Bitcoin’s path to $65,000: Will miner selling pressure halt the rally?

Bitcoin is now entering a critical level that will determine whether it can initiate the next major bullish wave.

Bitcoin may be on the verge of breaking out of its bullish flag pattern.

Assessing the Possibility of Resistance at a Critical Level

Bitcoin (BTC) has shown significant upward price movement over the past two weeks. Just a day ago, the cryptocurrency attempted to gather enough momentum for a sustainable uptrend or to break above the $60,000 price range.

It quickly erased the $60,000 resistance level and even surpassed it. The price of one Bitcoin at the time of writing was $63,404, marking an 18.35% increase over the past 14 days.

With only 10 days left in September, Bitcoin is on track to close the month in the green if it can maintain its current levels. However, if it pushes into the next major resistance zone at $65,000, it is likely to encounter some resistance.

Why is the $65,000 Level Critical for Bitcoin?

The price volatility of Bitcoin between March and now has formed a bullish flag pattern. If it follows this pattern, it suggests that a bullish breakout is likely to occur. Now seems like an ideal time for that breakout.

Source: CryptoQuant

A strong push above $65,000 is likely to break the higher lows we’ve observed in recent months. Breaking this pattern would indicate that the price is likely to initiate another round of price discovery.

The recently announced decrease in interest rates could be the next catalyst for the necessary liquidity to reinforce a strong bullish sentiment.

Can Bitcoin Bulls Maintain the Current Momentum?

Looksonchain recently pointed out that five miner wallets, active since 2009, have recently moved their Bitcoin. This increases the likelihood of selling pressure. The findings indicate that approximately 250 Bitcoin, worth over $15 million, have been transferred.

Miner reserves of Bitcoin have continued to decline over the past 24 hours, dropping to 1.81 million Bitcoin, the lowest level in the last five weeks.

Source: CryptoQuant

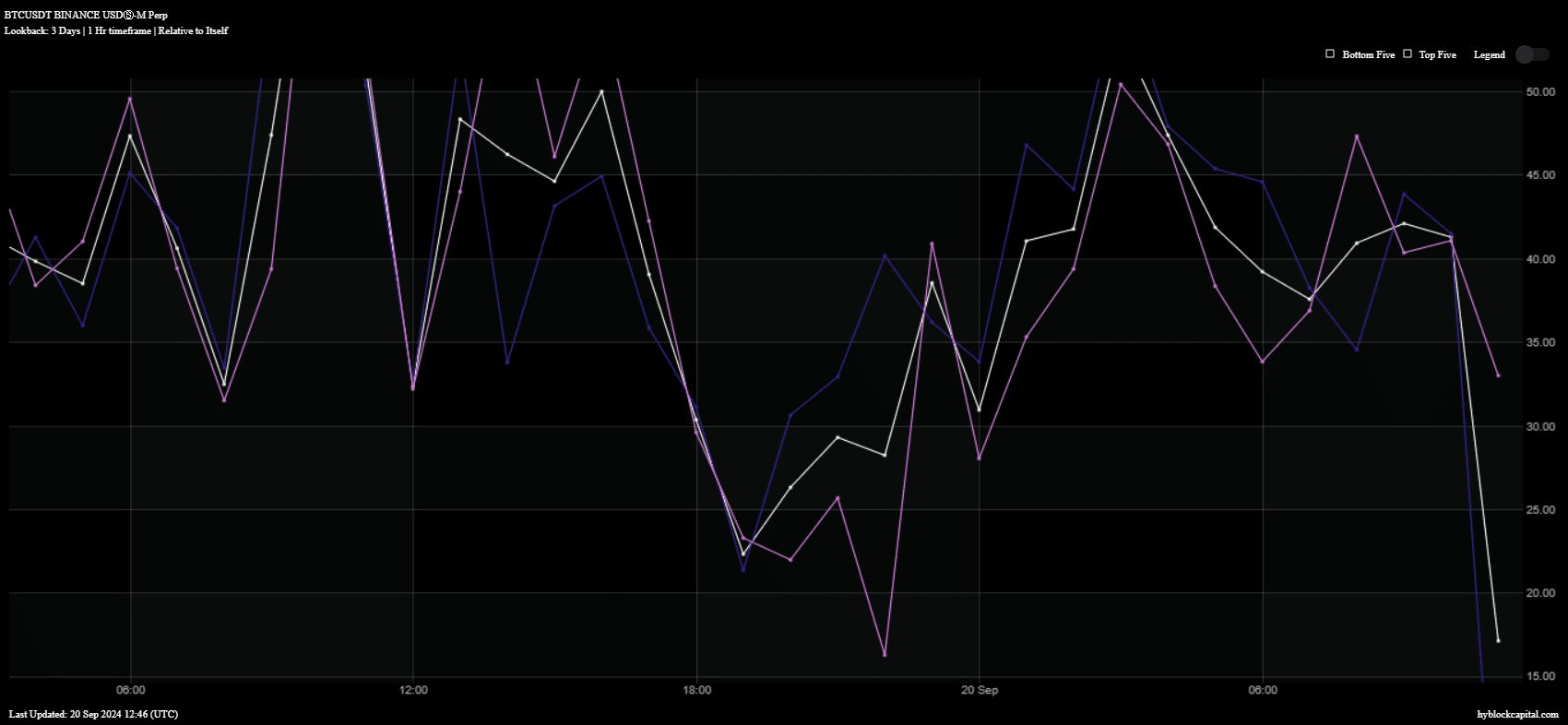

An increase in Bitcoin miner reserves indicates confidence in its ability to maintain its bullish trend. However, current observations suggest otherwise. This is also coupled with a risk appetite on the largest simultaneous exchange.

Net profits over the past 24 hours have sharply declined, indicating less confidence in Bitcoin’s potential upside in the short term.

Despite showing signs of a decline, net shorts remained relatively higher than net buys. This could also indicate uncertainty regarding a potential pullback.

Bitcoin holders may view the recent bullishness as a signal for increased momentum for the next long-term rally. This might influence them to shift from swing trading to a long-term HODL strategy.