WIF Breakout Points Up 43%: Is This The Next Big Move?

Dogwifhat gains 6.63% as it gains bullish momentum after breaking out of key patterns.

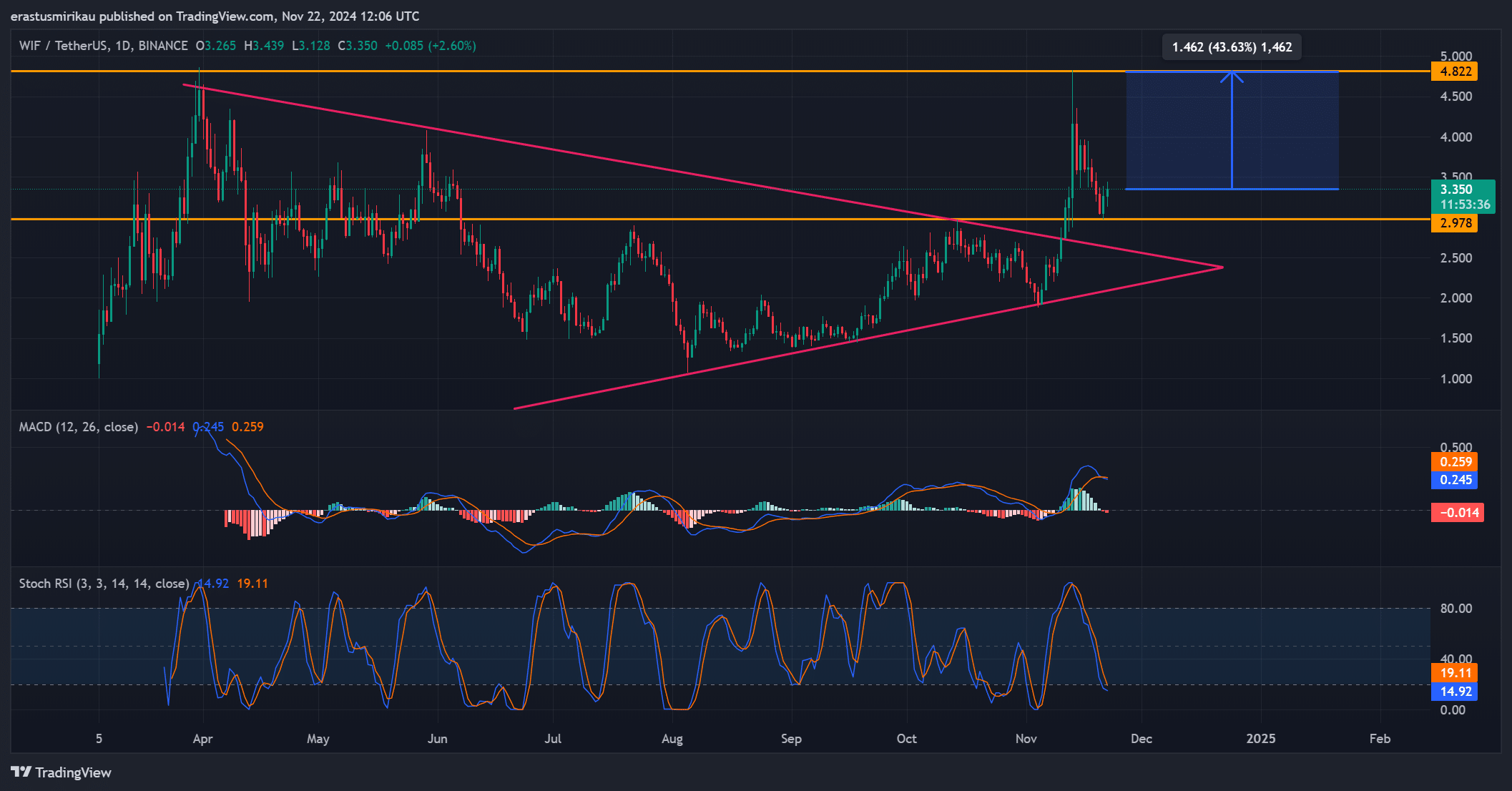

Dogwifhat broke out of a symmetrical triangle and found support at $2.978.

- Market dynamics, including long/short ratios and volume, indicate the potential for sustained upside.

Dogwifhat [WIF] has been making waves in the cryptocurrency market, rising 6.63% to $3.29 in the last 24 hours, indicating a renewed bullish move.

At the time of publication, trading volume increased by 19.38% to $1.02 billion, fueling growing interest in the asset. After breaking out of the critical symmetrical triangle pattern, WIF looks poised to hit higher price targets. The question remains: can it maintain this upward trajectory?

WIF’s upside breakout sets the stage for a rally

Dogwifhat’s departure from the symmetrical triangle pattern has caught the attention of traders. This pattern indicates a change in momentum from consolidation to bullish momentum.

Furthermore, WIF has retook its critical support level at $2.978, a key area that can now serve as a springboard for further gains. As a result, traders are eyeing the next price target of $4.822, which represents a potential upside of 43.63%.

From a technical point of view, WIF shows strong bullish signals . MACD has moved towards a positive reading of 0.259, with the signal line pulling back slightly at 0.245, confirming a bullish crossover. This suggests that momentum remains firmly on the buyers’ side.

Additionally, the Stochastic RSI is at an oversold level, reading 19.11, indicating that the asset could consolidate for a short time before continuing the uptrend. The breakout, along with these indicators, suggests that WIF has significant upside potential in the near term.

Are cows or bears controlled? Long/short ratio analysis

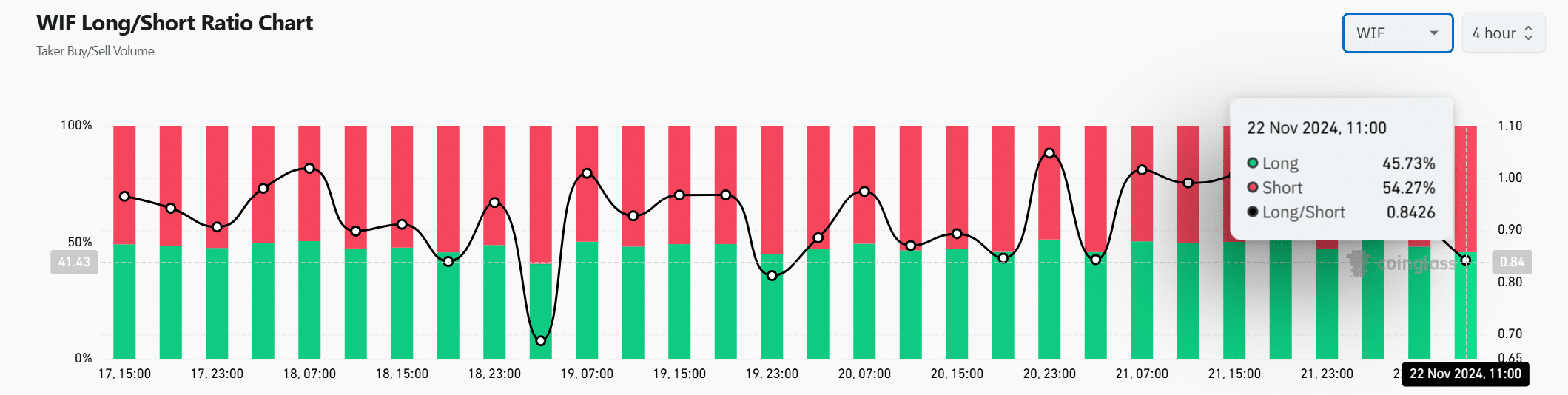

Long/short ratio analysis provides additional insight into market dynamics. Currently, shorts outnumber longs, with 54.27% of buyer volume being short positions while 45.73% are long.

However, this bearish sentiment could work in the bulls’ favor. If the price of WIF moves higher towards the $4.822 target, it may create short pressure, forcing bearish traders to close positions and increase prices.

Additionally, increased trading volume indicates increased interest, potentially favoring an upward move.

WIF’s social dominance suffers, but the fundamentals remain strong

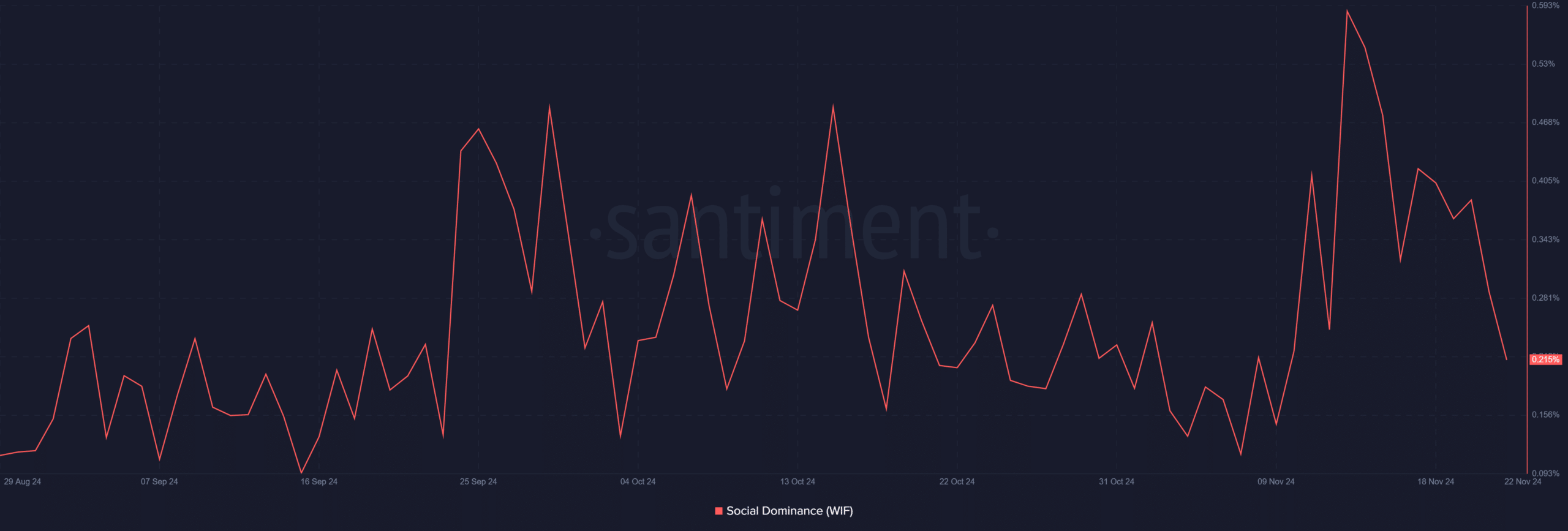

Interestingly, WIF’s social dominance has dropped to 0.215 from 0.287 the previous day. While this is indicative of a slight decline in community-driven engagement, the break above $2.978 and the subsequent rally suggest that price action is being driven more by technicals than social sentiment.

Nevertheless, it is still important to monitor social activity, as re-engagement can reinforce WIF momentum.

Is $4,822 available?

Dogwifhat is currently positioned for further gains , supported by strong technical indicators and increasing trading volume . MACD crossover, stochastic low RSI and break above $2.978 as support indicates strength.

With increasing upside momentum, WIF seems to be on track to reach its target of $4.822. Sustained volume and a break through the intermediate barriers will be the key to confirming this bullish path .