XRP breaks this pattern and targets a 300% price surge!

XRP has broken out of a bullish pattern, which may allow it to reclaim its peak from 2021.

Buying pressure on the token has increased in recent days.

- However, a technical indicator initially pointed to a price correction.

The bulls of XRP have exerted significant pressure in recent days, allowing the token to break above a key resistance level. This latest breakout could be a game-changer for XRP, as it may be poised for a price increase of nearly 300% in the coming days.

Successful Breakout of XRP

After remaining bearish for the past week, this token recently gained bullish momentum, increasing its price by over 2% in the last 24 hours.

At the time of writing, this token was trading at $0.6133, with a market capitalization of over $34.6 billion.

The situation could improve even further in the coming days, as the recent price surge enabled it to break out of a bullish pattern. Captain Faibik, a popular cryptocurrency analyst, recently tweeted showing a multi-year ascending symmetrical triangle pattern.

This pattern first appeared in 2021, and since then, XRP’s price has consolidated within it. The recent price increase allowed XRP to break free.

Captain Faibik’s tweet also indicates that this recent development could lead to a nearly 300% price increase for XRP in the weeks or months ahead.

However, since the 300% target seems a bit overly ambitious in the short term, the tweet also noted that the mid-term target could be $2.30.

Source: X

How soon can XRP touch $2.30?

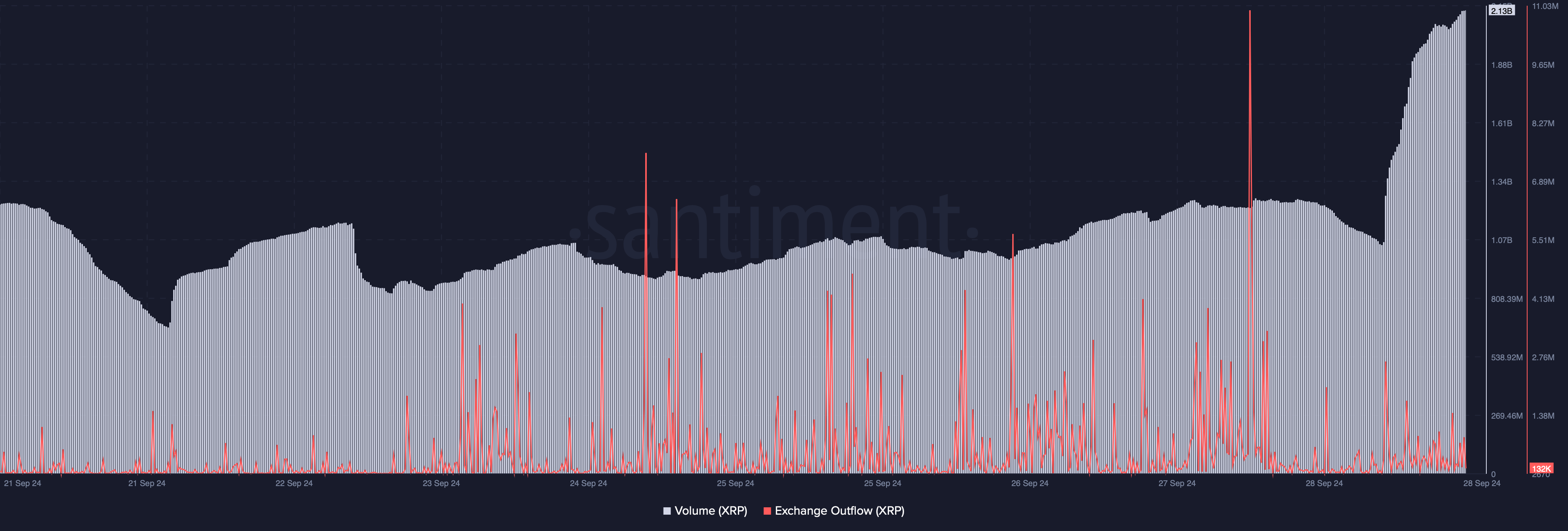

Then, AMBCrypto analyzed XRP’s on-chain data to assess the likelihood of reaching $2.30 in the coming days. According to our analysis of Santiment data, the trading volume of the token has surged alongside its price.

Whenever this happens, it indicates a high probability of continued upward price movement.

In fact, investors also showed confidence in the token. This was evident from the surge in XRP’s outflow, meaning that buying pressure on it was high. Overall, high buying pressure leads to price increases.

Source: Santiment

However, exposure to whales in the market has decreased over the past 24 hours.

AMBCrypto’s analysis of Hyblock Capital data revealed that the ratio of XRP whales to retail delta has dropped from over 90 to 81, indicating that retail investors are increasing their presence in the market compared to whales.

Source: Hyblock Capital

Then, oxichange analyzed the daily chart of the token to better understand whether this bullish rally will continue. The price of XRP had reached the upper limit of the Bollinger Bands, which often leads to a price correction.

If this happens, XRP may find support near its 20-day simple moving average (SMA).