With a 14% increase in LUNC, the volume of LUNA rises by 295% – what’s going on?

LUNA and LUNC increase market confidence with rising volume and bullish sentiment due to the increase in USTC's proposed price.

A 295% increase in LUNA’s volume following the USTC burn proposal indicates a potential bullish surge in the market.

- LUNC has witnessed a 14% price increase amid a 275% spike in volume, driven by community-led USTC efforts.

The Terra Luna Classic [LUNC] community has recently introduced a new USTC burn proposal.

This proposal aims to burn 46.55 million USTC through contract migration, specifically targeting wallets associated with the Mirror protocol.

While past burn efforts had minimal impact on pricing, the current proposal’s goal is to reignite investor interest in LUNA and LUNC tokens.

Despite initial reactions, the price movement of both assets has shown some correlation with this initiative.

LUNC jumped 14% amid increasing volume.

Similarly, LUNC has shown a price increase, trading at $0.00009694 with a 24-hour trading volume of $172,117,904.

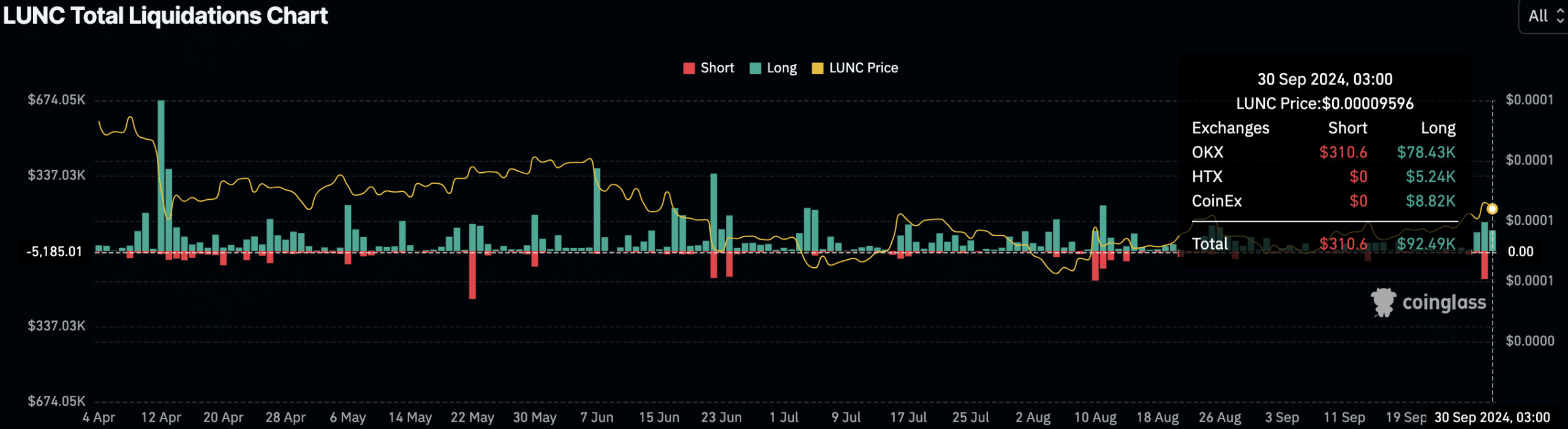

In the past 24 hours, LUNC has increased by 3.13%, with a 14.50% rise over the past week. Data from Coinglass indicated that trading activity increased with a 275.11% rise in volume and a 21.61% increase in open interest.

Liquidation data also shows bullish market pressure, with $92.49 thousand in long liquidations, while only $310.6 in shorts.

Source: Coinglass

Does the 295% increase in LUNA’s volume signal a bull run?

LUNA has also seen a steady price increase, reaching $0.4317 at the time of publication, with a 24-hour trading volume of $203,145,216. This reflects a 1.6% increase over the past 24 hours and a 14.44% rise compared to the previous week.

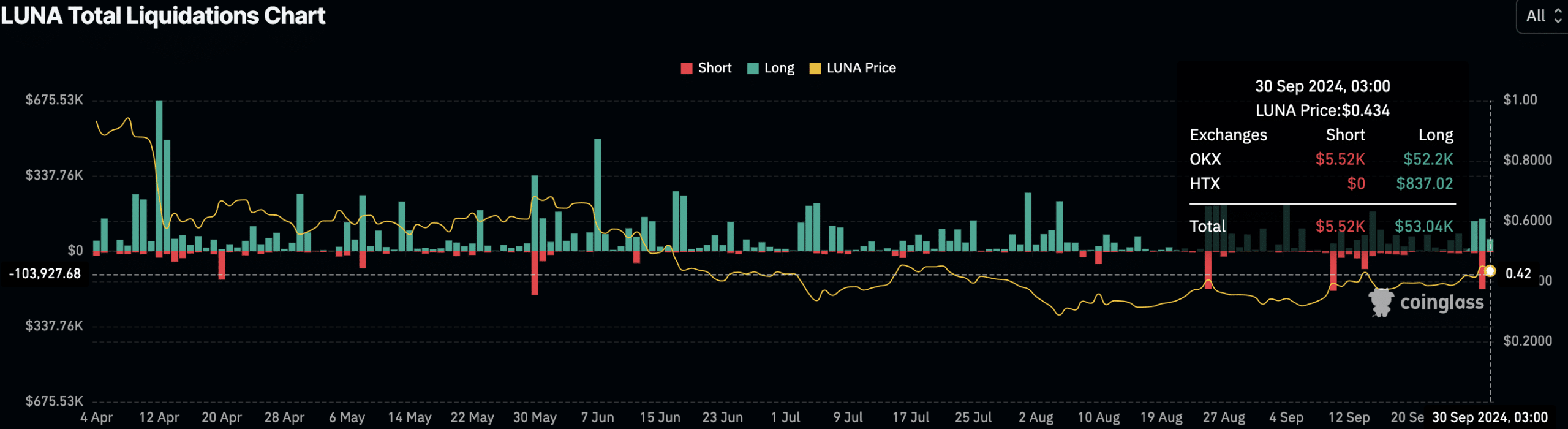

According to Coinglass data, market activity has also risen, with LUNA experiencing a 295.94% jump in volume and a 14.22% increase in open interest.

Liquidation data indicates a significant imbalance, with $53.04 thousand in long liquidations and only $5.52 thousand in shorts.

These metrics suggest that bullish sentiment has dominated the market despite increased volatility leading to liquidity, particularly among leveraged traders.

Source: Coinglass

In fact, the continuous increase in trading volume and open interest may indicate renewed investor confidence.

While the USTC burn proposal primarily targets Terra Classic assets, its impact on LUNC’s price has been significant.

The rise in volume and open interest suggests increased market participation, likely stimulated by the community’s renewed efforts.

Both LUNA and LUNC observed parallel price increases following the announcement of the USTC burn proposal.

In terms of market activity, LUNA experienced a greater percentage increase in trading volume compared to LUNC, with both tokens showing strong bullish sentiment in their respective liquidation data.