Shiba Inu shines with a 75-day winning streak: Is a 110% increase possible now?

SHIB is nearing a breakout as whales target potential gains of 110%.

SHIB shows signs of a breakout from a 75-day range.

The liquidity delta of the order book indicates that the depth of buy orders is thicker than sell orders.

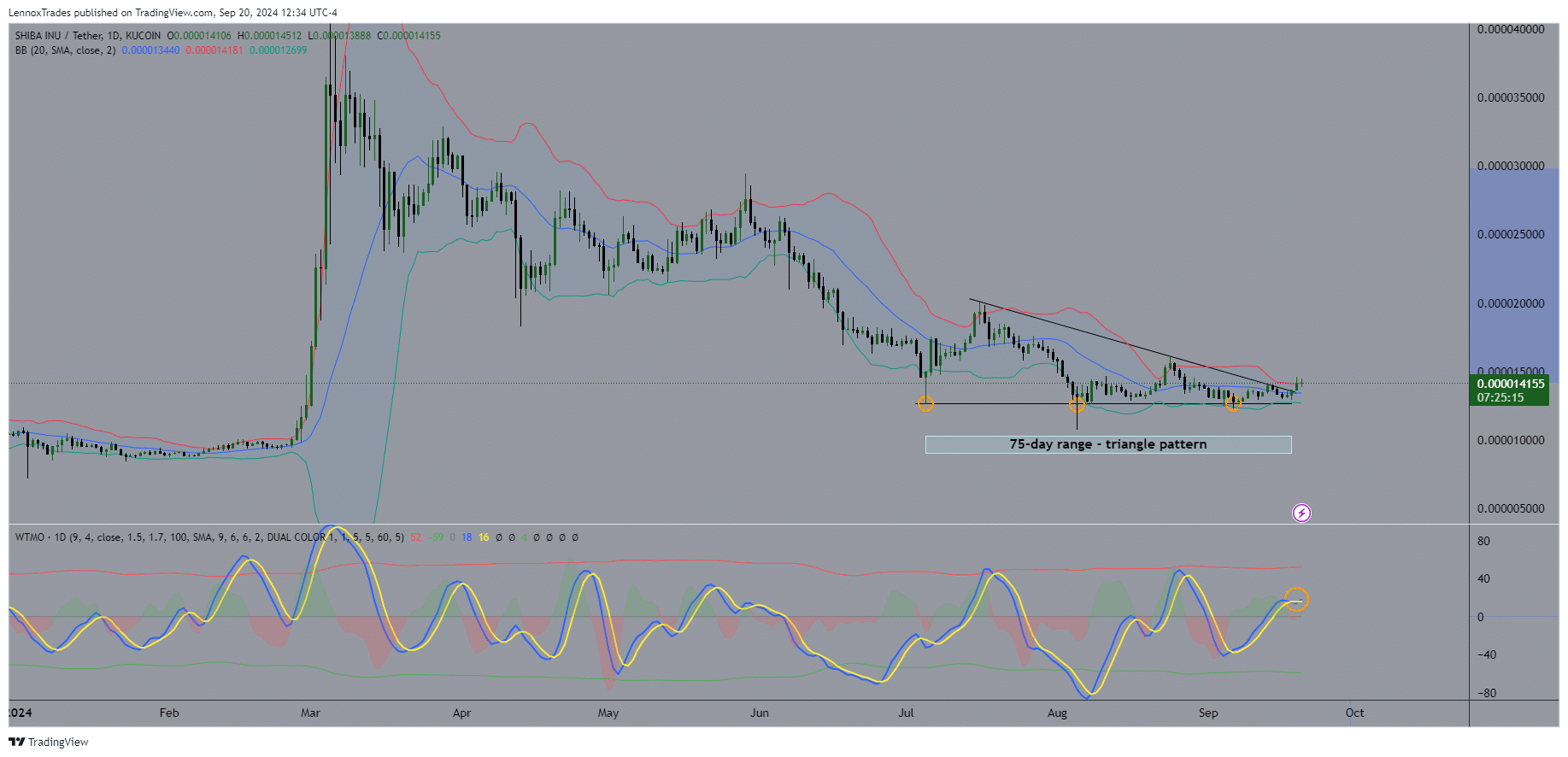

Shiba Inu [SHIB], the second-largest memecoin, has been consolidating near the support area of $0.000014416. It has tested this level three times but has not dropped below it.

However, the SHIB/USDT price is now indicating a potential breakout after 75 days. At the time of writing, the Bollinger Bands, which had been tightly compressed, are starting to expand.

This development could signal the end of the consolidation phase. Additionally, the momentum oscillator has formed a golden cross, further indicating increasing buying pressure and market momentum.

Source: TradingView

As seen with Bitcoin and most altcoins, SHIB offers a long opportunity by showing signs of overall market strength in the crypto space.

If Shiba Inu breaks out of its consolidation and confirms with a retest, it could yield a return of up to 110% if it reaches the level of $0.00002949 by next year. As previous AMBCrypto analysis indicated, a 300% increase is also possible.

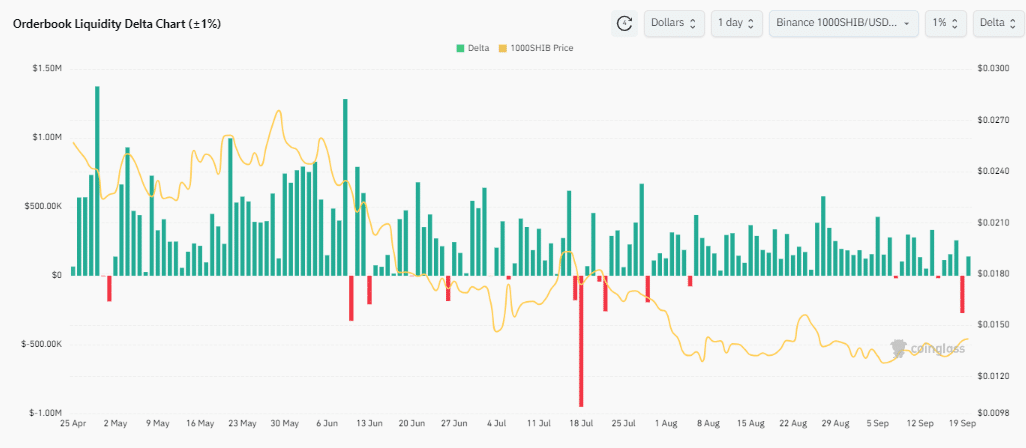

The order book signals of liquidity delta…

The difference in the total depth of the order book, which measures liquidity in buy and sell orders, shows that buy orders currently outnumber sell orders.

Since April 25, most days have indicated stronger buy-side liquidity, with only 15 days showing a sell-side advantage.

This trend suggests that traders have been accumulating despite the downward movement and range-bound conditions. This accumulation of buy positions further supports the idea that SHIB is nearing a breakout from the Bollinger Bands.

Source: Coinglass

While the liquidity of the order book does not determine the price by itself, a large number of buy orders can act as a catalyst, pushing the price of SHIB higher.

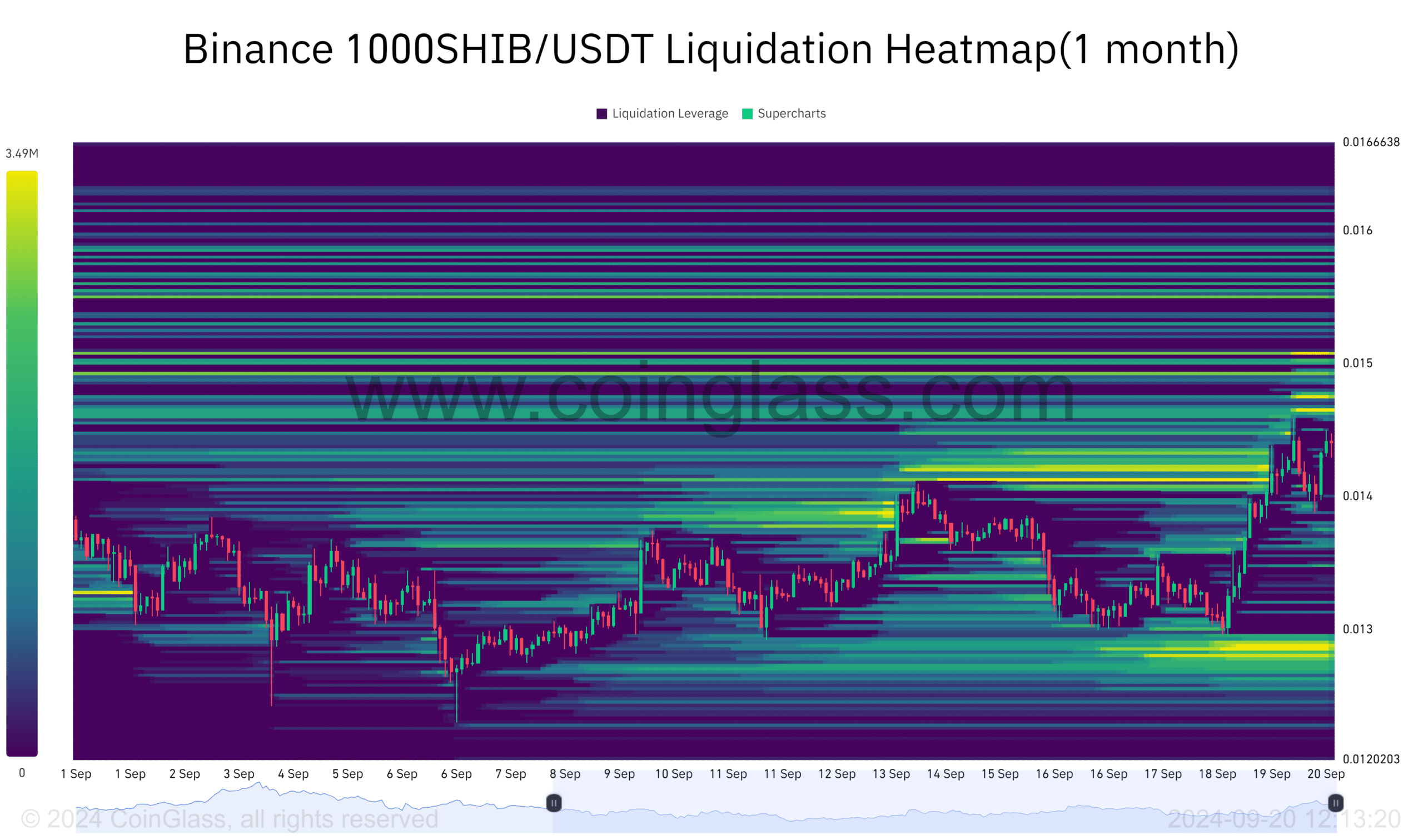

SHIB Liquidation Heatmap

The market tends to gravitate toward clusters with high liquidation, so the current price of SHIB is likely targeting the level of $0.0000146, where $3.49 million in SHIB shorts will be liquidated.

Further price advances could lead to additional liquidations, including $2.91 million in the $0.0000147 area.

Since these areas are close together, even a brief price spike could trigger this liquidity. Once this liquidity is utilized, SHIB could move past the $0.000015 level, where $3.13 million is slated for liquidation.

These clusters act as magnets, and once cleared, they could aim the price of SHIB for higher movements, targeting the liquidity just below the current price at $0.0000128, where $3.2 million in SHIB is set for liquidation.

Source: Coinglass

Concentrated Ownership

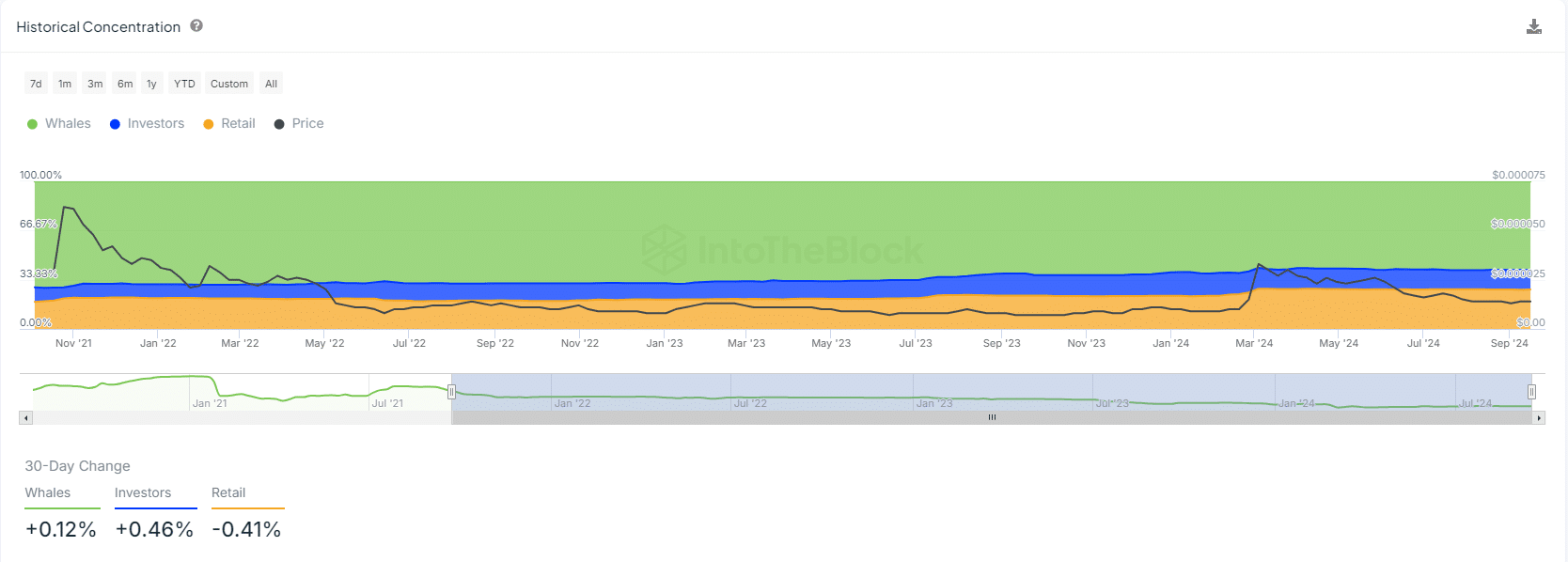

Historically, whales have dominated SHIB ownership, holding 59.97% of the total supply or 589.99 trillion SHIB. Investors hold 26.74%, while retail traders account for 13.29%, equivalent to 130.78 trillion SHIB.

Whale assets have increased by 0.12%, and the holdings of large investors have risen by 0.46%. Meanwhile, retail ownership has decreased by 0.41%, but this is not a significant concern.

The increasing accumulation by whales and larger investors suggests that a breakout and price increase for SHIB may be imminent.

Source: IntoTheBlock