Is the altcoin season approaching? Bitcoin dominance is testing a key resistance level.

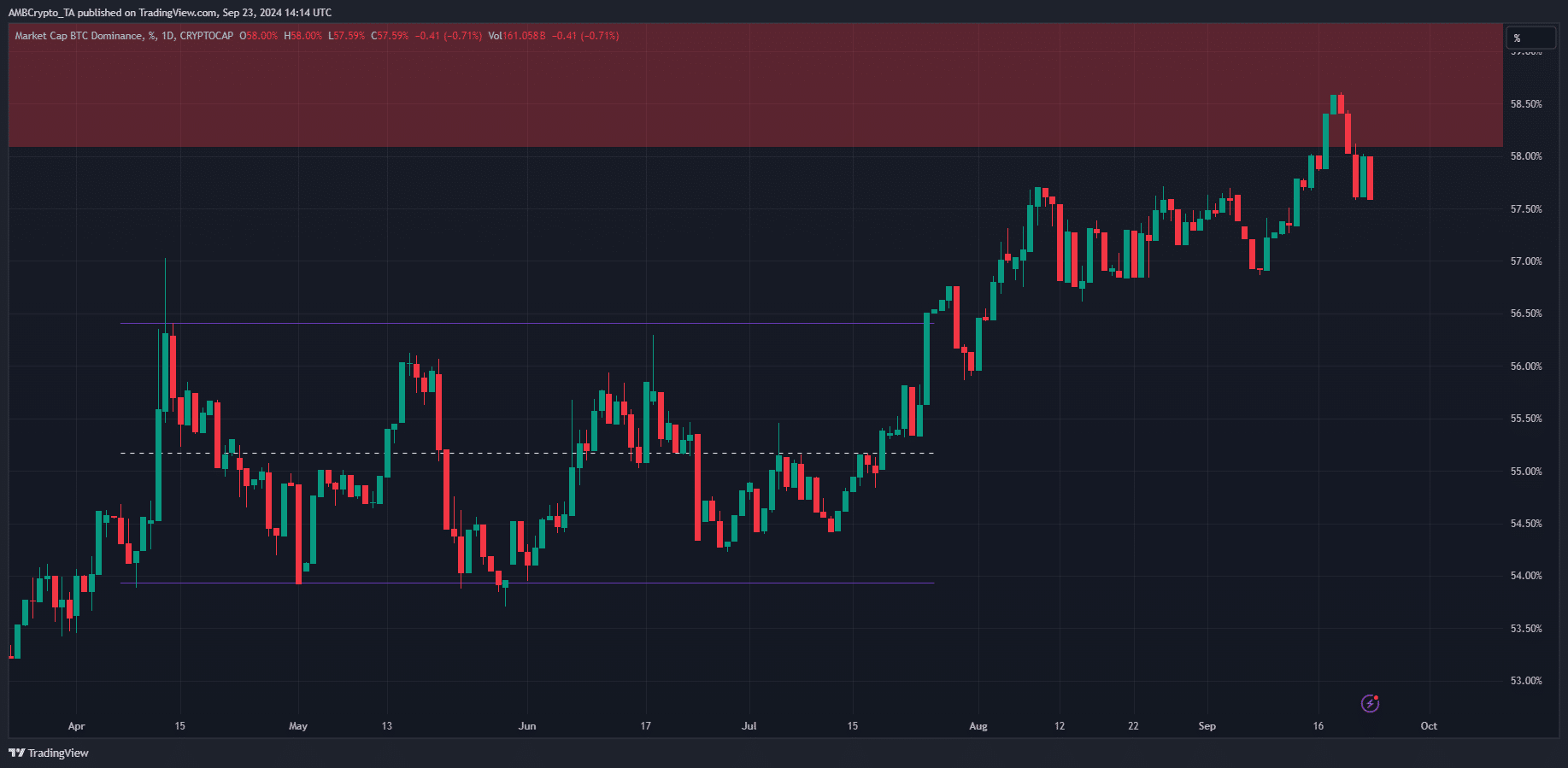

The Bitcoin dominance chart has formed a rising wedge pattern and could potentially rise above the 60% resistance.

The Bitcoin dominance chart has reached the resistance area.

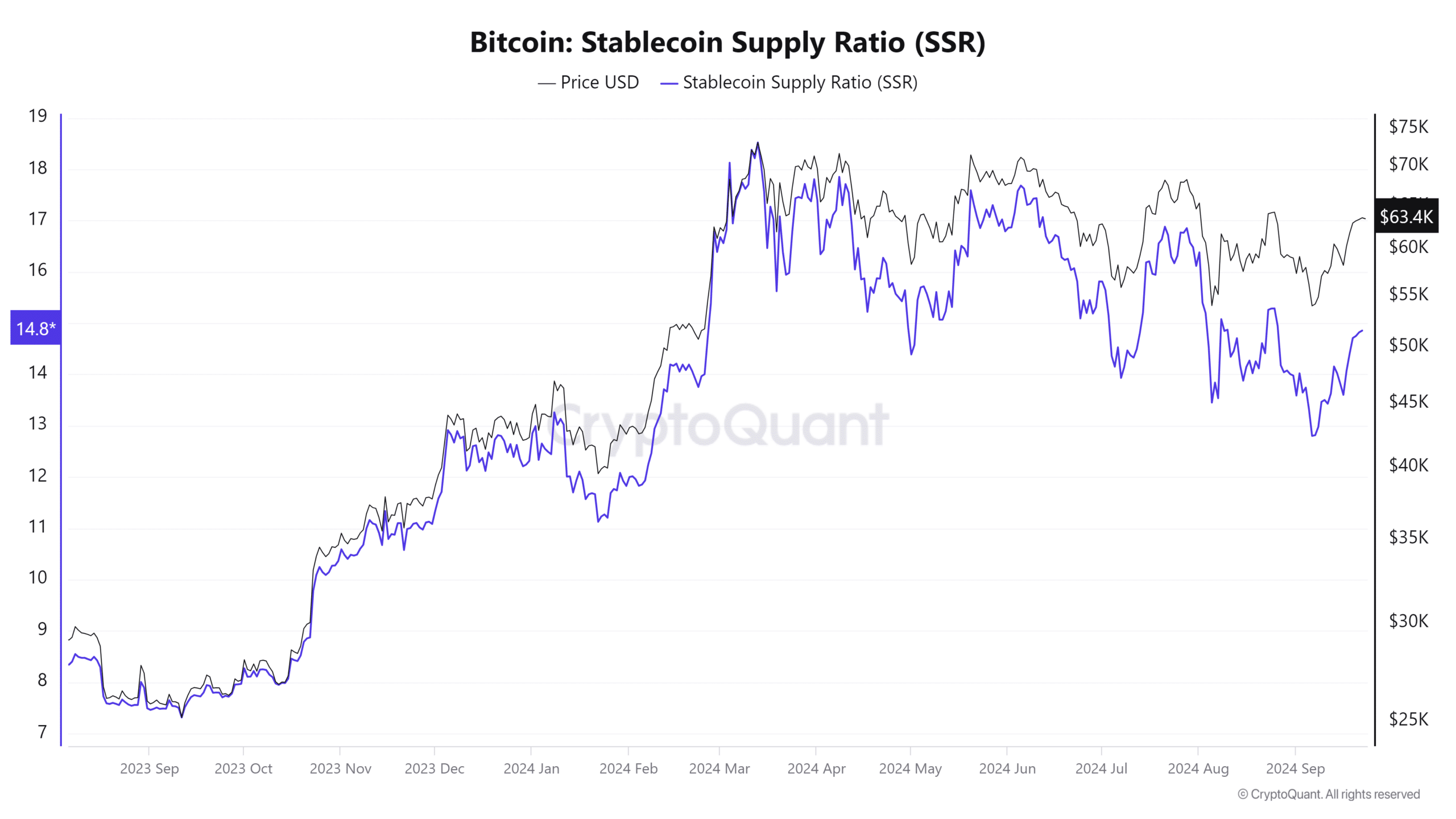

- The SSR metric is declining, aligning with increasing hopes for an altcoin season.

Since Friday, September 6, the total cryptocurrency market capitalization has increased by 20.33%, rising from $1.814 trillion to $2.182 trillion. This $368 billion increase was primarily driven by Bitcoin [BTC].

This was observed in the Bitcoin dominance chart. This metric increased from 56.87% on September 8 to 58.59% on September 18 before retreating. It also reached the resistance area just below the 60% threshold.

Importance of this resistance

The Bitcoin dominance chart measures the market value of Bitcoin as a metric of the entire crypto space, which includes the leading altcoins. An increase in BTC.D means that the king is performing better than the rest of the market.

In a post on X, crypto analyst Ali Martinez noted that the dominance chart has formed a rising wedge pattern and could break above the 60% resistance. A decrease in BTC dominance indicates a flow of capital to altcoins.

This could lead to an altcoin season, a period of significant profits for long-term holders of altcoin projects.

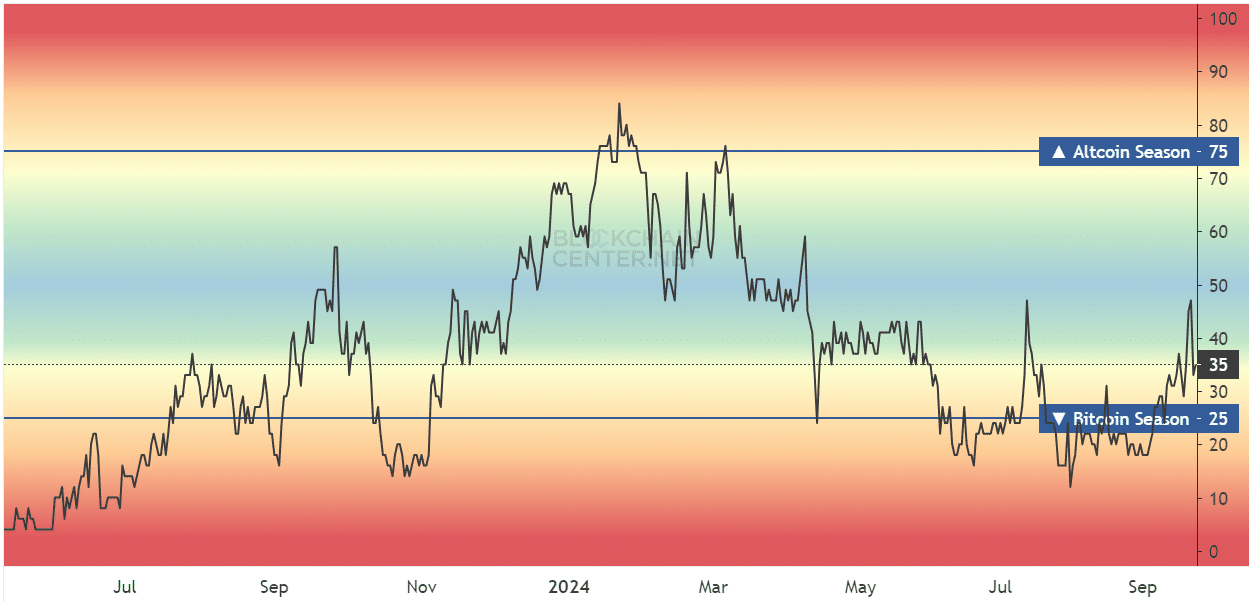

The Altcoin Season Index showed a score of 35, with a score of 75 needed for an altcoin season. An increase in this score could be encouraging for long-term participants in the crypto market.

Stablecoins indicate that the market is ready for an altcoin season.

The stablecoin supply ratio metric also indicates that the market is preparing for an altcoin season. The downward trend of this metric suggests that the total market value of all stablecoins relative to Bitcoin is increasing.

In turn, this means an increase in purchasing power in the market. Therefore, a price increase in the altcoin market may occur.

However, the readings of this metric are nowhere near the October 2023 lows that accompanied the previous uptrend.