Upcoming cryptocurrency week – How the U.S. workforce update could impact Bitcoin and Ethereum.

The U.S. labor market update and Federal Reserve interest rates in November have lowered expectations to determine the next market direction.

Bitcoin retested $66,000 after better-than-expected inflation data for August.

- The U.S. labor market update could determine the next market direction.

Bitcoin [BTC] rose on Friday following a milder reading of the Federal Reserve’s favored inflation data—the Core PCE (Personal Consumption Expenditures) index—testing $66,000 again. This index tracks U.S. inflation excluding food and energy price volatility.

The Core PCE index for August showed a 2.6% year-over-year increase, better than expected, compared to the market’s expectation of 2.7%.

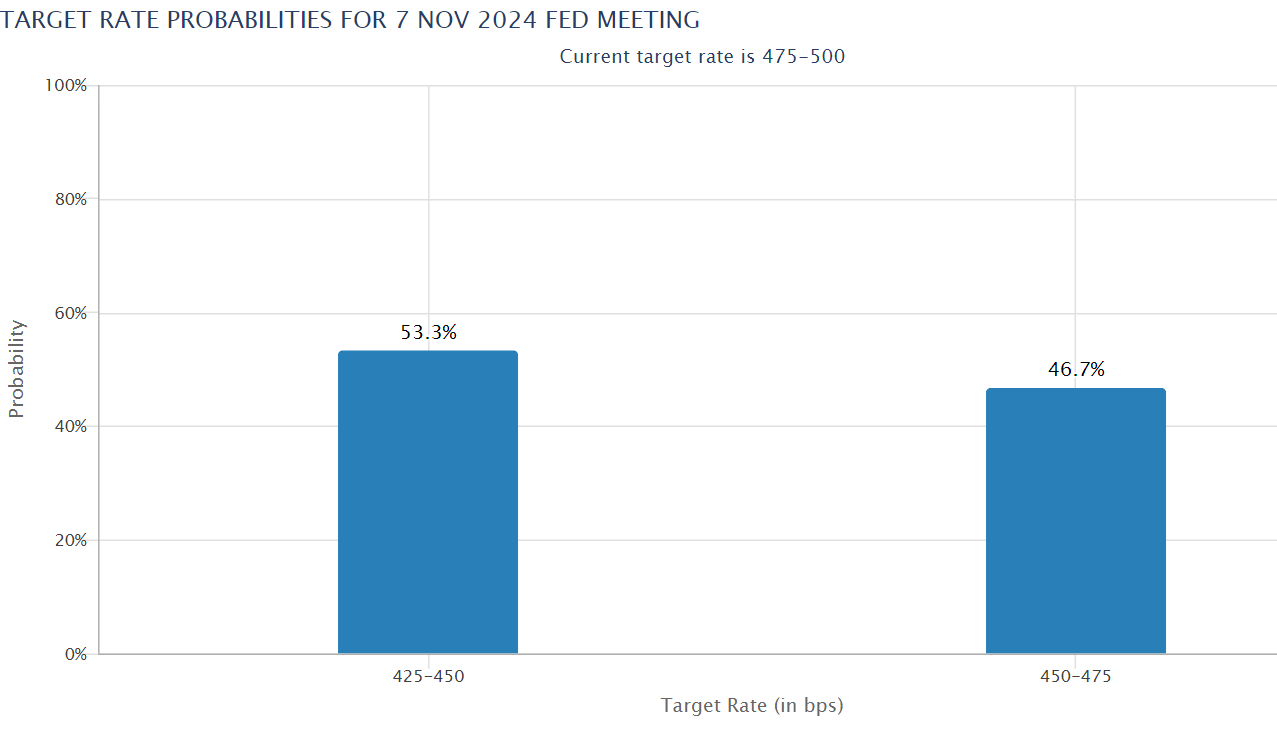

The lower inflation data boosted markets as traders priced in a higher chance of a 50 basis point rate cut by the Federal Reserve in November.

Source: CME FedWatch

Next Market Catalyst

The lower inflation data means that the Federal Reserve will now focus on the state of the U.S. labor market, particularly the unemployment rate, when adjusting the pace of interest rate cuts.

Trading firm QCP Capital noted that upcoming updates on the U.S. labor sector will influence the next market direction.

In part of the weekend summary from September 28, it stated:

As we approach next week, the main focus will be on upcoming labor market indicators, including JOLTs, ADP, and the U.S. unemployment rate.

Key updates to watch include JOLTs (Job Openings and Labor Turnover Survey) and the employment situation scheduled for November 1 and 4. QCP Capital added, anticipating the potential impact of the updates on the market.

Strong performance in these metrics could support a 50 basis point cut in November and further boost risk assets.

If that’s the case, Bitcoin could potentially rise above $70,000 after the recent bullish market restructuring, especially after recovering the 200-day moving average (MA).

Source: Daan Crypto/X

This increase could also benefit Ethereum [ETH]. In fact, ETH has outperformed BTC since the Federal Reserve’s pivot.

Therefore, an additional macro tailwind could significantly boost ETH’s recovery on the charts. According to market analyst Benjamin Cowen, ETH could rise to the psychological level of $3,000.

Source: Cowen/X

As mentioned, leading digital assets have seen renewed demand from American investors. This week, U.S. Bitcoin ETF funds recorded $1.11 billion in inflows, marking the largest weekly inflow since July 19.

A similar, albeit limited, investor appetite has been observed in ETH ETFs. These products attracted $84.6 million in inflows, representing the highest weekly demand since August 9. If this trend continues, price targets of $3,000 for each Ethereum and $70,000 for each Bitcoin may become achievable.