WIF Break: Analyst Predicts When Dogwifhat Will Reach Its ATH

Dogwifhat Rises 42% in a Week, with Bullish Signals Indicating Further Potential Upside and Steady Momentum

WIF is experiencing significant growth due to a confirmed breakout from a descending channel, indicating an upward movement.

- The increase in open interest and trading volume suggests a potential sustainable price rise in the short term.

Dogwifhat [WIF], a rising memecoin in the cryptocurrency market, has recently made waves and shown a positive response to the gradual recovery in the overall crypto market.

In the past week, WIF has shown a 42% increase, outperforming many other digital assets.

Bullish sentiment appears to persist, with WIF achieving an additional 5.4% rise in the last 24 hours, bringing its current trading price to $2.43.

Amid this price performance, Captain Faibik, a well-known cryptocurrency analyst on X, recently highlighted the price actions of WIF.

Faibik’s analysis pointed to a potentially strong future for WIF, attributing its current performance to significant technical signals that could indicate further growth.

Technical Breakout of WIF and Its Implications

In a recent post, Captain Faibik analyzed the technical chart of WIF and indicated that the memecoin might be on the brink of a sustained bullish trend.

Faibik emphasized that WIF has experienced a confirmed bullish breakout from a descending channel on the daily timeframe.

He stated,

The bullish breakout from the descending channel of WIF has been confirmed on the daily timeframe… sending it to a new all-time high.

Therefore, WIF can be set for upward movement, with new highs on the horizon.

Source: Captain Faibik/X

For context, a descending channel is formed when the price of an asset moves between two lower parallel trend lines, defined by a series of lower highs and lows.

A breakout occurs when the price of the asset surpasses the upper trend line, freeing itself from the downward movement.

This breakout not only indicates that buyers are gaining control but also signifies increased momentum, potentially paving the way for significant price increases.

Continued Potential for an Uptrend?

Beyond the technical outlook, it’s worth examining the fundamentals of WIF to determine whether the current uptrend is sustainable.

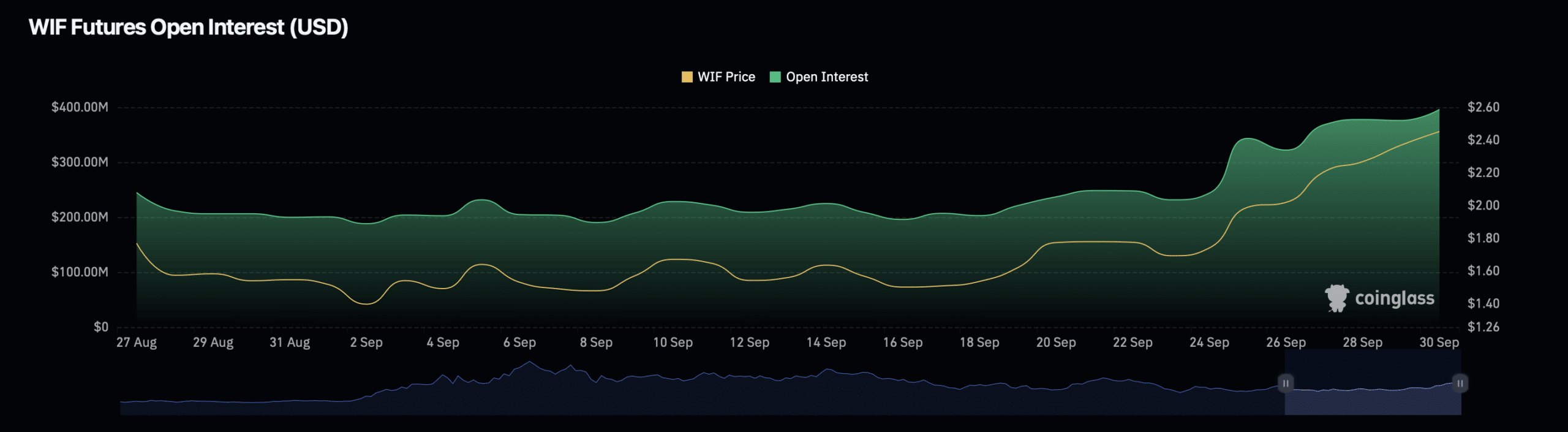

A key metric in this analysis is WIF’s open interest, which provides insight into the number of open positions in the futures market for the asset.

According to Coinglass data, WIF’s open interest has increased by nearly 4%, reaching $389.70 million.

Additionally, open interest volume has seen a significant rise, increasing by 43.78% to a value of $1.78 billion.

Source: Coinglass

This increase in open interest and volume indicates a growing market activity and interest in WIF.

Typically, an increase in open interest is accompanied by a greater influx of capital into the asset’s derivatives market, often signaling heightened expectations for price movement.

When open interest rises alongside increasing prices, it often suggests that traders are betting bullishly on the asset and expect the price to continue its upward trajectory.

Furthermore, the rise in open interest volume may highlight increased market liquidity, enhancing trading opportunities for WIF. Such liquidity can attract more traders and further drive the asset’s price movement.