PEPE Reaches This Key Level: Is a Reversal Possible Here?

Over the past month, PEPE has experienced a strong upward trend, rising by 44.8%. But is an imminent reversal on the horizon?

PEPE has seen a 39.07% increase in the past week.

- The fundamentals indicate that PEPE has reached an overbought level, with the RSI at 76.5.

Over the past two weeks, cryptocurrency markets have experienced significant advancements. Among this growth, memecoins are leading with substantial profits.

One such memecoin is Pepe [PEPE], which has sustained an upward trend over the last two weeks.

As of the writing of this article, PEPE was trading at $0.0000114. This reflects a 44.8% increase on monthly charts, with a 39.07% rise in the past week.

Despite these gains, the memecoin remains relatively low compared to its recent peak of $0.0001314, which is approximately 32% below its ATH of $0.000017.

Therefore, the prevailing market conditions raise questions about whether PEPE’s recent upward trend will be sustained or if the memecoin will undergo a correction.

PEPE’s RSI Approaches Overbought Levels

According to AMBCrypto’s analysis, PEPE is experiencing a strong upward movement, with bulls dominating the market.

Source: TradingView

However, its RSI has reached overbought levels at 76.5, which typically indicates a potential reversal of the current trend.

In this context, overbought conditions often suggest that the upward movement may be nearing its end, and a price reversal or consolidation period could occur.

However, while overbought conditions indicate the potential for a pullback, they do not guarantee a reversal.

Therefore, although the RSI indicates overbought conditions, our analysis shows that PEPE is undergoing a strong upward trend. In such a scenario, a short-term change seems unlikely.

Implications on PEPE’s Charts?

While the RSI suggests a potential reversal, it’s essential to determine what other fundamental factors indicate.

Source: Santiment

To begin with, the adjusted price divergence of PEPE’s DAA has been positive over the past week.

This indicates that active addresses for Pepe are increasing, reflecting growing user activity and interest, even if the price does not reflect this. Therefore, PEPE is gaining traction and could witness further price increases.

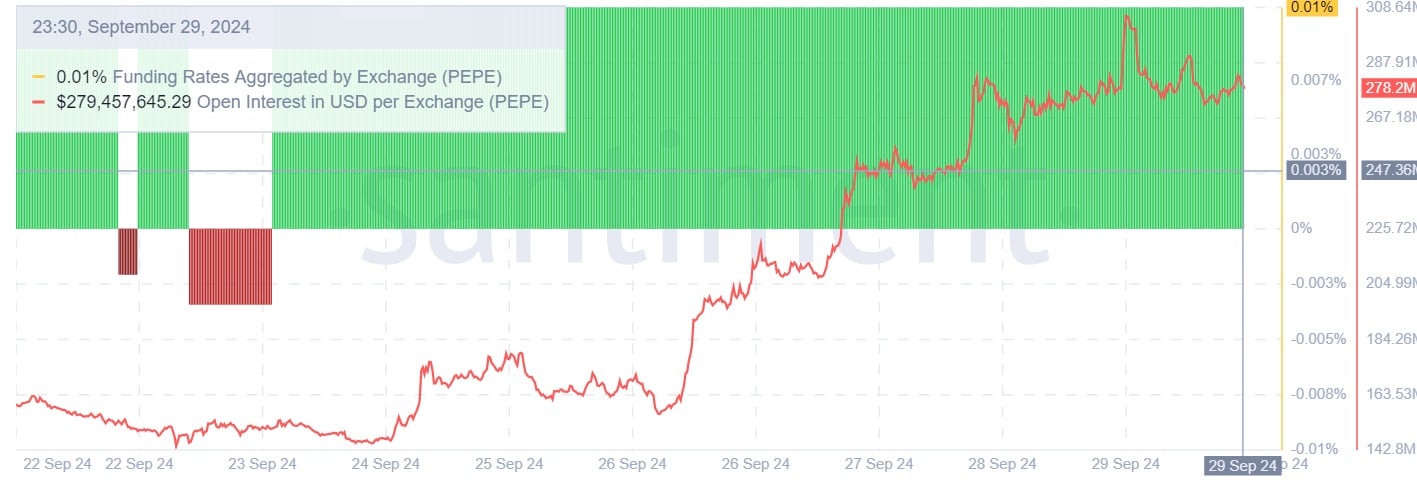

Source: Santiment

Additionally, the accumulation rate of PEPE by exchanges has been positive over the past seven days. This indicates that buyers are paying off shorts.

The fact that investors are willing to pay a premium to maintain their positions reflects their confidence in the future value of the memecoin.

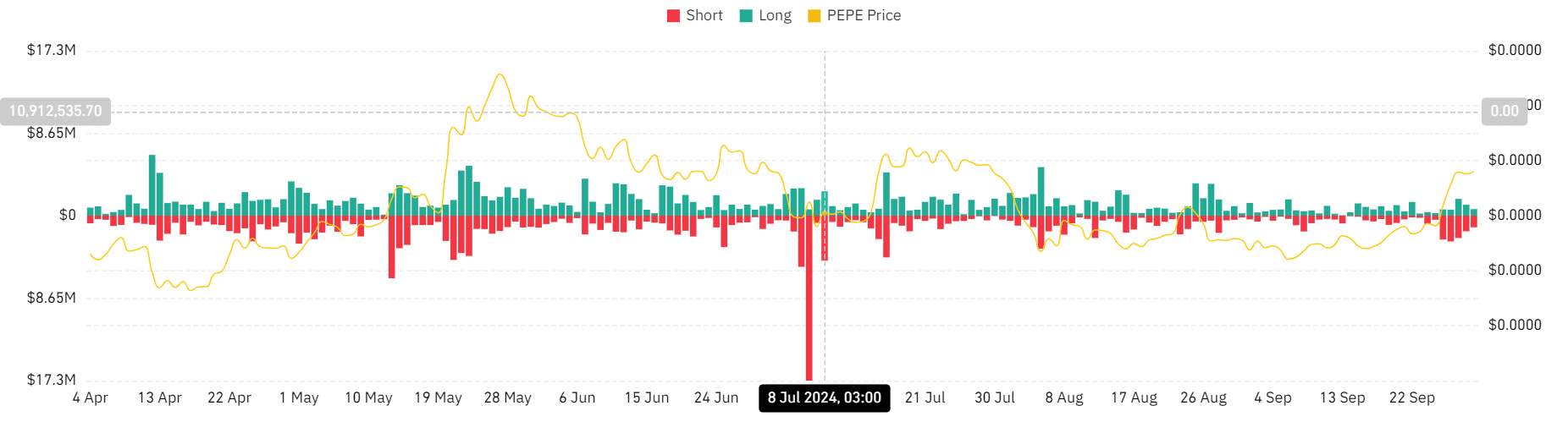

Source: Coinglass

Ultimately, this positive market sentiment is reflected in higher liquidity for those using shorts compared to those holding long positions. Short-term holders have faced significant liquidations over the past four days.

Therefore, based on our analysis, although PEPE’s RSI has reached overbought territory, the upward trend of memecoins remains strong. This suggests that it may stay at this level for a while before a price decline begins.

As such, if the prevailing conditions hold, PEPE will target the next significant resistance level at $0.0000119. Consequently, a correction would bring the price of the memecoin down to $0.000009847.