Hedera’s bullish failure – Will HBAR reach $0.10 in the fourth quarter?

HBAR will have a 65% profit with increased dominance, whale activity, and liquidity.

As of the time of publication, Hedera has increased by 14% this week.

- Hedera’s dominance and open interest are all on the rise.

Hedera [HBAR] is rising in alignment with the predicted bullish trend in Q4. After a more than 14% increase this week, it appears poised to capitalize on a broader market rally.

HBAR is currently trading at $0.061, showing a slight decrease over the past 24 hours, likely due to a correction after three consecutive days of gains.

Despite this, the price remains strong with a volume-to-market ratio of 2.13%. Its fully diluted market cap is $3 billion, with 37 billion HBAR circulating out of a maximum supply of 50 billion.

Hedera’s dominance and price action

Hedera’s market dominance is gradually increasing, indicating its potential to benefit from a Q4 cryptocurrency market surge. The rise in dominance reflects growing adoption among traders, investors, and institutions.

This has led to an upward trend in HBAR’s price performance over the past two weeks, bringing it to the important resistance level of $0.06. Breaking above this could confirm a double bottom formation, indicating a potential price floor for Hedera.

Source: TradingView

The MACD has turned bullish, and the histogram reflects increasing volume and strength for the HBAR/USDT pair.

If HBAR can break through the $0.06 level and approach the $0.10 resistance, it could see an increase of up to 65%, likely in the fourth quarter.

Open interest, funding rates, and whale activity

Key metrics, including open interest, funding rates, and whale activity, indicate that the broader market, including Hedera, is poised for further gains.

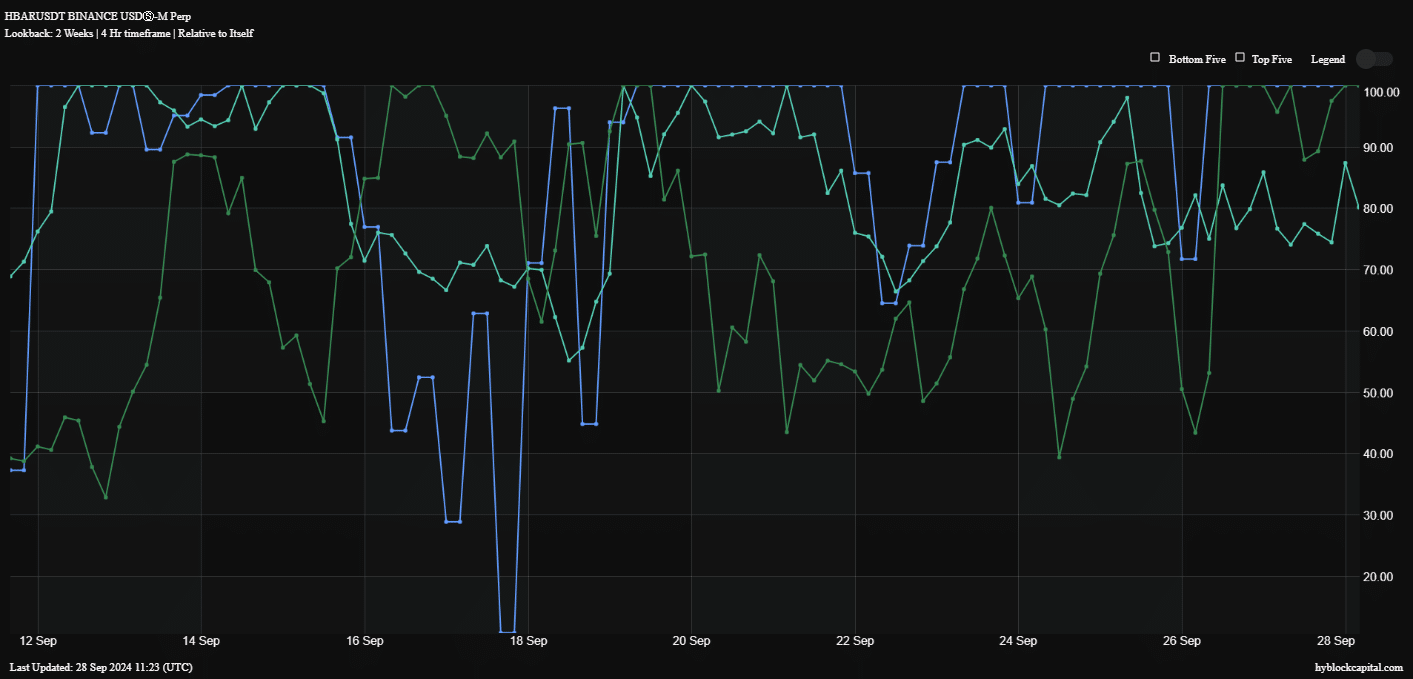

Open interest is at 80%, reflecting strong interest in HBAR, while funding rates suggest that long positions are outpacing short positions, indicating bullish sentiment.

Additionally, the delta of whales to retail is at its peak, suggesting that large investors are accumulating HBAR at a faster rate than retail traders, further supporting the likelihood of higher prices.

Source: Hyblock Capital

Liquidation Levels

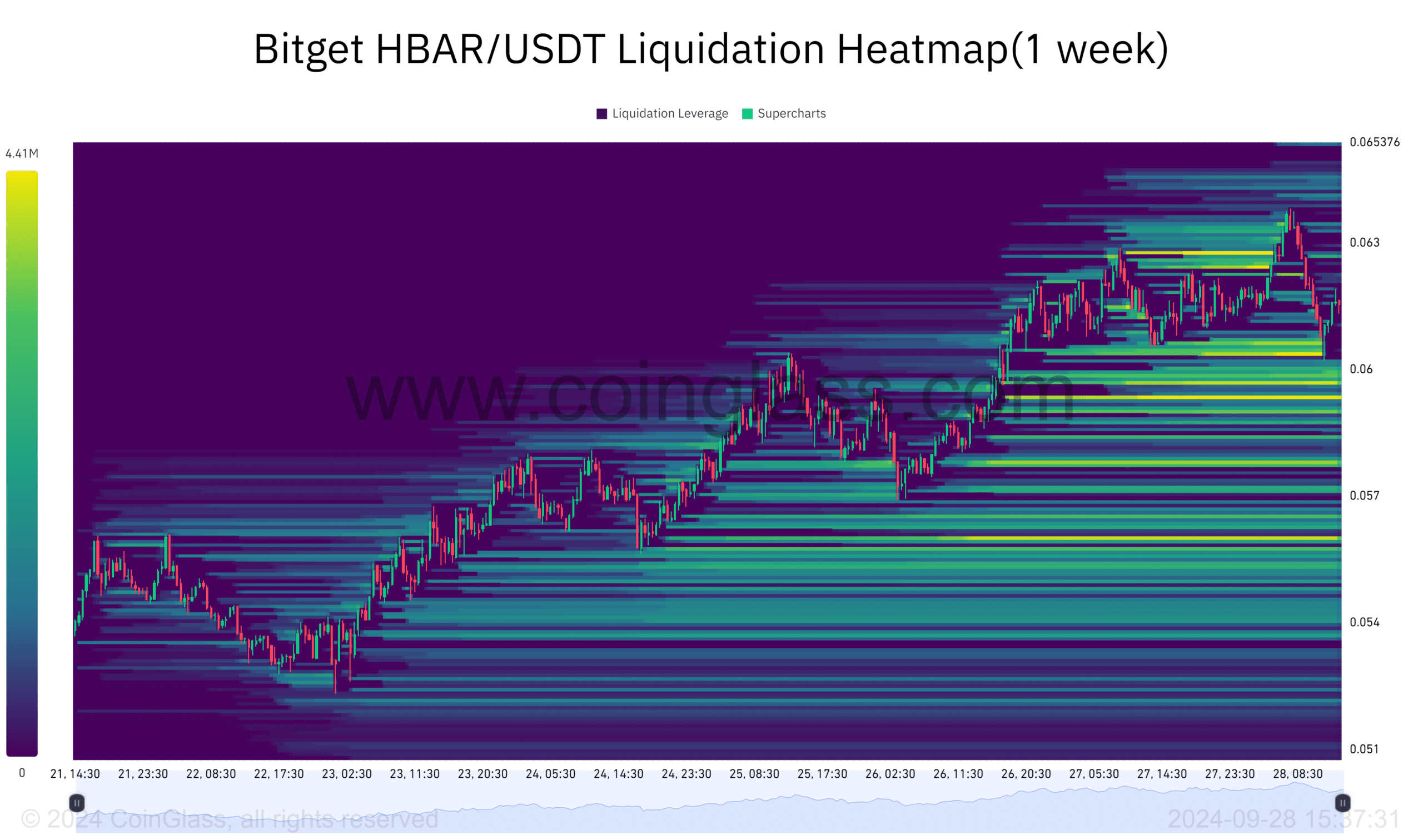

Analysis of the HBAR/USDT liquidation levels on Bitget shows that $2.25 million in orders begins at $0.0627. This indicates that market participants are targeting areas with high liquidity, prompting the price to move toward this level.

If the $0.0627 level is broken, the next target could be $0.0638 with $1.31 million in orders. As HBAR approaches these liquidity areas, its bullish momentum may strengthen and support its potential 65% increase.

Source: Coinglass

With growing adoption, bullish technical signals, and areas of high liquidity, HBAR appears poised for significant gains soon.

If this momentum continues, HBAR could reach $0.10, boosting its price during the anticipated Q4 market growth period.