The outflow of Bitcoin miners confirms the $61,000 support – why this is key for the October rally

Converting the $61,000 level into a support zone is crucial for launching a bull rally in Q4

Bitcoin miners exiting the market may signal a bearish trend and pave the way for new interests.

- However, specific conditions must align for a confirmed bull rally.

A week of bearish trends caused Bitcoin [BTC] to fall below $61,000 from its previous resistance of $65,000. However, at the time of publication, there seemed to be optimism in the market, with the cryptocurrency’s value nearing $62,000.

The second week of the fourth quarter may witness a price correction, especially as profit-seekers cash out and exit the market. Among them are miners who have capitulated as Bitcoin approaches $62,000.

However, until the downside is fully exhausted, it may be challenging for bulls to establish a sustainable rally.

Miner outflows may indicate a bearish market.

On the daily price chart, the weekly movement of BTC reflects price performance in mid-August, when a rejection near $65,000 halted a potential bullish trend.

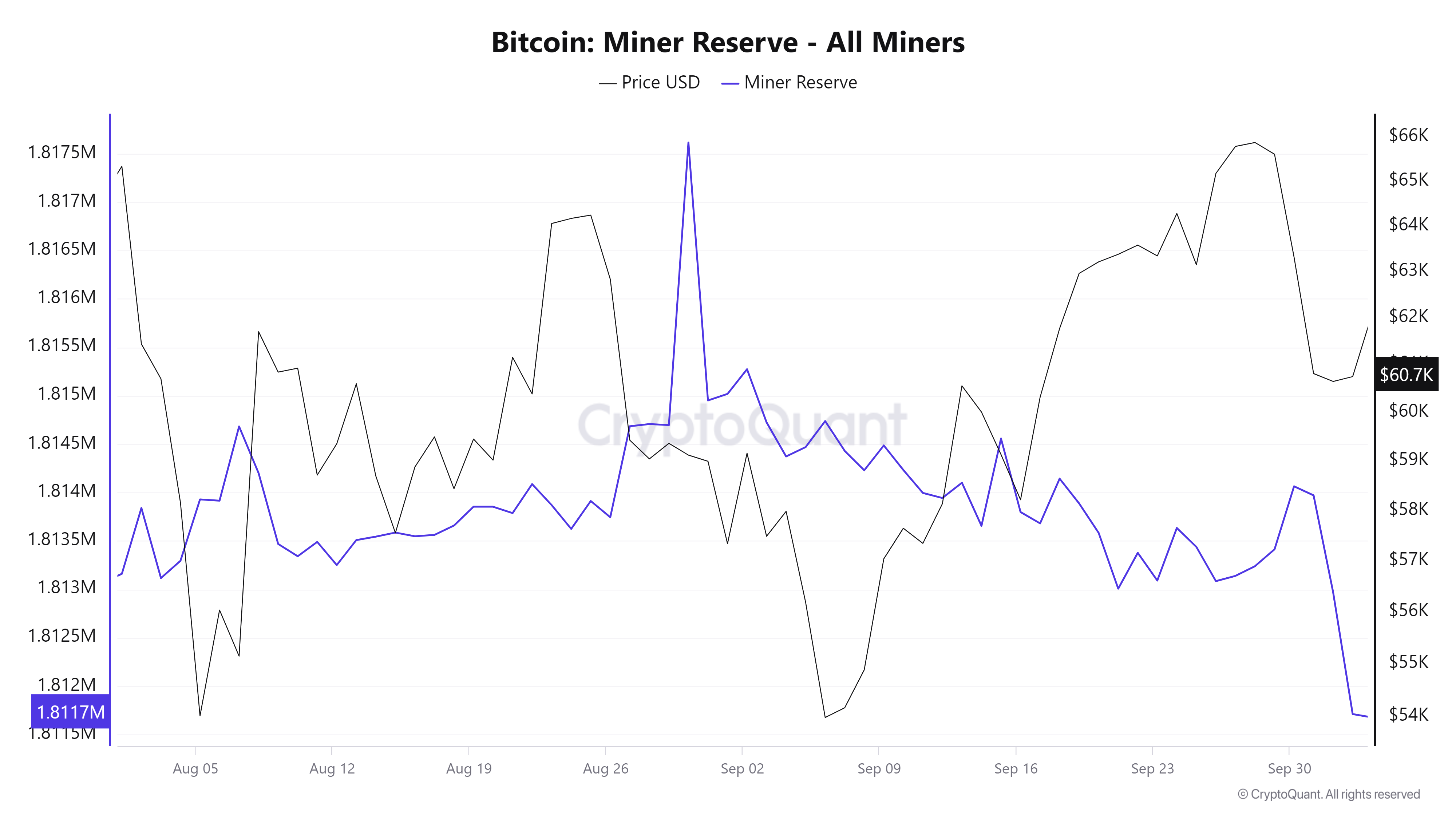

During this period, miners exited the market after five consecutive days of downward pressure, causing their assets to decrease from 1.817 million to 1.814 million.

Source: CryptoQuant

A similar trend has been observed recently. Last week, as Bitcoin dropped from $65,000 to $60,000, miner reserves experienced a significant decrease, falling from 1.814 million to 1.811 million at the time of publication.

Typically, the exit of weaker investors often leads to market stabilization, allowing stronger hands to accumulate positions at favorable prices.

If this trend continues, the miners’ capitulation may signal a market crash. As weaker hands lock in profits and exit, it could provide new buyers with ideal opportunities to purchase.

However, as previously mentioned, converting $61,000 into a crucial support level is important to initiate a bullish cycle. While the exit of miners can help confirm this support, other conditions must also align.

LTHs Trust Bitcoin Bulls

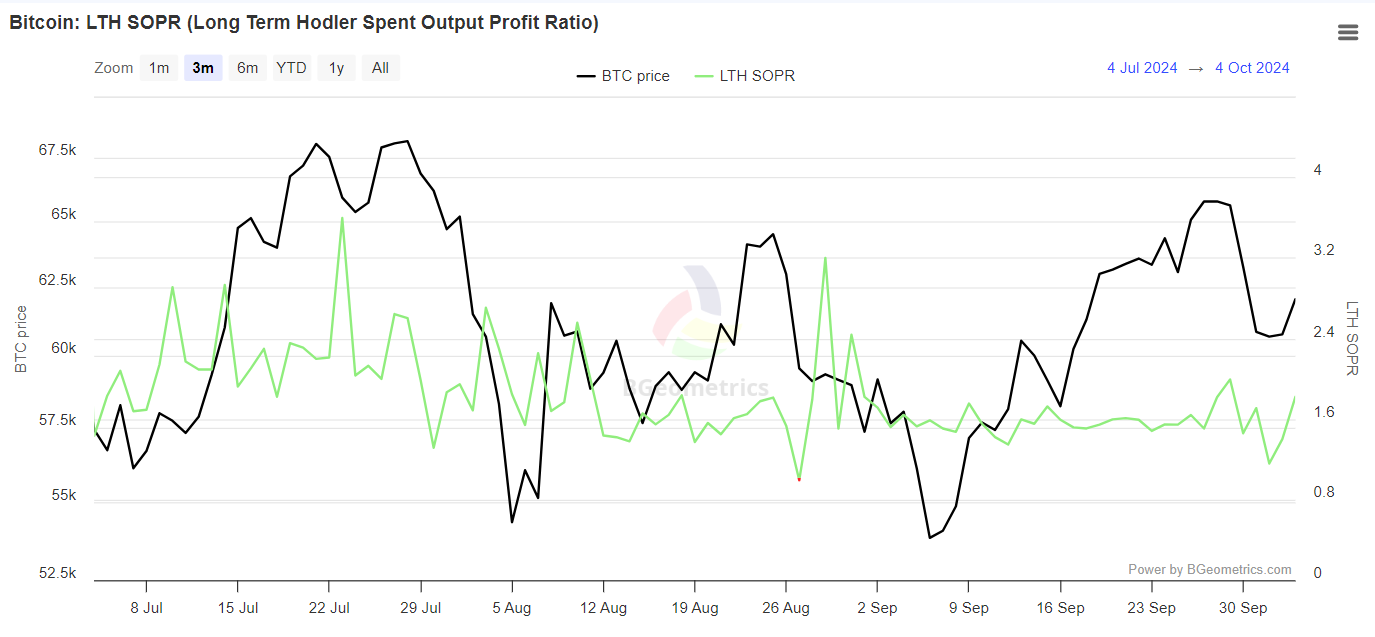

Unlike miners who capitulate to mitigate losses before a further market decline, Bitcoin holders seem to be selling with profit for over 155 days.

The LTH SOPR has recently reached its highest level. Historically, such movements have driven positions towards FOMO and increased expectations for future gains in the next cycle.

Source: BGeometrics

If LTHs avoid panic selling—which seems likely—a price correction may occur in the short term. This could allow the $61,000 resistance to turn into support, with bulls targeting the next resistance at $64,000.

In summary, Bitcoin’s drop from $65,000 to $60,000 was crucial in eliminating weak hands and establishing $61,000 as the next support level.

This decline filtered out less committed investors and allowed stronger holders to accumulate their positions.

However, while the figures indicate a solid foundation, AMBCrypto further examined to determine whether the recent rally is genuine or merely a short squeeze.

BTC is Regaining Control for a Long Time

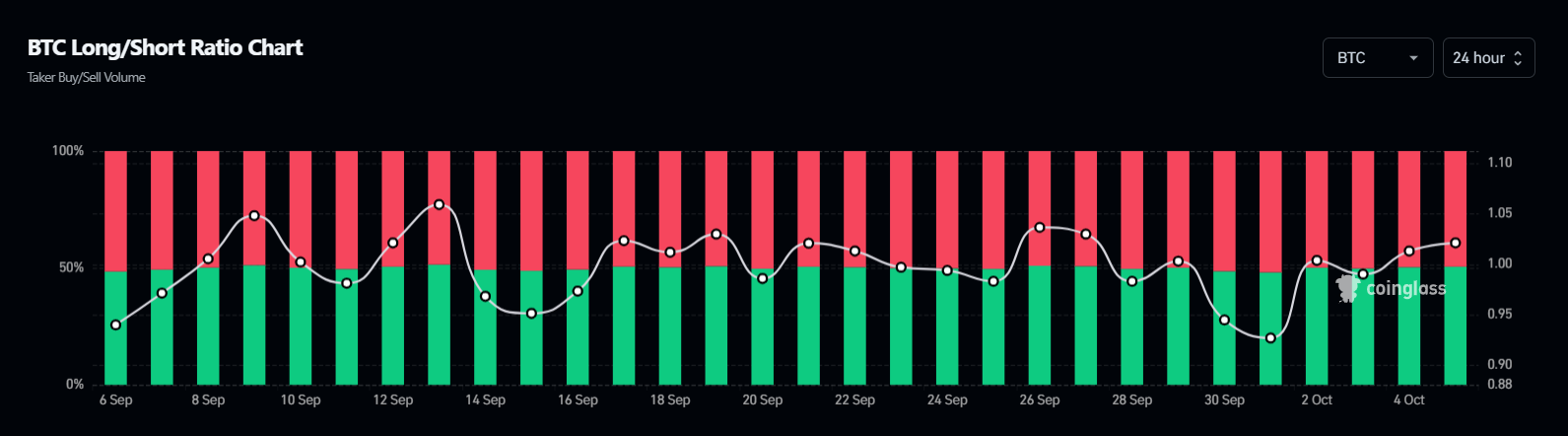

Over the past four days, buy positions in the derivatives market have regained dominance, preventing effective shorting of Bitcoin by short-term sellers.

Source: Coinglass

While this is a bullish sign, it also indicates that the influx of buy positions has pressured the shorts, resulting in significant liquidations.

Therefore, this does not entirely dismiss the short squeeze scenario but could serve as an entry point for a bullish reversal, generating excitement among buyers.

Overall, with $61,000 confirmed as support and renewed optimism from buy positions, bulls are likely to maintain the next target at $62,000, which could lead to a rise toward $64,000.

However, to achieve this, close monitoring of short-term sellers is essential.