Will Binance Coin Rally? Active Signals and Liquidation Indicate…

BNB is rising with a 14.42% increase in volume, supported by strong on-chain metrics that fuel the upward movement.

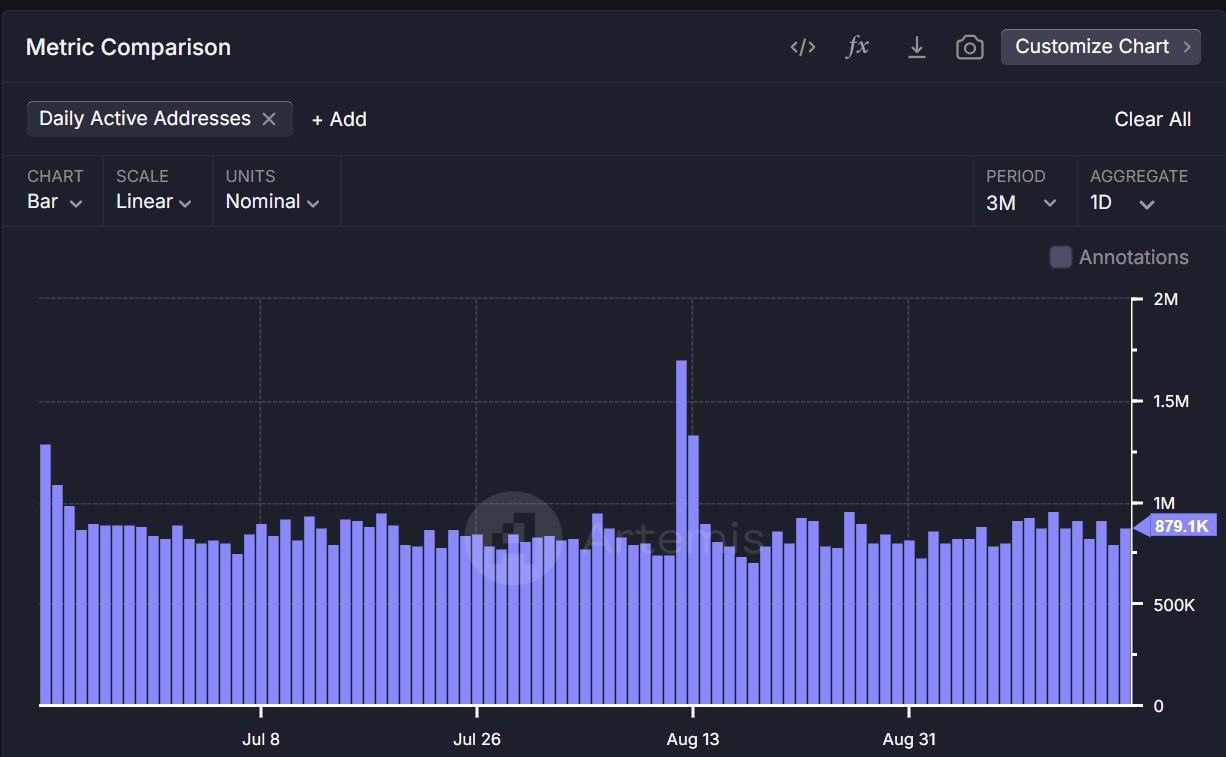

The daily active addresses for BNB increased from 797.3K to 879.1K, indicating a rise in network usage.

The liquidation of $311.1K in shorts adds momentum to the upward trend as BNB looks towards further price increases.

Binance Coin [BNB] has attracted traders’ attention with a significant increase in trading volume, reaching $758.83 million with a 14.42% increase in 24 hours at the time of publication. This rise coincides with a breakout from a notable descending wedge pattern.

However, with BNB trading at $571.25, reflecting a 2.67% increase in the last 24 hours at the time of publication, the focus is on on-chain metrics to determine if this movement will continue. Could this mark the beginning of a breakout rally?

Has BNB’s network activity reached new heights?

One of the key on-chain metrics for BNB is the number of active addresses. The daily active addresses increased from 797.3K to 879.1K, reflecting a significant rise in network activity.

More active addresses imply greater engagement on the Binance Smart Chain. This often indicates increased demand for the coin. The rise in active users points to growing institutional and retail interest in BNB.

As more addresses interact with BNB, its utility and growth potential increase.

Source: Artemis

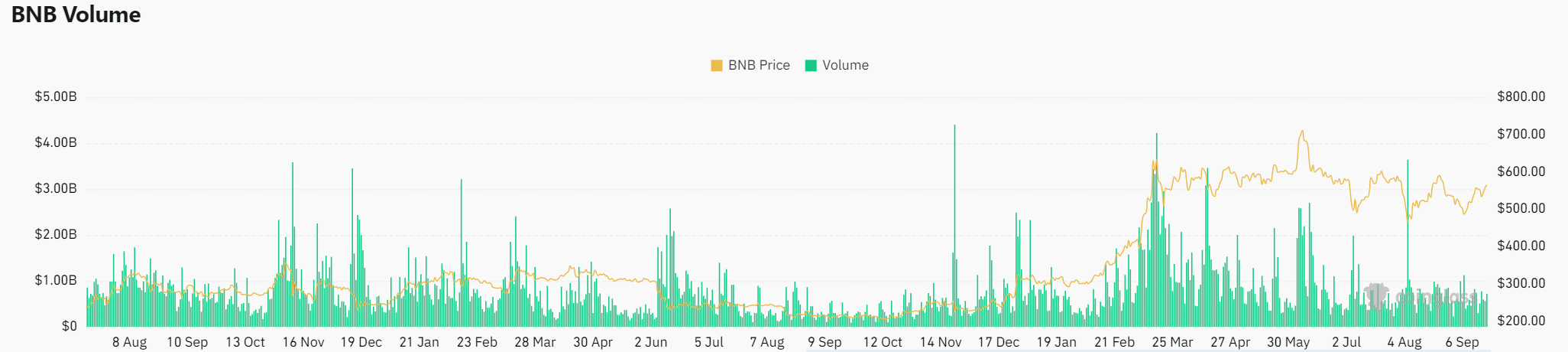

How strong is the BNB transaction volume?

Trading volume is another important indicator of market sentiment. BNB’s volume increased by 14.42%, reaching $758.83 million. A significant rise in trading volume can precede major price changes. Generally, an increase in volume indicates growing investor confidence.

More people are actively trading BNB, which could lead to further price movement. If the volume trend continues, it may signal a sustainable increase for BNB as more participants enter the market.

Source: Coinglass

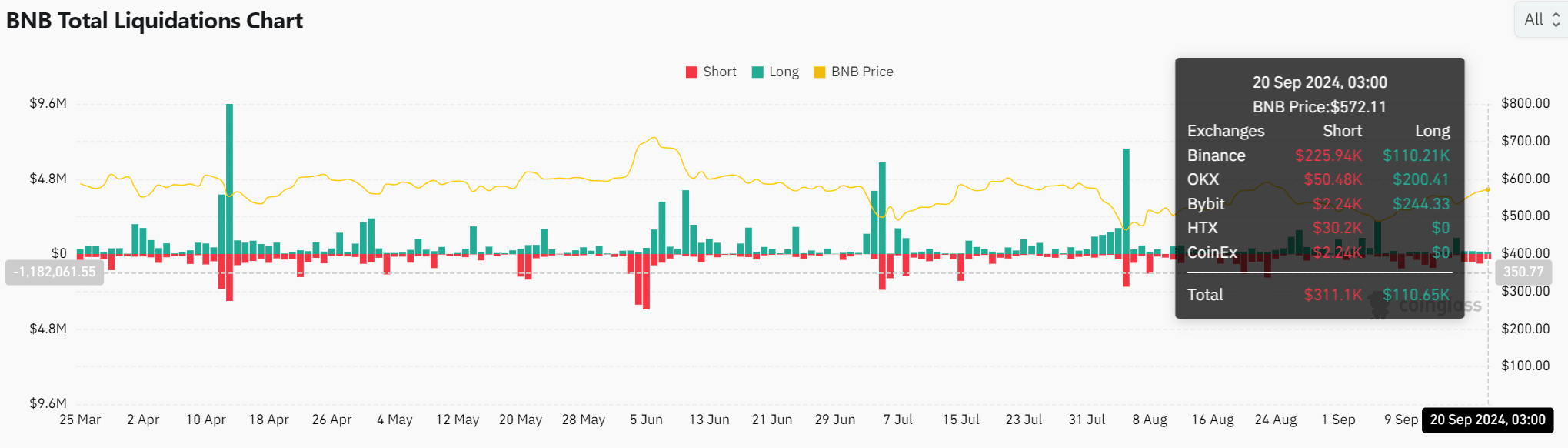

What do liquidations indicate about market sentiment?

Liquidation data provides an interesting perspective on market sentiment. BNB experienced a total liquidation of $311.1 thousand in short positions and $110.65 thousand in long positions on major exchanges such as Binance, OKX, and Bybit.

Increased short-term liquidations suggest that bearish traders were forced to close their positions, potentially contributing to the recent price increase as more short positions were eliminated.

Therefore, considering that BNB was around $571 at the time of writing, the liquidation of shorts could create a cascading price movement effect, further encouraging bullish sentiment in the market.

Source: Coinglass

Is BNB poised for a bull run?

On-chain metrics indicate that BNB is gaining strength, with rising active addresses, healthy transaction volumes, and declining exchange reserves all suggesting a potential bullish outlook. The liquidation of shorts adds further momentum to the current price increase.

If these trends continue, BNB could be well-positioned for further gains, setting the stage for a sustained upward trend in the coming weeks. However, traders and investors alike should monitor these key metrics as BNB continues to rise.