Ethereum Open Interest, RSI Hit Multi-Month High – Is $3000 Near?

69% of all ETH addresses are in profit, representing a 6% increase in seven days.

Ethereum has hit an eight-week high as RSI’s buying pressure increases.

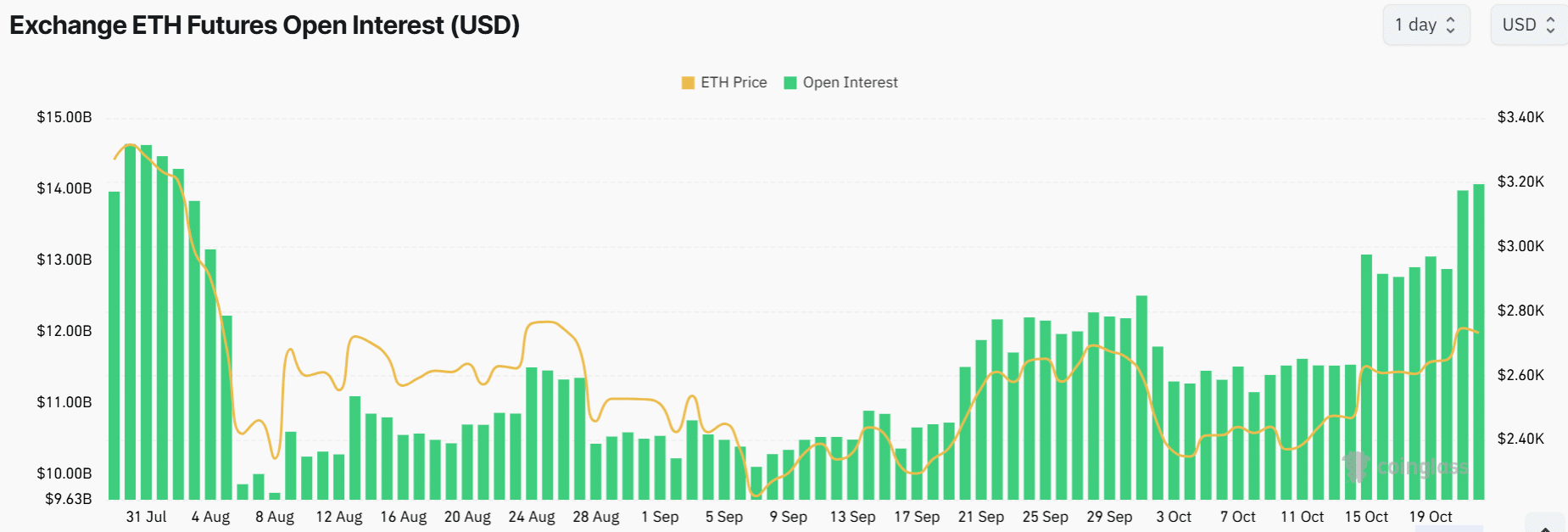

- Open interest at $14 billion reflects increased market participation by derivatives traders.

Ethereum [ETH] traded at an 8-week high of $2,735 after gaining about 4% in 24 hours. According to CoinMarketCap , trading volume has increased by more than 100%, indicating increased market interest.

These gains made ETH record the largest amount of short-term liquidity in the cryptocurrency market. At the time of publication, more than $23 million in ETH short positions had been liquidated per Coinglass .

A high number of short liquidity is a bullish sign as it indicates that short sellers are converting to buyers to close their positions. A look at Ethereum’s one-day chart shows that this bullish trend could continue.

Ethereum is showing bullish signs

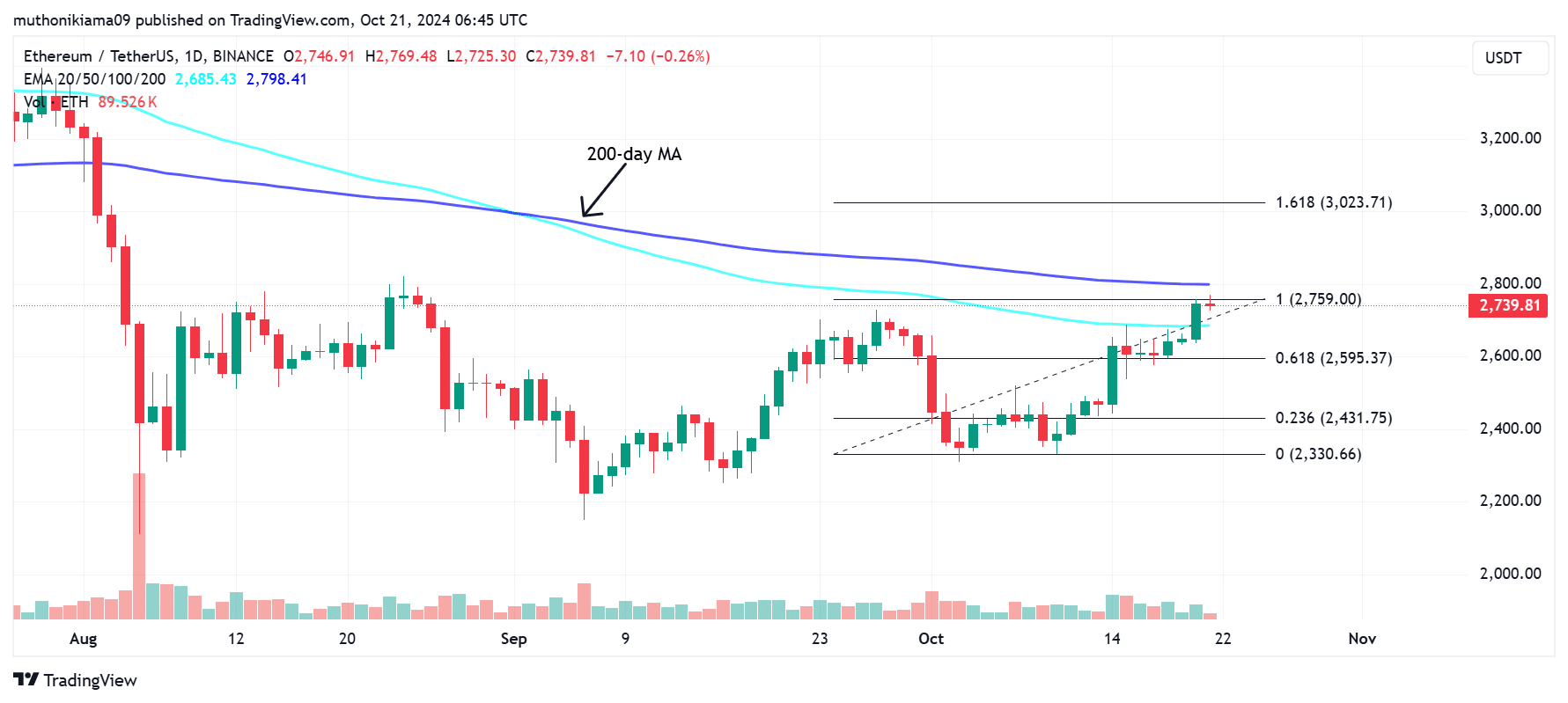

Consolidating the uptrend, ETH crossed the 100-day exponential moving average (EMA) at $2,685. The uptrend later met with resistance as ETH approached the 200-day EMA.

The 200-day EMA, which is currently around $2,800, is a psychological level for traders. If Ethereum makes a decisive break above this resistance, the altcoin will enter a long-term uptrend that could see it climb towards the 1.618 Fibonacci level above $3,000.

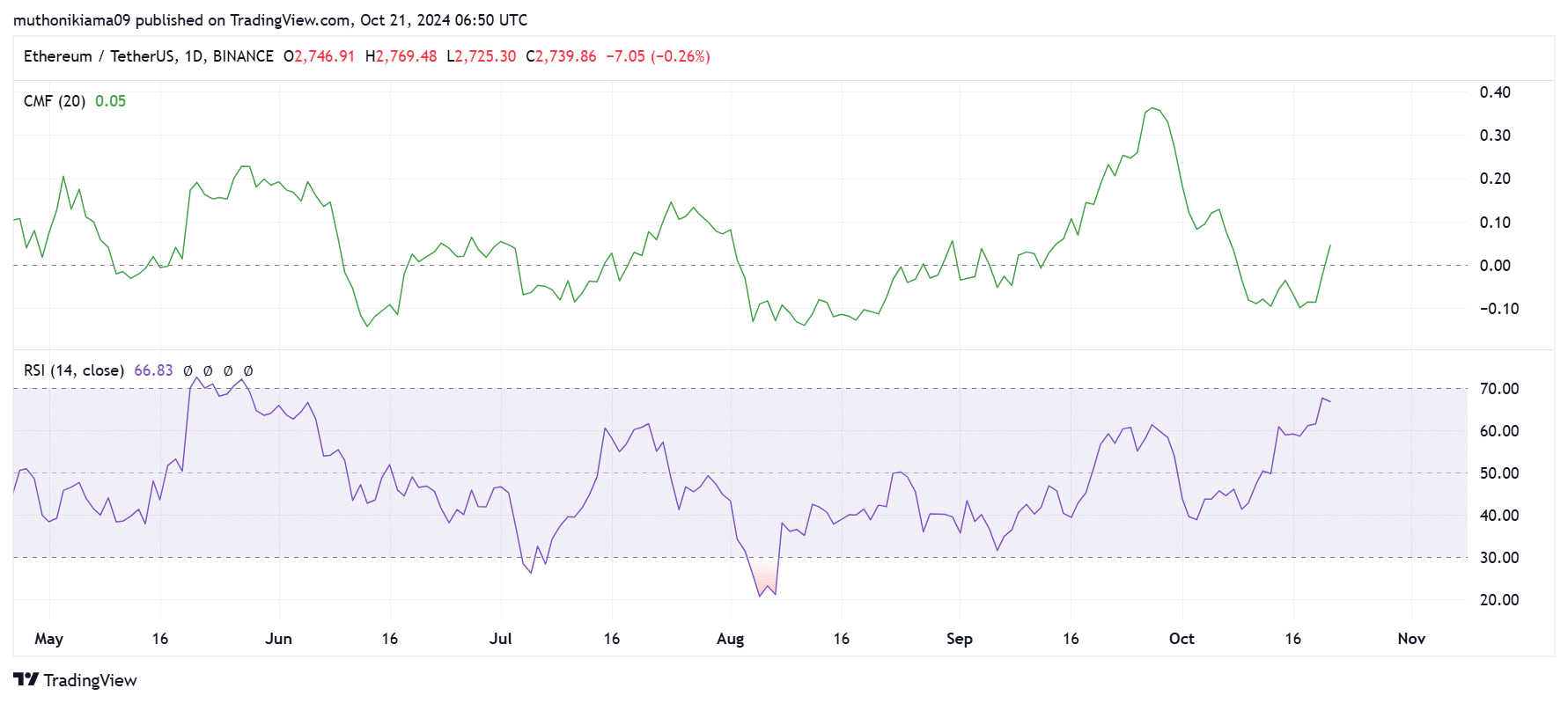

Technical indicators indicate that there is a possibility of a break above the 200-day EMA. Chaikin Money Flow (CMF) has turned positive for the first time in nearly two weeks, indicating that more capital is flowing into ETH.

In addition, the Relative Strength Index (RSI) reached an all-time high and reached its highest level since June, indicating strong buying pressure.

Despite the rush of buyers, Ethereum’s RSI at 66 indicates that it is not overbought. This shows that there is room for growth.

Increase open interest and leverage ratio

As data from Coinglass shows, open interest in Ethereum has reached its highest level since August. This benchmark was $14 billion at the time of release, indicating a large number of market participants and capital flowing into ETH.

If traders are opening long positions, the increase in open interest is usually bullish. However, this increase can also lead to price volatility.

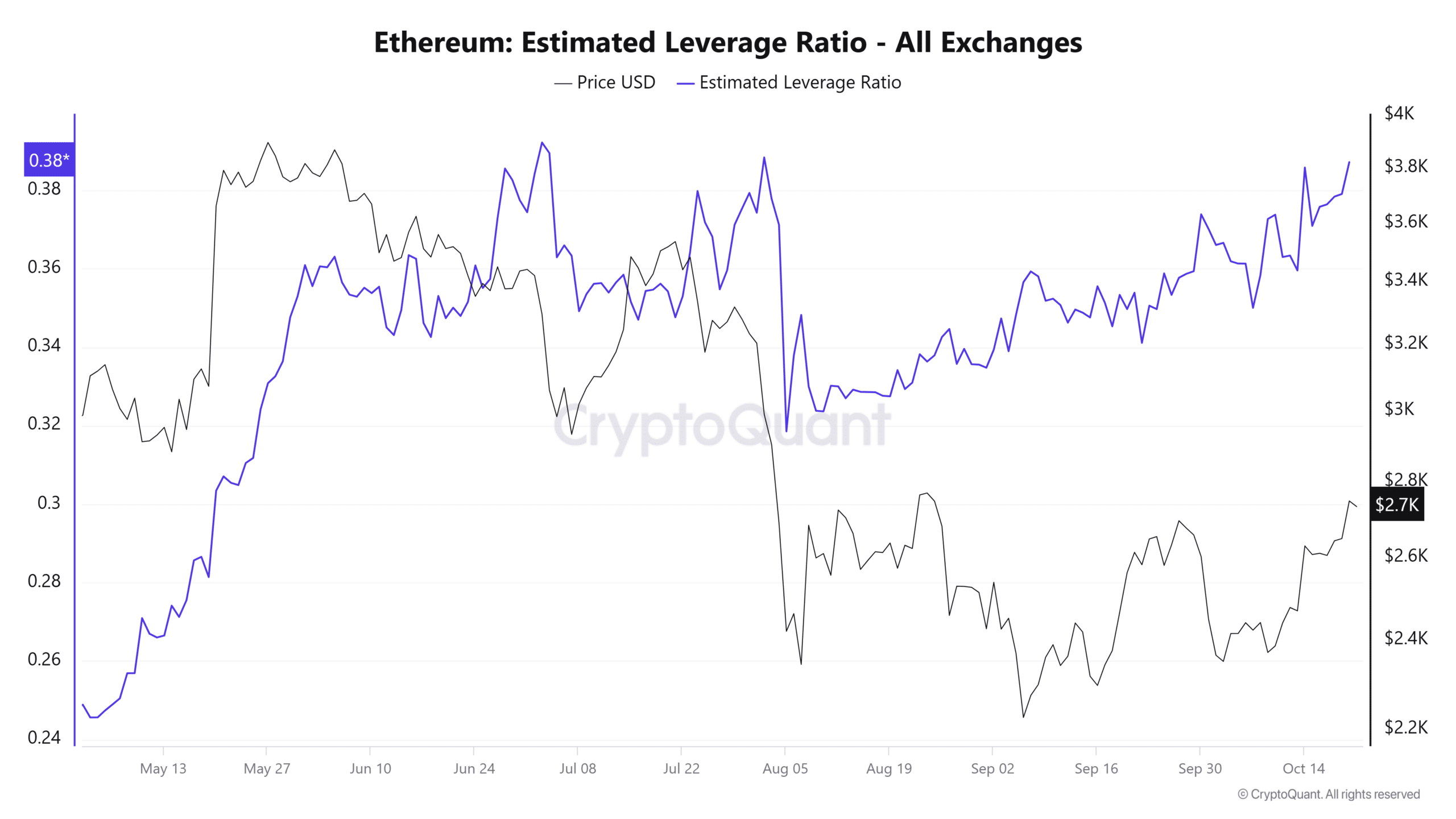

Ethereum’s estimated leverage ratio is nearing a three-month high, indicating an influx of borrowed capital. If ETH makes sudden moves, it can lead to a large number of forced liquidations that cause volatility.

Ethereum wallets in profit

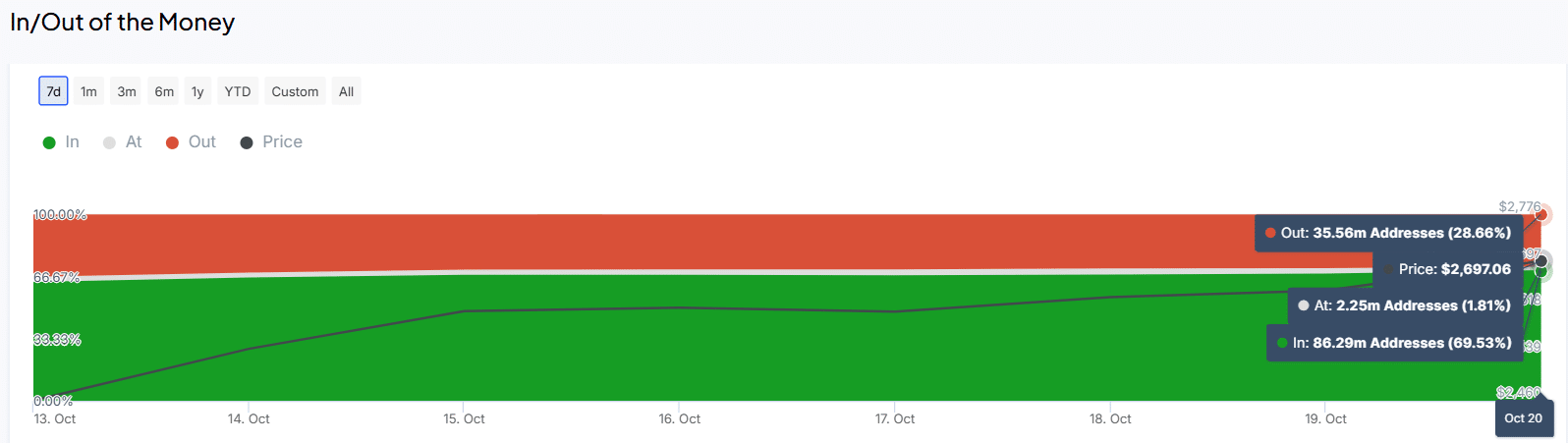

Ethereum’s recent gains have also led to a surge in In The Money wallets. At press time, 69% of all ETH addresses were in profit, representing a 6% increase over the past seven days.

On the other hand, the loss of wallets reached 35 million addresses at the time of publication, a significant decrease from 42 million addresses in just one week.

As Ethereum wallets become more profitable, it could lead to positive sentiment around Ethereum.