain last week.

Dogwifhat [WIF] topped the list after a 17.7% increase in 7 days. PEPE increased by 5.5% during the same period. It has also maintained its bullish technical structure on the daily time frame, but can the buyers continue?

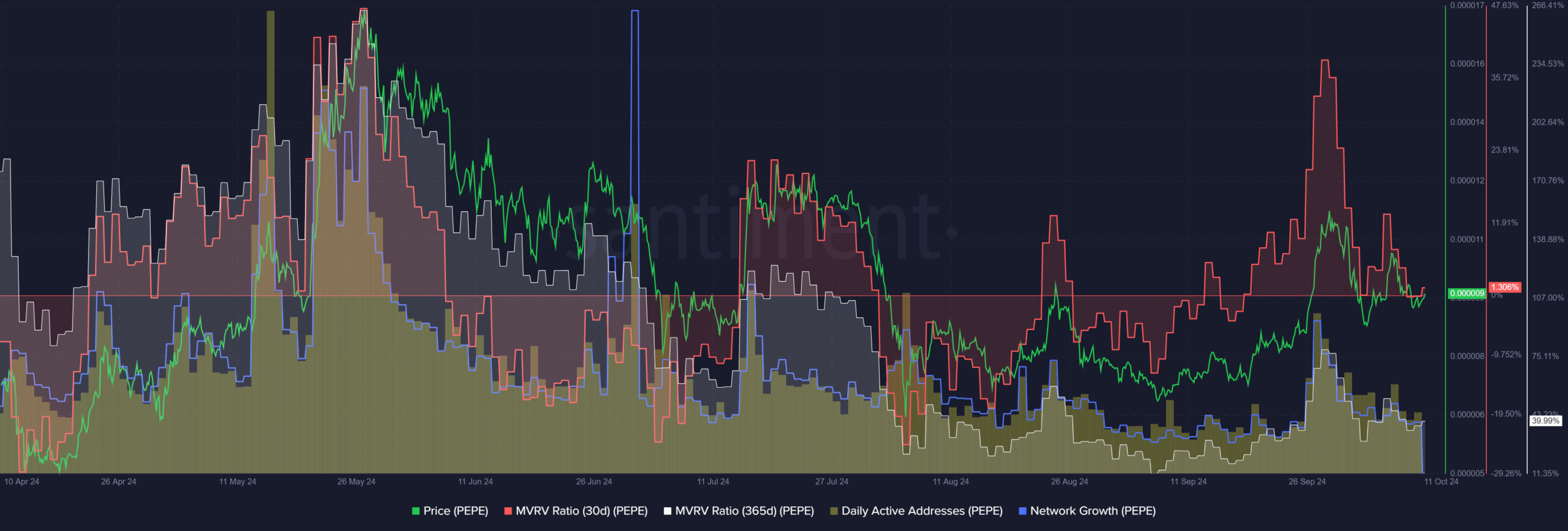

Growth and network activity caused by price increases

Source: Santiment

Since the price and activity of memecoin is largely due to their popularity, the bearish price action of the past few days has affected the metric of daily active addresses. Network growth also slowed in October.

The selling pressure may not end, at least in the short term. Despite corrections in the past two weeks, the 30-day MVRV was still around zero. Hence, any further price jumps are likely to see profitable activity and some selling volume.

Long-term MVRV was also positive, which is not a cause for concern. This measure has been positive since October 2023. This suggests that PEPE’s performance has generated decent returns for holders even with all the turmoil.

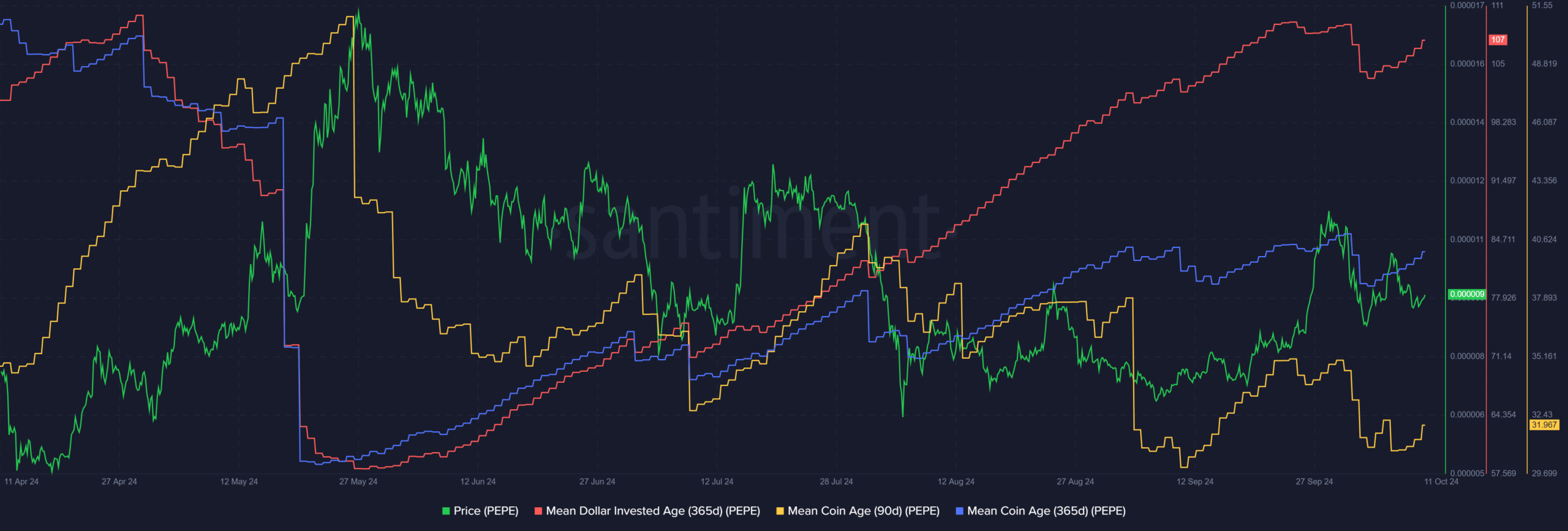

Worried about market stagnation

Source: Santiment

The 90-day average age of the coin has been on a steady downward trend since July. This represents a distribution phase among the 3-month holders. The 365-day average age of the coin has not been able to have a higher trend since the end of August.

This highlights the consistent signal movement between addresses and is a clue to sales activity. At the same time, the average age of investment dollars continued to trend higher. The upward trend indicates that increasingly stagnant coins and old coins are held in a wallet.

When they start entering newer wallets, the metric could head south. This will be an early sign of bullish pressure.