Ethereum breakout potential – Is $3,200 a reasonable price target?

A combination of factors could enable ETH to break through a key target again!

Ethereum was trading at a key level in the daily timeframe at the time of publication.

- Institutions and whales resumed their activities as optimism returned to the market.

Ethereum (ETH), the second-largest cryptocurrency by market cap, is trading again at critical levels. These levels are particularly significant for long-term investors. At the time of writing, Ethereum was fluctuating around $2,700—a major resistance level in the daily timeframe.

Last month’s price levels now act as key support and resistance areas. Ethereum respects the previous month’s low as support, while the midpoint between the previous month’s high and low serves as resistance.

Market sentiment remains optimistic, indicating a potential breakout above the $2,700 resistance. This could drive ETH towards the target of $3,200. However, market dynamics are unpredictable, and any sudden change could alter this outlook.

Source: Hyblock Capital, TradingView

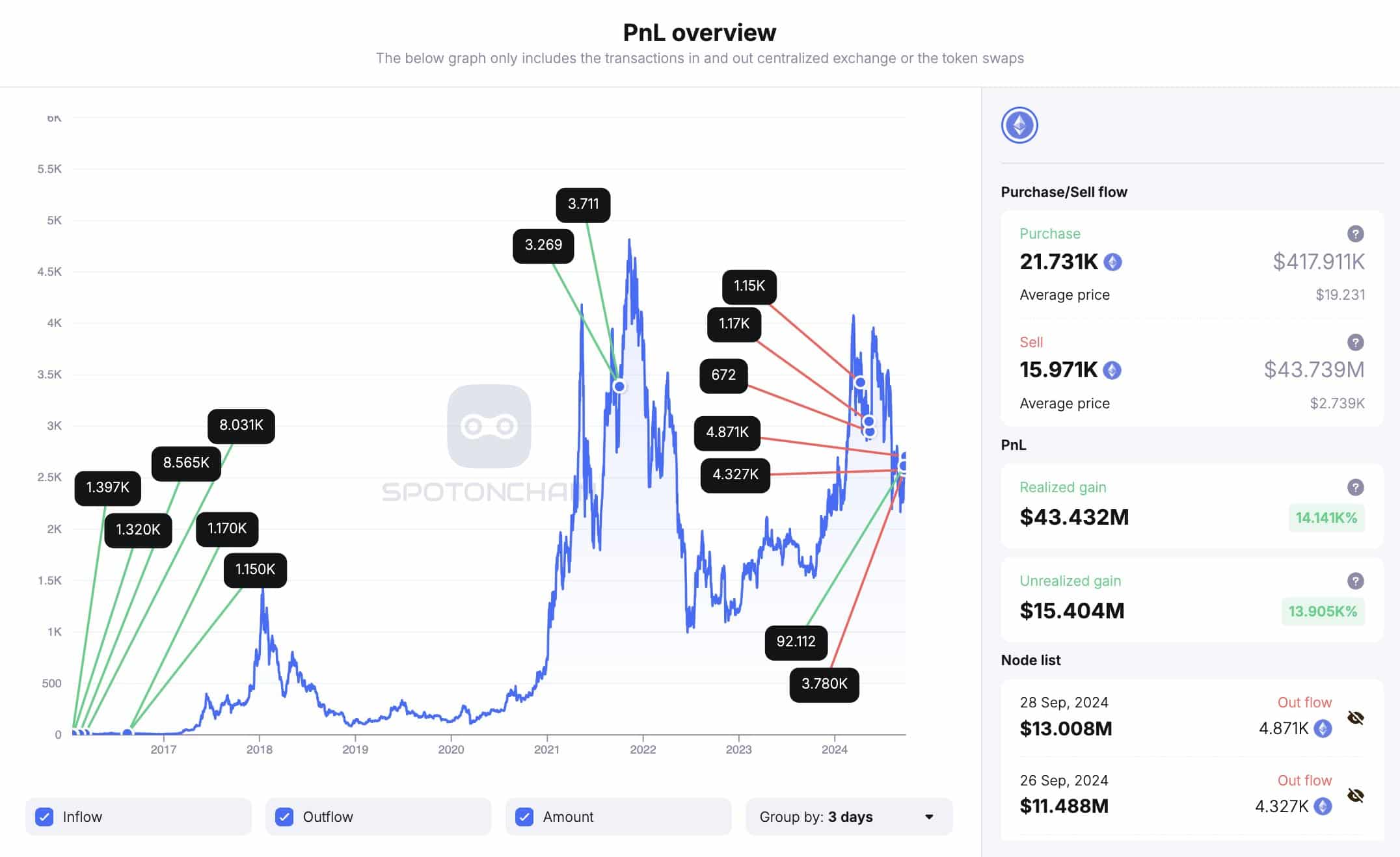

Increase in Whale and Institutional Activity

Increased institutional and whale activity has supported higher ETH prices. Recently, an Ethereum whale that had been silent for four months received 12,979 ETH, realizing a profit of $34.3 million.

This whale initially purchased ETH at just $7.07 per token. Since then, the whale has sold a total of 15,879 ETH, making a profit of $43.5 million.

As this whale still holds 5,760 ETH, worth approximately $15.5 million, it indicates that larger investors are betting on ETH reaching the $3,200 target. This renewed whale activity is a strong indicator of ETH’s bullish potential, further supporting the $3,200 target.

Source: SpotOnChain

In the meantime, institutional actions are also impacting the market.

Recently, two major institutions have liquidated ETH. Cumberland, a trading firm, deposited 11,800 ETH worth $31.88 million into Coinbase. In contrast, ParaFi Capital withdrew 5,134 ETH from Lido and transferred it to Coinbase Prime.

Despite this selling activity, the increase in whale participation indicates that many remain optimistic about Ethereum’s future price movements.

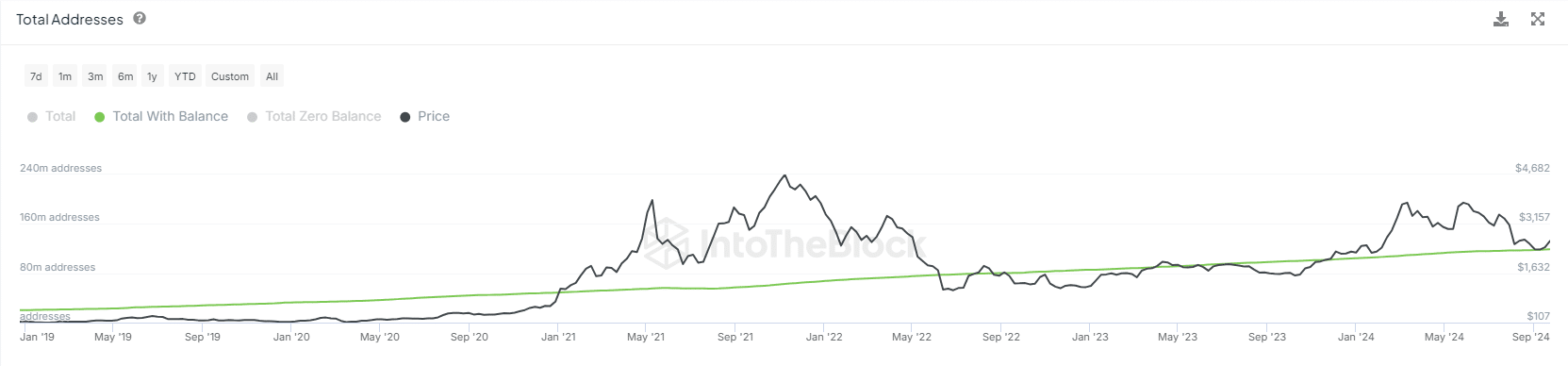

Increase in Total ETH Addresses with Balances

Another positive signal for ETH is the rising number of total addresses holding a balance. The increasing number of wallet addresses suggests that more investors are entering the Ethereum ecosystem.

This trend is often viewed as a bullish signal, indicating that Ethereum adoption is growing due to its use in decentralized finance (DeFi) solutions and scalability.

Source: IntoTheBlock

The increase in wallet addresses can be interpreted as another bullish signal indicating a price target of $3,200 for ETH in the fourth quarter of the year. This period is historically known for bullish activity in the cryptocurrency market.

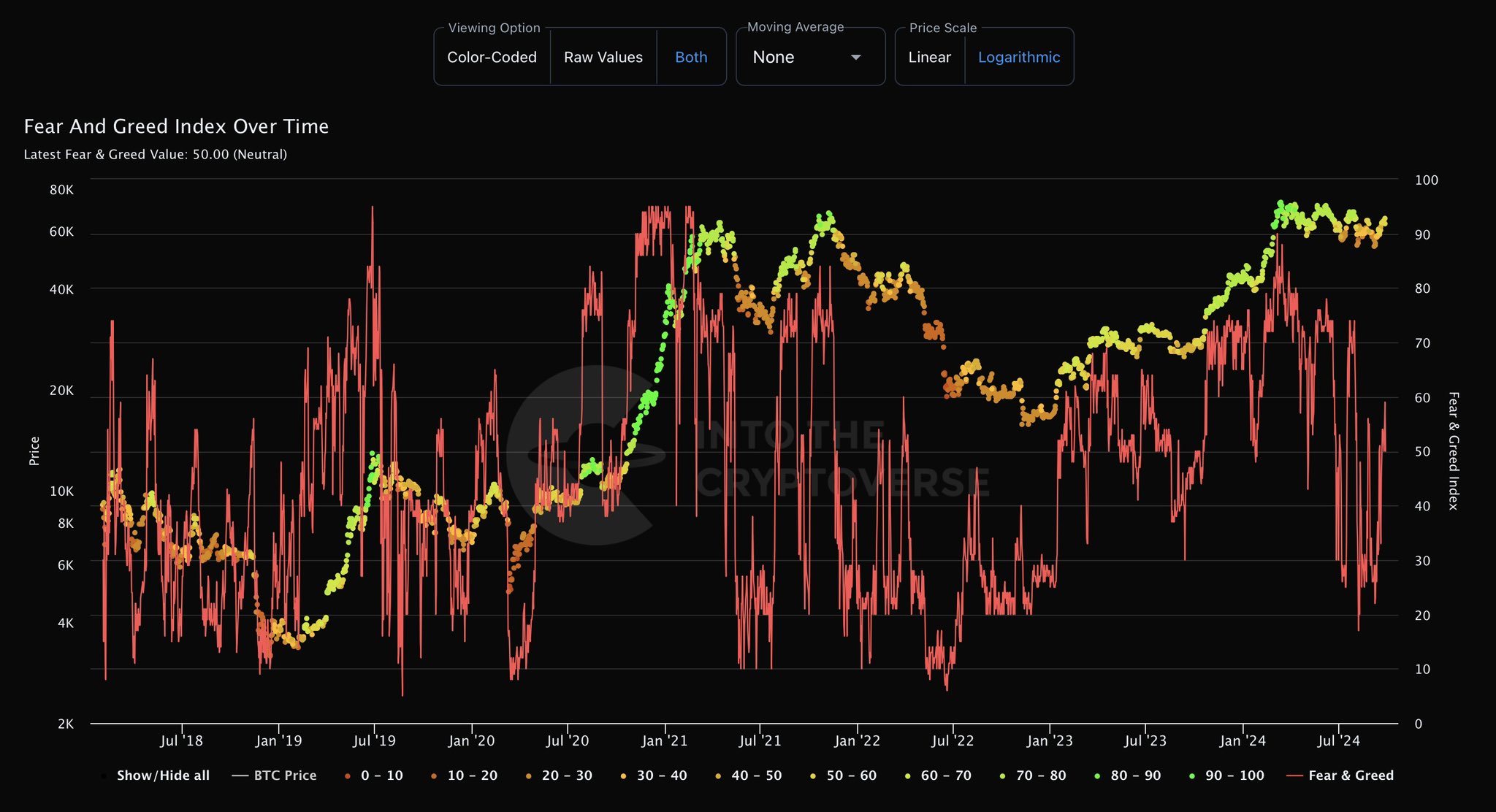

Fear and Greed Index Now Neutral

Market optimism is also reflected in the Fear and Greed Index, which reached a neutral level of 50 at the time of publication. This is a positive change following a prolonged period of intense fear, especially after the market crash on August 5.

As the market begins to recover, it is likely that more traders will be drawn to Ethereum, making it an ideal time to accumulate more ETH before the anticipated upward movement.

Historically, entering the market when sentiment is neutral often provides better opportunities than waiting for extreme greed, which typically signals market tops.

Source: IntoTheCryptoverse

Currently, Ethereum is positioned to move higher due to whale activity, increased adoption, and improving market sentiment.

If Ethereum can break through the $2,700 resistance, the next target of $3,200 may be within reach.